The world's farmers face soaring fertilizer and fuel prices as the war in the Middle East escalates, leaving some scrambling for supplies as the spring planting season approaches and causing…

Thirteen Ships Sail From Ukraine, Biggest Grain Convoy Yet, While Australia Wheat Production Climbs

Reuters writer Aleksandar Vasovic reported earlier this week that, “Ukraine said it had dispatched its biggest convoy of grain vessels under a U.N.-brokered deal so far after 13 ships set sail from its ports on Sunday carrying 282,500 tonnes of agricultural products to foreign markets.”

The Reuters article stated that,

Eighty-six ships have since set sail from Ukrainian ports under the deal, carrying 2 million tonnes of agricultural products to 19 countries, the Ukrainian Infrastructure Ministry said in a statement on Facebook.

“Ukraine hopes to export 60 million tonnes of grain in eight to nine months, presidential economic adviser Oleh Ustenko said in July, cautioning that those exports could take up to 24 months if ports do not function properly.”

Also this week, New York Times writer Carly Olson reported that, “One shortcoming of the grain deal so far, experts say, has been volume: Many more ships need to be leaving Ukrainian ports to make a difference. This is partly a capacity issue, with only three of Ukraine’s 17 ports in use. Plus, some importers are hesitant to risk sending ships into a war zone even with the security guarantees under the agreement.

“But the pace has gradually picked up. In the past two weeks, 35 ships from Ukraine have been inspected in Istanbul, compared to 25 from the previous two weeks, according to the U.N.’s shipment tracker.”

Late last week, Reuters writers Pavel Polityuk, Gus Trompiz and Sybille de La Hamaide reported that, “Ukraine may lack 12 million tonnes of regular grain storage capacity by the end of November, a manageable level that is less than feared before the re-opening of the country’s Black Sea ports, First Deputy Agriculture Minister Taras Vysotskyi said.

“The war-torn country’s grain and oilseed exports rose to 4.5 million tonnes in August, up from 3 million tonnes in July, Vysotskyi said during an online briefing on Thursday.”

And Reuters writer Max Hunder reported this week that, “Ukraine’s exports of agricultural products will total about 50 million tonnes this marketing year, the deputy chair of the Ukrainian Agrarian Council told reporters on Monday.

“The country’s harvest of agricultural products is expected to total 60-65 million tonnes, said Denys Marchuk, whose organisation represents agricultural producers.”

Meanwhile, Pavel Polityuk reported today at Reuters that, “Ukrainian farms have sown the first 5,170 hectares of winter wheat for the 2023 harvest, the agriculture ministry said on Tuesday.

“The ministry did not provide a forecast, although minister Mykola Solsky told Reuters last week that the area could fall to 3.8 million hectares from 4.6 million a year earlier due to the Russian invasion.”

Elsewhere, Bloomberg writer Aine Quinn reported on Friday that, “Russia is struggling to export its record wheat crop, just as the opening of a safe corridor supports an uptick in shipments from the country it invaded just over six months ago.”

“Food was exempted from western sanctions, but bankers and insurers are cautious about doing business with Russia and shipping lines are wary of sending their vessels into a war zone,” the Bloomberg article said.

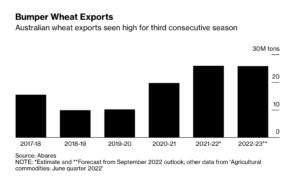

In other news, Bloomberg writer Sybilla Gross reported on Monday that, “Australia, one of the world’s largest wheat exporters, will produce another huge crop this season, which is set to boost agricultural export earnings by almost 50% from a decade ago.

“Growers are on track to harvest 32.2 million tons of wheat in 2022-23, just shy of last year’s all-time high of 36.3 million tons, according to government forecaster Abares. That’s up 6.3% from its previous outlook as favorable weather conditions during winter buoyed yield potential across most crops.”

Wall Street Journal writer Stuart Condie reported today that, “Australia forecast another bumper wheat crop following above-average rainfall on its east coast, but supply chain bottlenecks could limit its ability to export more and ease concerns about global food security.”

More broadly with respect to global production, Jaweed Kaleem and Scott Johnson reported on the front page of Sunday’s Los Angeles Times that, “It’s not only France. A withered Europe faces what scientists say could be its worst water shortage in the hundreds of years on record.

“Farms are going fallow, and vineyards are seared. Reservoirs and aquifers have been depleted. Rivers have dried up to reveal Roman-era artifacts and unexploded war munitions. Wildfires have raged across a dozen countries. Scores of small cities and towns are trucking in water because the taps have run dry.

“Altogether, 64% of the continent — 13 of the 27 nations in the European Union, as well as Britain, Serbia, Moldova and Ukraine — is either facing drought or in imminent danger of it, according to a recent report by EU scientists that predicted at least three more months of ‘warmer and drier’ days.”

And in a closer look at U.S. production variables, Bloomberg writer Elizabeth Elkin reported late last week that, “North American fertilizer prices are spiking as plant closures in Europe squeeze supplies.

“An index of weekly North American fertilizer prices by Bloomberg’s analysis organization Green Markets rose by over 11% Friday, the most since March, as an energy crunch in Europe forces some plants to close or curtail production. Natural gas is the No. 1 input for most nitrogen fertilizer. The common nitrogen fertilizer ammonia in the US Corn Belt saw prices rise nearly 24%.”