Republican U.S. lawmakers plan to create a task force to study potential year-round sales of higher-ethanol E15 gasoline blends in the U.S., after an attempt to pass such legislation in…

“Drought, Watchword of the Week,” While India May Curb Some Rice Exports, and Black Sea Exports Continue

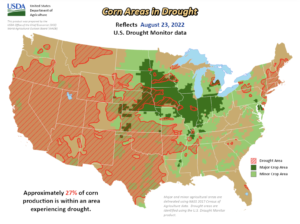

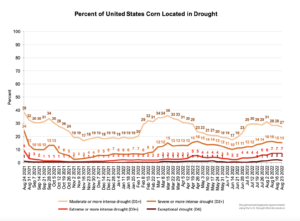

Kirk Maltais reported today at The Wall Street Journal Online that, “The worst drought in a decade is posing fresh challenges to farmers in the Corn Belt who already are struggling with surging costs, the dark side of a post-Covid commodities boom.

“Crop damage from South Dakota and Nebraska to Iowa and Illinois was evident this week in surveys by this year’s Professional Farmers of America Inc. Midwest Crop Tour, in which farmers, traders and others in agricultural industries evaluated corn and soybeans growing in fields across seven states.

“Pro Farmer this month cut its outlook for corn yields by 13% in Nebraska and 22% in South Dakota, relative to levels in its survey last year. The reductions helped fuel a rebound in the prices of many grains this past week, adding to the volatility in futures trading on the Chicago Board of Trade.”

The Journal article noted that, “The Plains drought is only the latest weather-related hit farmers have suffered this year. A string of hailstorms hammered Nebraska crops in June, with hail coverage claims ranking among the most ever seen by crop insurer Rural Community Insurance Services, said Jason Meador, head of the insurer, which is a division of Zurich North America.

“In Nebraska, projected crop yields dropped even in fields with irrigation systems, an unusual turn of events that reflects just how hot and dry the weather has been this summer in the Midwest.”

Maltais explained that, “The implications are global. Archer Daniels Midland Co. and Bunge Ltd. forecast last month that Russia’s ongoing war in Ukraine and poor weather in South America, the EU and China would keep world grain supplies tight.”

The Journal article indicated that, “To be sure, the news from the farm isn’t all bad. Crop stress in the western Corn Belt is being balanced in part by wetter crops in the east. In its most recent supply and demand report this month, the U.S. Agriculture Department said that it expects domestic corn production to total 14.4 billion bushels—down only slightly from its projection in July.

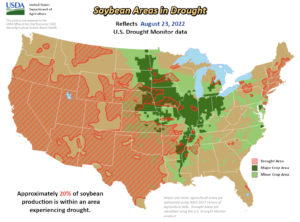

“Additionally, the agency revised its soybean-production projections higher in its August report, to 4.5 billion bushels. ”

And yesterday, Bloomberg writers Tarso Veloso Ribeiro and Kim Chipman reported that, “Drought was the watchword of the week: dry soils plagued the [Pro Farmer Midwest Crop Tour] participants throughout the western crop belt. Even in the east, where plants received more rain, yields were still looking a bit mediocre. Some evidence of crop disease and pest infestations also added to the woes.”

More broadly, Christian Shepherd and Ian Livingston reported in today’s Washington Post that, “The unprecedented heat wave that has engulfed China this summer has dried up rivers, wilted crops and sparked forest fires. It has grounded ships, caused hydropower shortages and forced major cities to dim lights. Receding waters have revealed long-submerged ancient bridges and Buddhist statues.”

“At 73 days and counting, the heat wave has easily surpassed China’s record of 62 days in 2013. All-time highs are being broken, often only to be re-broken days later,” the Post article said.

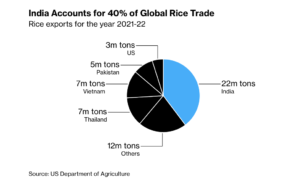

Elsewhere, Bloomberg writer Pratik Parija reported today that,

India, the world’s biggest rice shipper, will likely restrict some exports as domestic supply is under threat, according to people with knowledge of the matter, a move that risks adding to the chaos in global food markets.

“The government is discussing curbs on broken rice exports, which account for almost 20% of India’s shipments abroad, as local prices have soared, said the people, who asked not to be identified as the information is private. Talks are in advanced stages and a decision may be announced soon, the people said.”

The Bloomberg article explained that, “Unlike wheat and corn prices, which surged after Russia’s invasion of Ukraine, rice has been subdued due to ample stockpiles, warding off a bigger food crisis. Back in 2008, prices soared above $1,000 a ton, more than double the level now, as India and Vietnam banned exports, causing panic over supplies.

“Broken rice is mainly used for animal feed or to produce ethanol in India. Prices have jumped this year on increased export demand. Top buyers include China, which uses it mostly for livestock feed, and some African countries, which import the grain for food.”

And Reuters News reported today that, “India, the world’s biggest exporter of rice, is examining whether there is a need to restrict exports of 100% broken rice mainly used for feed purposes, government and industry officials told Reuters on Friday.

“The curbs on exports by India could lift rice prices in the world as the south Asian country accounts for more than 40% of global rice shipments.”

Also today, Reuters News reported that, “Germany’s grain and rapeseed harvest is better than expected after a heatwave and drought but damage is expected to maize (corn) and sugar beet crops, the German agriculture ministry estimated on Friday.”

“Europe is facing its worst drought in about 500 years, with crops in several countries suffering, especially maize,” the Reuters article said.

In other news, Bloomberg writer Michael Hirtzer reported yesterday that, “Merchant vessels have a new route to reach three ports in war-torn Ukraine, a move that could further boost shipments of food out of the Black Sea where disruptions earlier this year sent wheat prices to a record.

“The new 320-nautical-mile route connects Ukraine’s ports of Odesa, Chornomorsk and Pivdennyi/Yuzhny with inspection areas inside Turkey’s territorial waters, according to a press release Thursday from the Joint Coordination Centre. The group includes representatives from Russia, Ukraine, Turkey and the United Nations with a mission to ensure the safe transportation of food and fertilizer.”

“The development comes as more than 800,000 tons of grain and other food products have been shipped in recent weeks from Ukrainian ports. Those exports have helped to cool fears of vital supplies running short,” the Bloomberg article said.