China has bought about 12 million metric tons of U.S. soybeans, fulfilling a U.S.-stated pledge to purchase that volume by the end of February, three traders told Reuters on Tuesday,…

FAS: China Becomes World’s Largest Wheat Importer; Argentina Corn, Soybean Production Estimates Fall

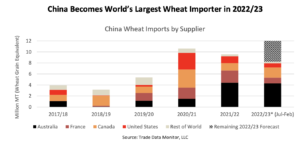

In its monthly Grain: World Markets and Trade report yesterday, the USDA’s Foreign Agricultural Service (FAS) indicated that, “China wheat imports are forecast up to 12.0 million tons this year—the country’s highest level of imports since 1995/96 when imports reached 12.5 million.

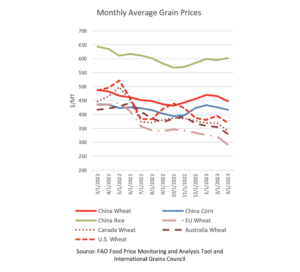

“Domestic grain prices in China have remained high given the country’s minimum support price policy and reduced auction activity amidst uncertainty surrounding the government’s COVID-19 policies. Chinese wheat prices have lingered around $450/ton over the past year while Chinese corn prices have averaged above $400/ton. Meanwhile, international wheat prices have trended lower over the past few months, falling below $400/ton with ample exportable supplies from Australia, the European Union, and Canada.

FAS explained that, “Competitive pricing has prompted China to import large volumes of both milling and feed quality wheat. Australian wheat is especially competitive following 3 consecutive years of record crops. China continues to aggressively purchase Australian wheat supplies, with July-February imports up 66 percent compared to the previous year. Imports from Canada, which supplies hard red milling wheat to the Chinese market, are up 83 percent year over year.

“With international wheat at a discount to domestic grain, some Chinese feed mills have substituted corn with imported wheat in feed rations. Although China’s wheat feed use is down year over year as corn feed use rebounds, it still represents a quarter of the country’s total wheat consumption. Food, seed, and industrial use, meanwhile, remains robust.”

And in its World Agricultural Production report yesterday, FAS pointed out that,

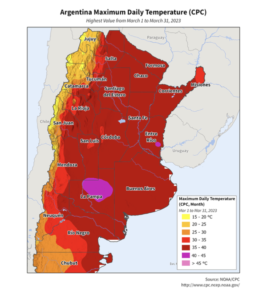

Argentina corn production for marketing year 2022/23 is estimated at 37.0 million metric tons, down 8 percent from last month, and down 25 percent from last year.

“Corn yield is estimated at 5.52 tons per hectare, down 7 percent from last month, and down 21 percent from last year. Harvested area is estimated at 6.7 million hectares, unchanged from last month, and down 6 percent from last year.”

FAS noted that, “Yield is down month-to-month due to heat and dryness that impacted the late-planted corn, which accounts for roughly two-thirds of area. Temperatures during March were well above normal, with many days above 35 degrees Celsius. Dryness continued until about late March when rainfall occurred.”

With respect to soybeans, yesterday’s report stated that, “Argentina soybean production for marketing year 2022/23 is estimated at 27.0 million metric tons, down 18 percent from last month, and down 38 percent from last year. Soybean yield is estimated at 1.80 tons per hectare, down 15 percent from last month, and down 35 percent from last year. Harvested area is estimated at 15.0 million hectares, down 3 percent from last month, and down 6 percent from last year.”

In a closer look at Brazilian production variables, FAS indicated that,

Brazil corn production for marketing year (MY) 2022/23 is estimated at a record 125.0 million metric tons (mmt), unchanged from last month, and larger than last year’s crop by 9.0 mmt (8 percent).

“Total harvested area, for all three corn crops, is estimated at a record 22.7 million hectares (mha), up 0.9 mha (4 percent) from last year. Yield is estimated at 5.51 tons per hectare, 3 percent above last year’s crop, and 6 percent above the 5-year average yield.”

FAS added that, “Brazil soybean production for marketing year (MY) 2022/23 is estimated at a record 154.0 million metric tons (mmt), higher by 1.0 mmt (1 percent) from last month, and higher by 24.0 mmt (18 percent) from last year.

Brazil #Soybean Area, Yeild and Production pic.twitter.com/96t0Zgqs8L

— FarmPolicy (@FarmPolicy) April 11, 2023

“Harvested area is estimated at a record 43.7 million hectares (mha), up 0.3 mha (1 percent) from last month and up 2.1 mha (5 percent) from last season. Yield is estimated at 3.52 tons per hectare (t/ha), slightly below last month and up 12 percent from last year.”

Reuters writer Naveen Thukral reported today that, “Chicago soybean futures ticked lower on Wednesday, giving up some of the last session’s gains, although the market was supported by the U.S. government’s estimate of lower output in key supplier Argentina.”

The Reuters article pointed out that, “Soybean production in Argentina will fall to a 23-year low and corn production to a five-year low, smaller than previously thought, as a crop-wasting drought decimated fields in the key South American producer, the U.S. government said on Tuesday.”

And Bloomberg writers Megan Durisin and Daryna Krasnolutska reported yesterday that, “The Black Sea grain corridor ground to a halt on Tuesday after no ship inspections were conducted under the safe-passage deal that allows Ukraine to export its crops from three key ports, although activity is now expected to resume on Wednesday.

“The Joint Coordination Centre in Istanbul didn’t conduct inspections as the parties involved ‘needed more time to reach an agreement on operational priorities,’ the United Nations said in a statement. Inspections are expected to restart tomorrow after ‘intensive discussions,’ it said.

Note to Correspondents - on the Black Sea Grain Initiative: https://t.co/7hfInHLLEG

— UN Spokesperson (@UN_Spokesperson) April 11, 2023

“The JCC hosts teams from Ukraine, Russia, Turkey and the United Nations that mutually check all ships headed to and from the three ports covered by the Black Sea grain agreement.”