Republican U.S. lawmakers plan to create a task force to study potential year-round sales of higher-ethanol E15 gasoline blends in the U.S., after an attempt to pass such legislation in…

Kansas City Fed: Rising Interest Rates Impacting Farm Lending

In an update last week from the Federal Reserve Bank of Kansas City (“Interest Rates Rise and Farm Lending Softens“), Nate Kauffman and Ty Kreitman indicated that, “Growth in farm lending activity at commercial banks was limited in the first quarter of 2023 as interest rates climbed higher. Alongside additional increases in the federal funds rates, interest rates on farm loans rose sharply. The rapid rise has shifted the range of rates offered to borrowers upward considerably. Non-real estate farm loan volumes decreased about 10% from the previous year in the first quarter of 2023, following average growth of 15% in 2022. Lending activity was pushed down by fewer new loans and smaller-sized operating loans.

The outlook for farm finances remained favorable alongside elevated commodity prices, but higher interest rates, increased production costs and drought remained key ongoing concerns.

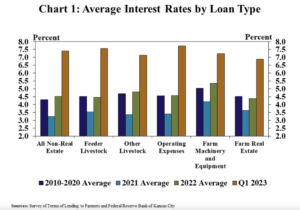

Kauffman and Kreitman pointed out that, “Interest rates on agricultural loans rose alongside further increases in benchmark rates. The average rate charged on all types of farm loans increased for the fifth consecutive quarter and reached the highest level since 2007.”

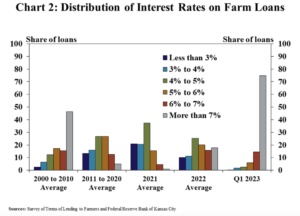

The Fed report noted that, “The range of interest rates available to borrowers has also shifted rapidly. In contrast to the average over the past two decades, three fourths of new loans in the first quarter had an interest rate above 7%. In comparison, more than half of farm loans had rates below 5% on average from 2011 through 2020.”

Last week’s update added that, “While costs for farmers remained elevated, the price of some key inputs such as fertilizer and fuel were notably lower than a year ago and likely reduced credit needs for some producers.”