Agriculture Secretary Brooke Rollins said on Tuesday that the Trump administration will announce a 'bridge payment' for farmers next week that is designed to provide short-term relief while longer trade…

U.S. Sorghum Exports Dwindle on “Near-Evaporation” of Chinese Demand, as China Looks to Brazilian Corn

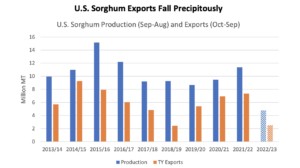

In its monthly Grain: World Markets and Trade report for January, the USDA’s Foreign Agricultural Service (FAS) indicated that, “U.S. sorghum exports for 2022/23 are forecast down 1.5 million tons to 2.5 million (Oct-Sep), the lowest since 2018/19 and the second-lowest volume of the last decade. The flagging export prospects come on the heels of the smallest sorghum crop since 1944/45 at just under 4.8 million tons. Dry conditions in Kansas and Texas, two major sorghum-producing states, negatively impacted yields and overall production.”

FAS explained that, “China is by far the world’s largest importer and the top destination for U.S. sorghum.

The steep decline in total commitments represents the near-evaporation of China’s sorghum demand from the United States; in an October GAIN report, FAS/Beijing reported quotes of over $500/ton for imported U.S. sorghum at major ports in China, about $100/ton higher than a year ago.

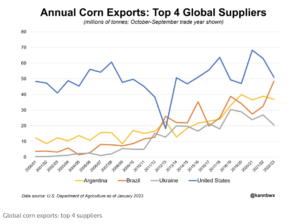

“China has diversified its sourcing of grain, with the United States continuing to face competition from Argentina and Australia in the sorghum market. This year, U.S. sorghum must also compete against a larger pool of origins for corn. In May 2022, an agreement was reached that would allow Brazilian corn to be exported to China. The fruits of this agreement were borne out last month as Brazil reported 1.1 million tons of exports to China, becoming the top market for Brazilian corn in December. With Brazil corn exports winding down seasonally in the next few months and Ukraine corn exports still dependent on the continuation of the Black Sea Grain Initiative, competition from corn in China’s grain market may ease slightly, but by all appearances, 2022/23 is expected to be a rough year for U.S. sorghum.”

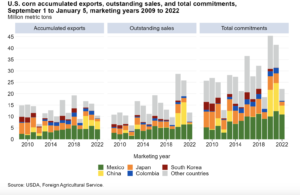

In a closer look at U.S. corn exports, the USDA’s Economic Research Service pointed out in its monthly Feed Outlook report for January that, “[FAS] reported total U.S. corn export commitments (shipments plus outstanding stales as of January 5, 2023) at 22.0 million metric tons (down 47 percent from last year and 33 percent below the 5-year average). Outstanding sales to all destinations total just 11.6 million metric tons (down 55 percent from this time last year and 37 percent below the 5-year average).”

More broadly with respect to China, Financial Times writers Kai Waluszewski and Edward White reported on Wednesday that, “Xi Jinping has expressed concern about the spread of Covid-19 to rural China on the eve of the lunar new year, in the Chinese president’s most direct acknowledgment of the worsening health crisis since suddenly abandoning his zero-Covid strategy in early December.

“Xi, who was speaking at the Great Hall of the People in Beijing, said he was now ‘primarily concerned about rural areas and rural residents‘ as China entered a ‘new phase’ of its pandemic response,” the FT article said.

Lily Kuo reported in Sunday’s Washington Post that, “Facing economic and social pressures, as well as an omicron variant that was already breaching covid defenses, China’s leaders had little choice about relaxing restrictions, but a potent mix of factors, including President Xi Jinping’s highly centralized decision-making, the party’s total mobilization for ‘zero covid,’ and confused messaging, resulted in a rushed and chaotic reopening.

This mismanagement could not only dent public confidence in Xi just as he begins his third term, but also hurt the ruling party’s ability to govern.

And Reuters writer Brenda Goh and Lananh Nguyen reported on Friday that, “China’s declaration that it is open for business was welcomed by attendees at the World Economic (WEF) as a likely boost to global growth, though many also expressed caution over how it could drive up global COVID-19 cases and inflation.

“The topic of China’s reopening came up at several discussions, both public and private, as China’s economic tsar Liu He made a big pitch for foreign investment in the ski resort of Davos on the first visit abroad by a high-level Chinese delegation since Beijing shelved its three-year-old zero-COVID policy.

“While Liu said that people in China were recovering faster than he had expected from COVID-19 after the dismantling of curbs unleashed a giant wave of infections, many executives with businesses in China said they were still forecasting a bumpy few months before things start to get better.”