Republican U.S. lawmakers plan to create a task force to study potential year-round sales of higher-ethanol E15 gasoline blends in the U.S., after an attempt to pass such legislation in…

“Relative Optimism” on Black Sea Grain Export Deal, While Some Mississippi River Grain Terminals “Halt” Deliveries

Reuters writer Michelle Nichols reported yesterday that, “United Nations aid chief Martin Griffiths said on Wednesday that he was ‘relatively optimistic‘ that a U.N.-brokered deal that allowed a resumption of Ukraine Black Sea grain exports would be extended beyond mid-November.

“Griffiths traveled to Moscow with senior U.N. trade official Rebeca Grynspan earlier this month for discussions with Russian officials on the deal, which also aims to facilitate exports of Russian grain and fertilizer to global markets.”

The Reuters article noted that, “The United Nations is working to extend the deal for up to a year and smooth the joint inspections of ships by U.N., Turkish, Russian and Ukrainian officials. The United Nations recently warned there was a backlog of more than 150 ships.”

Reuters writer Guy Faulconbridge reported yesterday that, “Russian President Vladimir Putin is likely to use the possible extension of the U.N.-brokered Black Sea grain deal as a way to gain leverage and dominate next month’s G20 summit in Indonesia, a European diplomat briefed on the grain talks told Reuters.”

Faulconbridge added that, “Since the deal was clinched on July 22, several millions of tonnes of corn, wheat, sunflower products, barley, rapeseed and soya have been exported from Ukraine’s Black Sea ports.

“Leaders at the G20 will push Putin to extend the deal, the diplomat said. Ultimately, the diplomat said, Russia will allow the deal to rollover for four months – or even go for a longer extension.”

More than 9 M tons of agrofood was exported from the beginning of the #BlackSeaGrainInitiative. However, this is only a part of all the possibilities of Ukraine in protecting the world from the food crisis

— Oleksandr Kubrakov (@OlKubrakov) October 27, 2022

Also yesterday, Reuters writer Pavel Polityuk reported that, “Grain exports from Ukraine have slowed over the past 10 days, with volumes so far this month 9% behind the same period last year, agriculture ministry data showed on Wednesday.

“Ukraine has blamed Russia for what it says are ‘artificial delays’ to inspections of grain corridor vessels that ship Ukrainian grain abroad, resulting in a significant reduction to exports.”

And earlier this week, Wall Street Journal writer Will Horner reported that, “Shipments of grain from three Ukrainian ports were halted Wednesday while officials investigated reports of a mine-like object in a shipping corridor established under a United Nations-backed grain-export deal between Ukraine and Russia.

“A search by two Ukrainian ships on Wednesday found no mines, according to the Joint Coordination Center, which is composed of United Nations, Ukrainian, Turkish and Russian officials and was set up to oversee the smooth running of the grain deal.”

Meanwhile, Bloomberg writers Marc Champion and Daryna Krasnolutska reported this week that, “In recent days, Russia’s number two at the UN, Dmitry Polyanskiy has told news outlets he was pessimistic about the grain deal’s prospects, because even though it lifted sanctions on Russia’s own grain and fertilizer exports, Western buyers have shunned them. He also threatened to break off cooperation with the UN, the deal’s broker, if it proceeds with an investigation into Russia’s use of Iranian drones in Ukraine.

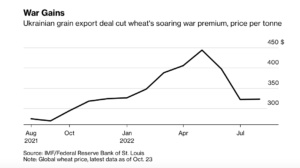

“Still, in a war Putin has pitched to the developing world as a struggle against Western domination, he could settle for the disruption caused even with the grain deal in place; ending it would risk turning more nations against him, driving global prices for wheat, sunflower oil and other food staples back to the stratospheric levels seen in May.”

Reuters writer Tom Polansek reported yesterday that, “Chicago Board of Trade wheat futures rose on Wednesday amid uncertainty about exports from war-torn Ukraine, analysts said.”

Elsewhere, DTN Ag Policy Editor Chris Clayton reported yesterday that,

As Mississippi River levels continue to hinder grain shipping, at least some Cargill grain terminals on the river now have stopped taking corn and soybeans.

“Cargills’ facilities in Hickman, Kentucky, and Keithsburg, Illinois, both posted on their websites that they have stopped taking deliveries this week. Hickman’s website noted, ‘We are full on corn and YSB (yellow soybeans). Will not be taking until river levels change. Hickman Harbor was closed due to low water. We are filling our remaining space. Customers can expect slower unload times and we apologize for any disruptions this causes our producers.’

“Mike Steenhoek, executive director of the Soy Transportation Coalition, sent a river update on Wednesday, stating that the conditions of the inland waterway system remain ‘very concerning.'”

Clayton also pointed out that, “Meanwhile, U.S. Army Corps of Engineers officials in the Missouri River Basin have been holding fall public meetings this week across the basin. The overall theme is that dry conditions persist everywhere in the Missouri River Basin as well.”

Widespread rain over the last couple of days led to widespread rainfall accumulations of 2-5 inches across much of the area. Despite the high rain totals, rivers did not see much of a rise due to the recent drought, with no reports of flooding. #mowx #kswx pic.twitter.com/bZ7ibynnVH

— NWS Springfield (@NWSSpringfield) October 26, 2022

Also this week, DTN’s Mary Kennedy reported that, “Farmers are in the midst of harvest, and many have been left looking for a new home to dump their grain at or keep it on their farm stored in grain bids or bags. The bottom line is that higher freight costs and lack of space at terminals are absorbed by farmers in the weaker spot basis bids if they need to sell.”

And DTN meteorologist John Baranick reported yesterday that, “Farther south, precipitation increased rapidly on Oct. 24 across Texas and Oklahoma as the cold front was moving through…Moderate to heavy rain erupted from central Texas and Oklahoma to Wisconsin and Michigan, including widespread areas of over 1 inch of rain through some of the most drought-stricken soils in the country from Texas through Oklahoma, eastern Kansas, Missouri, Illinois, and northwest Arkansas. In this area, amounts over 2 inches were also fairly common.

“The water is helping to replenish soil moisture and could fill in some of the rivers. The southern half of the Mississippi River, which is at historically low levels, will only benefit slightly. Some of the heaviest rains fell over the Red River Valley, which is not a tributary of the Mississippi. The Arkansas River runs into the Mississippi River south of Rosedale, Mississippi. That is closer to the terminus of the river than where it is needed farther up.

“Still, the impacts will limit the continued decline of the river for at least a period of time. As far as the drought, the rainfall is a step in the right direction for the Southern Plains into the southwestern Midwest, but the deepness of the drought will take more than just one event to create significant improvement.”