Tariffs imposed by the Trump administration collected an estimated $958 million in revenue from selected agricultural inputs from February to October of 2025, according to North Dakota State University's monthly…

FAS: “Brazil and the United States Vie for World’s Top Corn Exporter”

In its monthly Grain: World Markets and Trade report yesterday, the USDA’s Foreign Agricultural Service (FAS) indicated that, “Brazil 2022/23 corn exports (Oct-Sep) are forecast to equal those of the United States at 51 million tons on expanding production and strong exports in the second half of its 2021/22 marketing year (Mar 2022-Feb 2023). Brazil corn exports have exceeded those of the United States only one other time, in the drought year of 2012/13. Since October 2022, Brazil has exported about 25 million tons of corn, far exceeding the same period in any prior year. In contrast, U.S. corn exports have been off to a slow start. Production in 2022/23 was smaller than initially forecast and logistical concerns on the Mississippi River in the months after harvest kept U.S. prices elevated and volumes low, especially as U.S. corn competed with competitively priced supplies from other exporters.

“This convergence in forecasts has also been driven by the level of trade from the two other major exporters, Argentina and Ukraine. Ukraine has been able to export an impressive amount of corn under the Black Sea Grain Initiative, but monthly volumes remain below pre-war capacities. Unlike Brazil, Argentina corn exports have flagged in the tail end of its 2021/22 marketing year (ending Feb 2023) and the country is facing significant production cuts for the 2022/23 year due to drought.

In the last several months, Brazil has stepped in to help fill some of the gap left by Argentina and Ukraine in supplying the world with corn.

FAS added that, “From February onwards, exports from Brazil are expected to seasonally decline until its safrinha harvest later in the year. In addition, U.S. prices have eased during the last few months and, as of last month, export bids are now lower than those from both Argentina and Brazil. If U.S. corn production returns to a more historically normal level, the United States will likely return to being the world’s top corn exporter. However, the continued and persistent expansion of Brazilian agriculture could mean that the United States will find itself fighting Brazil for the crown more often in the coming years.”

Meanwhile, Reuters writer Ana Mano reported yesterday that, “China became the main destination of Brazilian corn exports in January by volume, surpassing traditional importers like Japan, Iran and Spain, according to revised trade data released by the government on Wednesday.

“Brazil sold 983,684 tonnes to China in the period, the second full month of corn trading action following Beijing’s authorizations for Brazilian sales of the cereal in late November.”

Mano pointed out that, “Wooing a big customer like China will help Brazil grab an even larger share of the global corn trade.

“Until recently, China used to import approximately 70% of U.S. corn and 29% of Ukrainian corn, Brazilian grain exporters group Anec said on Wednesday.

“But after Russia’s invasion of Ukraine, China sought new suppliers.”

Reuters writer Pavel Polityuk reported yesterday that, “Ukraine grain exports in the 2022/23 season, which runs through to June, are down 29.2% to 28.2 million tonnes so far, due to a smaller harvest and logistical difficulties caused by the Russian invasion, agriculture ministry data showed on Wednesday.”

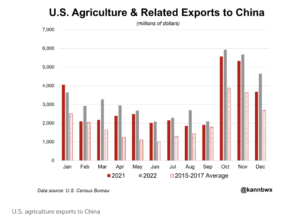

Also yesterday, Reuters Columnist Karen Braun stated that, “China was the top destination for U.S. agricultural products in 2022 at a record 19.2% of the value, led by increased purchases of soybeans, cotton and beef.”

Braun explained that, “U.S. corn exports to China last year were down 14% by volume from 2021’s high, and forward bookings are relatively very light. Brazil also has a hand in this as its corn trade with China opened late last year, and shipments have surged.”