A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Over One Million Tons of Grain Exported by Ukraine Under Black Sea Agreement, But Global Grain Stock Rebuilding a Concern

Wall Street Journal writers Isabel Coles and Jared Malsin reported on Saturday that, “Exports of grain from Ukraine’s southern ports have surpassed one million metric tons under a United Nations-brokered deal with Russia that has held up for nearly one month even as hostilities rage elsewhere in the country.”

‘Ukraine was, is, and will be among the guarantors of global food security,’ Ukraine’s President Volodymyr Zelensky said in an address late Friday, hailing the million-ton milestone.

Reuters News reported late last week that, “In an evening address [Friday], Zelenskiy said 44 ships had been sent to 15 nations. A further 70 applications for ships to be loaded had been received, he added, reiterating that Kyiv’s goal was to export three million tonnes a month.”

Meanwhile, Reuters writer Pavel Polityuk reported today that, “Ukraine’s grain exports are down 52.6% year on year at 3.6 million tonnes in the 2022/23 season so far, the agriculture ministry said on Monday.”

Polityuk added that, “The government has said that Ukraine could harvest at least 50 million tonnes of grain this year, compared with a record 86 million tonnes in 2021, because of the loss of land to Russian forces and lower grain yields.”

Also today, Reuters writer Naveen Thukral reported that, “Ukraine’s 2022 wheat harvest is 98% complete at 18.8 million tonnes, data from the country’s agriculture ministry showed.”

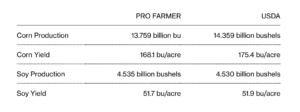

The Reuters article also pointed out that, “Advisory service Pro Farmer projected a U.S. corn harvest of 13.759 billion bushels, which would be the smallest since 2019 and below government forecasts for 14.359 billion bushels.

“Pro Farmer predicted a soybean crop of 4.535 billion bushels, slightly bigger than the U.S. Department Agriculture forecast for a record 4.531 billion bushels.

“Lower U.S. corn production outlook is adding to concerns over tightening global production of grains, including wheat and rice.”

Reuters writer Tom Polansek reported on Friday that, “European crops have also struggled with drought. French maize crop conditions declined last week to their lowest rating in more than 10 years, data from farm office FranceAgriMer showed, suggesting that recent rain has brought limited benefit to fields damaged by heatwaves and dryness.”

And yesterday, Bloomberg writers Kim Chipman and Tarso Veloso Ribeiro reported that, “Meanwhile, drought is taking a toll in Europe, China and India, while the outlook for exports out of Ukraine, a major corn and vegetable oil shipper, is hard to predict amid Russia’s invasion.

“‘Even before this week’s news from the crop tour, I have been concerned that we would not see much stock rebuilding until 2023,’ said Joe Glauber, a former chief economist at the US Department of Agriculture who now serves as a senior fellow at the International Food Policy Research Institute in Washington. The ‘opening of Ukraine ports is a welcome sign, but volumes remain far below normal levels.'”

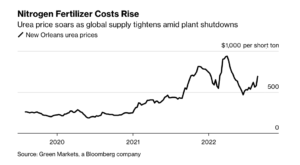

Elsewhere, Bloomberg writers Samuel Gebre and Elizabeth Elkin reported last week that, “Europe’s fertilizer crunch is deepening with more than two-thirds of production capacity halted by soaring gas costs, threatening farmers and consumers far beyond the region’s borders.

“Russia’s squeeze on gas shipments in the wake of Moscow’s invasion of Ukraine is hurting industries across Europe. But fertilizer companies are being especially affected because gas is both a key feedstock and a source of power for the sector.”

“Wholesale fertilizer prices, which fell back after climbing to multiyear highs following Russia’s assault, are rising again as European Union producers curb capacity. Ammonia prices in Western Europe have surged over the last two years, according to data by Bloomberg’s crop nutrient analysis company Green Markets. Dwindling supplies will keep prices elevated, threatening productivity as farmers are forced to scale back their use of the key nutrient. That in turn will hit consumers as food inflation accelerates,” the Bloomberg article said.

Underwhelming yield prospects in the US, China, Europe and India have revived tensions on international #grain markets, while #fertilizer plant shutdowns in Europe in response to high #gas costs are expected to continue adding upward pressure on food prices

— AMIS (@AMISoutlook) August 29, 2022

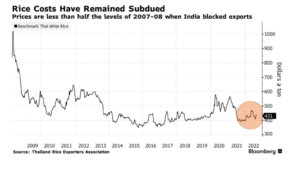

With respect to rice exports and India, Bloomberg writers Pratik Parija and Bibhudatta Pradhan reported today that, “India’s potential clampdown on exports of broken rice shows the world’s top shipper trying to thread the needle of cooling domestic inflation without causing global panic.”

The Bloomberg writers explained that, “With the potential trade curbs on broken rice, only about a fifth of India’s rice exports will be affected. This type of rice is fragmented during processing. The top buyers are China, which uses the grain for animal feed, and some poor African countries that import the grain for food as it tends to be cheaper.”

In news regarding U.S. food prices, Kristina Peterson reported in today’s Wall Street Journal that, “Even while gasoline prices are starting to inch down, food prices have continued to ratchet higher. Grocery prices rose 13.1% in July from a year before, the fastest annual pace since 1979, according to the Labor Department.”

And Abha Bhattarai reported in Sunday’s Washington Post that, “Inflation has been at or near 40-year highs since the spring, but families have been pinched by higher food prices for two years. Meat prices in particular have surged 17 percent since July 2020, spurring families around the country to change their purchasing patterns and eating habits.

“More than 70 percent of Americans have adjusted how they buy meat because of inflation, according to Glynn Tonsor, an agricultural economics professor at Kansas State University who oversees the school’s Meat Demand Monitor, which surveys 2,000 people nationwide about their meat consumption and purchasing habits.

“Many are buying less meat or trading down to cheaper cuts — ham instead of pork chops, for example, said Tonsor.”