Tariffs imposed by the Trump administration collected an estimated $958 million in revenue from selected agricultural inputs from February to October of 2025, according to North Dakota State University's monthly…

China: Pork Prices Fall, While Soybean Production Improves, as Covid Hits Countryside

Bloomberg writer Jinglu Gu reported today that, “China is ramping up Covid preparations in rural areas ahead of Lunar New Year holidays that may unleash a surge in infections across some of the country’s poorest regions.”

The Bloomberg article explained that, “‘The countryside is the key area for the current Covid epidemic prevention and control, and the task is very heavy,’ said Zeng Yande, head of development and planning division under the agriculture ministry. ‘Medical resources in the countryside are relatively inadequate, bringing great difficulty to epidemic prevention and control.’

“While rural areas brace for a wave, several officials — most recently Vice Premier Liu He this week — have declared the peak of infection has passed in some parts of the country just six weeks after the end of Covid curbs. Consumption-related industries have returned to normal, Liu said at the World Economic Forum’s annual meeting in Davos, Switzerland.”

And in a separate Bloomberg article yesterday, Jinglu Gu reported that, “‘Tis the season in China when whole hams and cured sausages should be flying off the shelves as households prepare for the Lunar New Year, the biggest festival in the nation’s calendar.

“But as hundreds of millions grapple with an unprecedented Covid outbreak, the country’s fondness for the celebratory dishes that usually accompany gatherings with friends and family is in deep freeze. The price of pork, China’s favorite meat, has plunged.”

Yesterday’s article pointed out that, “The food industry is again bearing some of the harshest economic costs of the pandemic, although this time around the problem stems from the government’s abrupt exit from the Covid Zero policies that had shaped its response to the virus for three years. As infections rip through the population, fewer people are meeting up at home or in restaurants, and they’re spending less on pricier items like meat, while the sick eat lighter meals.”

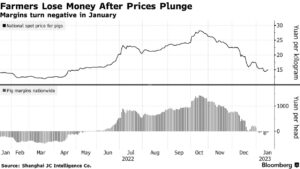

“Producers are now losing money after pig prices dropped by about a third since the start of December, according to data from Shanghai JC Intelligence Co.,” the Bloomberg article said.

Also yesterday, Reuters writers Dominique Patton and Ella Cao reported that, “China’s agriculture ministry urged farmers on Wednesday to take measures to reduce excess pork output and pressure on prices, which an official said have fallen below the cost of breeding due to weak consumption.”

Patton and Cao added that, “China’s hog farmers had expected demand and prices to rise in December ahead of the Lunar New Year holiday that starts on Saturday. Many had raised heavier pigs, hoping to benefit from anticipated price rises.”

Reuters also reported earlier this week that, “China’s pork output in 2022 increased by 4.6% from 2021 to reach its highest since 2014, official data showed on Tuesday, confounding some expectations for a smaller rise.

“Pork output in the world’s top producer of the meat reached 55.41 million tonnes, the highest since 56.71 million tonnes recorded eight years ago. The 2022 output compared with 52.96 million tonnes in 2021.”

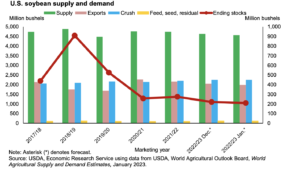

Meanwhile, Dow Jones writer Yusuf Khan reported yesterday that, “Chinese demand remains uncertain and according to Fitch Solutions remains a market risk in 2023. The country became the largest agricultural importer in 2019, Fitch Solutions said, meaning that how it reacts to postlockdown measures will be a major factor when it comes to pricing.

“‘As 2023 starts, uncertainties related to China’s exit from its ‘zero-Covid’ policy and the authorities’ ambition to enhance domestic food security have coalesced and augur heightened market risks for the year ahead,’ Fitch Solutions said in a note.”

Elsewhere, Stella Yifan Xie, Jason Douglas and Lingling Wei reported on the front page of today’s Wall Street Journal that, “Economists said China’s shrinking population poses a major future challenge for the world’s second-largest economy, while President Xi Jinping’s top economic adviser sought Tuesday to restore investor confidence after one of the most disappointing growth rates in decades.”

The Journal writers pointed out that, “A dwindling population means fewer consumers when China is under pressure to power growth through greater consumption instead of investment and exports.

“Any rebound in consumption will also likely be constrained by a weak labor market and a housing downturn that has eroded the wealth of Chinese families. The jobless rate among people age 16 to 24 remained elevated at 16.7% in December, versus the peak of near 20% last summer. Growth in disposable income per capita could slow to around 4% each year in the next five years, downshifting from around 8% before the pandemic, according to David Wang, chief China economist at Credit Suisse.”

Reuters writer Matthew Chye reported today that, “China, the world’s biggest soybean importer, is expected to boost purchases in the months ahead as the country reopens after years of COVID-19 restrictions.

“Urban workers crowded train stations across China’s largest cities on Tuesday as travel for the Lunar New Year holidays hit high gear, an early sign of economic recovery.”

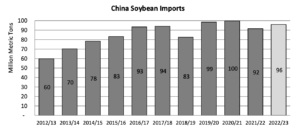

In its monthly Oilseeds: World Markets and Trade report last week, the USDA’s Foreign Agricultural Service stated that, “The China soybean import forecast for the 2022/23 marketing year (Oct-Sep) has been reduced by 2.0 million tons to 96.0 million as first quarter imports have not met expectations.

“Additionally, new marketing year soybean production in China rose by 24 percent, partially offsetting demand growth for foreign soybeans. Soybean imports in the first quarter of the marketing year are estimated at 21.5 million tons, 5 percent lower than the previous year and below the 5-year average. Ongoing challenges related to COVID-19 and growing economic uncertainty continue to cast shadows on prospects for demand recovery.”

The USDA’s Economic Research Service pointed out yesterday in its monthly Oil Crops Outlook report that, “China’s soybean harvest for 2022/23 is estimated to be nearly 2 million metric tons higher compared with last month at 20.3 million metric tons. The change reflects official data indicating increased planted area for soybeans in China—up nearly 10 percent from the previous estimate.

“Increased domestic soybean production is expected to reduce reliance on foreign soybean supplies to satisfy current domestic demand projections. Hence, the soybean import forecast is lowered from 98 million metric tons to 96 million metric tons. Sluggish soybean crush volumes place downward pressure on the 2022/23 forecast, which is lowered to 95 million metric tons from 96 million metric tons.”