A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

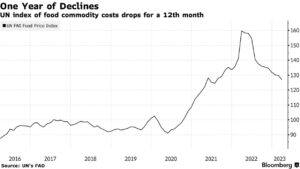

World Food Prices Fell Again in March, Down 21% From Last Year’s Record High

Bloomberg writer Agnieszka de Sousa reported today that, “Global food costs fell for a 12th straight month to reach the lowest level since July 2021, though there is still little sign the rout is actually feeding through to grocery shelves.

“A United Nations’ index of food-commodity prices eased 2.1% in March, capping the longest run of losses in data going back three decades. Last month’s decline was driven by grains, vegetable oils and dairy, which offset a rise in sugar and meat prices.

“The gauge has fallen 21% from a record set a year ago when Russia’s invasion of Ukraine disrupted grain exports, although it’s still up almost 40% from two years ago.”

The Bloomberg article pointed out that, “‘Food price inflation is still a serious concern in many countries,’ the Agricultural Market Information System, which tracks global food markets, said Thursday.”

Also today, Reuters News reported that, “A combination of ample supplies, subdued import demand and the extension of a deal allowing the safe export of Ukrainian grain via the Black Sea contributed to the drop, FAO said. The Rome-based agency said the decline in the index reflected lower prices for cereals, vegetable oils and dairy products, which offset rises in sugar and meat prices.

“‘While prices dropped at the global level, they are still very high and continue to increase in domestic markets, posing additional challenges to food security,’ Maximo Torero, FAO’s chief economist said in a statement.”

The Reuters article added that, “In a separate report on cereals supply and demand, the FAO raised its forecast for world wheat production in 2023, now pegged at 786 million tonnes — 1.3% below the 2022 level but nonetheless the second largest outturn on record.”

And Dow Jones writer Will Horner reported today that, “The [FAO] food-price index remains close to levels seen in 2011, when a spike in prices helped prompt a wave of global civil unrest, particularly in Middle Eastern and North African states. Weak local currencies compared with the U.S. dollar and the euro and mounting government debts were further exacerbating the concern over developing countries’ access to affordable food, [Máximo Torero, chief economist at the FAO] said.”