President Donald Trump on Friday signed an executive order temporarily expanding the amount of beef the U.S. can import from Argentina, a move the White House says is aimed at…

Bird Flu Impacts, and A Glance at Production Cost Variables

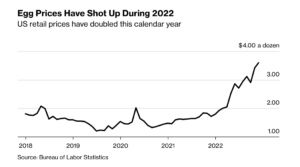

Bloomberg writers Megan Durisin and Elizabeth Elkin reported earlier this week that, “The bird flu outbreak ravaging global poultry flocks is now the worst since records began, driving a spike in the price of eggs, threatening free-range chicken and risking long-term impacts to animal health.”

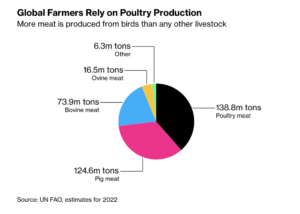

Durisin and Elkin explained that, “Poultry losses since October are almost 70% above last year’s pace, hitting 16.1 million by Dec. 1, according to the World Organisation for Animal Health. Before then, more than 138 million birds were lost in the 12 months through September, more than the prior five years combined, WOAH said.”

The Bloomberg article also pointed out that, “For now, high prices are bolstering poultry farmers, though the risks are accelerating just as swiftly, [Nan-Dirk Mulder, animal-protein specialist at Rabobank] said. ‘Demand is there, but the supply is not,’ he said. ‘It’s an extremely uncertain market.'”

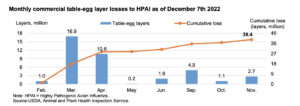

In its monthly Livestock, Dairy, and Poultry Outlook report last week, the USDA’s Economic Research Service (ERS) indicated that, “The total number of table-egg layers lost to HPAI [Highly Pathogenic Avian Influenza] since February has increased to 39.4 million birds.”

ERS stated that, “The latest HPAI-Situation report issued by the World Organization for Animal Health (WOAH), covering the period between October 12 to November 10, reported 140 new outbreaks in poultry in Africa, Asia, North and South America, and Europe. Over 4.6 million birds died or were culled over the period covered by this report. The report mentions the first case of HPAI in South America (Columbia) since 2002. According to the global data collected by the WOAH, HPAI tends to be seasonal, with the outbreaks beginning to increase in October, followed up by a peak in February. Since the date of the report more HPAI outbreaks have been reported, either as recurrent or first occurrence.”

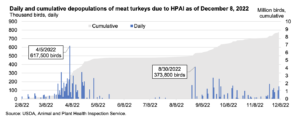

ERS added that, “The second wave of the HPAI outbreak has continued into December, impacting 322,100 commercial meat turkeys in the first week of December alone. Since the outbreak began in February, 8.7 million meat turkeys and 298,760 turkey breeding animals have been depopulated.”

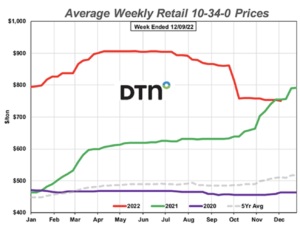

Meanwhile, in a look at variables associated with agricultural production costs, DTN writer Russ Quinn reported last week that, “Retail fertilizer prices continue to drift slowly lower, according to prices tracked by DTN for the second week of December 2022. This has been the general trend in prices over the last several months.”

More broadly, Wall Street Journal writers Laurence Norman and Jared Malsin reported last week that, “The European Union implemented a new sanctions package on Russia Friday that officials hope will significantly relieve food-security problems facing developing and poor countries.

“The sanctions agreement, which was pushed through by EU leaders when they met for a summit Thursday, came amid intense lobbying by United Nations Secretary-General António Guterres. He called a number of European leaders in recent days to persuade them to ease the transit of Russian fertilizers through EU ports.”

The Journal writers noted that, “In recent months, vessels carrying fertilizers have been held up for weeks or denied permission to transit through large European ports, such as Rotterdam in the Netherlands, because of concerns over sanctions.”

The article said that, “Under Thursday’s deal, agreed after days of arguments within the 27-country bloc, it was agreed that national governments can unfreeze the assets if strictly necessary for shipments of fertilizers. The exemptions must be reported to the European Commission, the EU’s executive body, to ensure they are being properly applied.”

Recent reports from USDA’s Agricultural Marketing Service (AMS) highlight a variety of production costs for Illinois and Iowa:

#Illinois Production Cost Report, Dec. 15th. pic.twitter.com/16ObITfc4f

— FarmPolicy (@FarmPolicy) December 19, 2022

#Iowa Production Cost Summary, Dec. 13th. pic.twitter.com/RWgMWWJ1pS

— FarmPolicy (@FarmPolicy) December 19, 2022

Data from the Federal Reserve Bank of St. Louis and USDA- AMS show that gas and diesel prices have been weakening:

Average U.S. prices per gallon for gasoline and diesel decrease in the week ended Dec. 12, to $3.24 and $4.75, respectively https://t.co/e28N2AZ6Wq pic.twitter.com/57opMtdBv2

— St. Louis Fed (@stlouisfed) December 14, 2022

1/ For a 6th week in a row, #diesel prices continued to decline.

— FarmPolicy (@FarmPolicy) December 15, 2022

For the week ending December 12, the U.S. average diesel fuel price fell 21.3 cents from the previous week to $4.754 per gallon—110.5 cents above the same week last year. https://t.co/6PYj3rmiMS @USDA_AMS pic.twitter.com/o4hEoVsuOH