Tariffs imposed by the Trump administration collected an estimated $958 million in revenue from selected agricultural inputs from February to October of 2025, according to North Dakota State University's monthly…

Flow From Black Sea Grain Export Deal Slowed by Russia, ERS- Challenges for the Deal “Remain”

Bloomberg writers Kateryna Choursina and Aine Quinn reported on Monday that, “From his post at the mouth of the Black Sea, Ukrainian ship inspector Ruslan Sakhautdinov has seen his Russian counterparts repeatedly slow the flow of his country’s grain abroad — from scrutinizing fuel gauges to crews’ personal belongings.

“Last year’s landmark deal to reopen some Ukrainian ports for vital food exports included a requirement that joint teams from Ukraine, Russia, the United Nations and Turkey inspect each ship. The idea is to prevent unauthorized cargo or passengers from moving in and out.

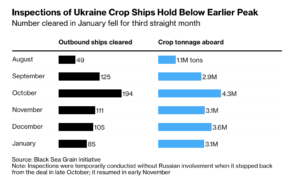

“But Ukrainian traders and authorities say that Russia is purposefully slowing the pace by pushing the bounds of that mandate and limiting personnel. Sakhautdinov said Russian team members end work by 3:30pm, which halts the day’s inspections. The number of crop-laden ships to clear the corridor in January fell to the lowest since its August launch.”

Choursina and Quinn pointed out that, “The volume of crops cleared on ships from Ukraine fell to 3.1 million tons in January, holding shy of its 5-million ton goal. Bad weather also stalled work for a few days at the Joint Coordination Centre in Istanbul, which facilitates the grain deal.”

“JCC procedures require ships and inspectors to verify a host of details, from cargo manifests to crew lists and reporting fuel-oil consumption,” the Bloomberg article said.

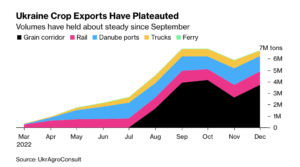

Choursina and Quinn added that, “[Ukraine’s] Black Sea crop exports peaked in October at about 4 million tons, UkrAgroConsult data show. The initiative is up for renewal in March and uncertainties over its longevity could also impact flows.”

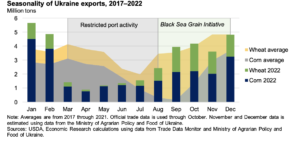

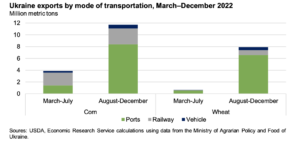

Recall that the USDA’s Economic Research Service (ERS) pointed out last month that, “The Russia-Ukraine war substantially altered the flow of Ukraine’s wheat and corn exports in 2022. This has far-reaching effects in global trade with major importers being forced to change suppliers and adjust to higher price levels.

“The Black Sea Grain Initiative increased the opportunities for Ukrainian grain to leave the country and relieved some price pressures internationally, but challenges remain. Inspections by a third country add cost and time, insurance is hard to find and costly, and not all shipping companies are willing to risk sailing in the Black Sea. Along with these challenges, the BSGI is only in effect until mid-March and may not be extended.

“Despite increased trade in recent months, Ukraine farm prices remain low due to the increased stockpiles and decrease in export demand as some countries shifted to other suppliers. Expectations for continued lower returns have reportedly motivated wheat producers to plant fewer acres in 2023/24 which will likely result in a smaller production from Ukraine. A falloff in Ukraine production is expected to reduce exportable supplies, encouraging trading partners to seek alternatives sources of grain.”

Meanwhile, Reuters writer Pavel Polityuk reported on Monday that,

Ukraine has exported almost 27.7 million tonnes of grain so far in the 2022/23 season, down from the 39.2 million tonnes exported by the same stage of the previous season, agriculture ministry data showed on Monday.

“The volume included about 9.9 million tonnes of wheat, 15.9 million tonnes of corn and about 1.8 million tonnes of barley.”

The Reuters article noted that, “A major global grain grower and exporter, Ukraine’s grain output is likely to drop to about 51 million tonnes in clean weight in 2022 from a record 86 million tonnes in 2021. Officials have blamed the fall on hostilities in the country’s eastern, northern and southern regions.”

In separate perspective on Ukrainian agricultural production, Dow Jones writer Yusuf Khan reported on Monday that, “Grain markets this week are looking to the Black Sea once again with worries over the volume of crops coming out of the region.

“‘Markets continue to react to news from the Black Sea region,’ the U.K.’s Agriculture and Horticulture Development Board said in a note. The agriculture ministry in the Ukraine said on Friday that farmers harvested 20.2 million metric tons of wheat in 2022 compared with 32.2 million tons the year prior, said AHDB. Total grain harvested in 2022 were 53.2 million tons and the country’s economy ministry said this might decline to 49.5 million tons in 2023, AHDB said.”

And Dow Jones writer Kirk Maltais reported on Monday that, “Wheat futures appear little moved by indications that Russia may step up its offensive in Ukraine this month, a year after fighting first began. Instead, traders focused on the strong dollar making U.S. exports even less competitive on the global stage. ‘Fact is, our wheat exports are at a 51-year low at 775 million [bushels] and the current pace is still lagging,’ Joel Karlin of Ocean State Research told the WSJ.”