As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Black Sea Grain Export Deal “Effectively Stopped,” Ukraine Says

Reuters writer Olena Harmash reported today that, “Russia has effectively stopped the Black sea grain deal by refusing to register incoming vessels, Ukraine’s reconstruction ministry said on Monday.

“Ukrainian Black Sea ports were blockaded after Russia’s invasion last year, but access to three of them was cleared last July under a deal between Moscow and Kyiv that was brokered by the United Nations and Turkey.

‘The Russian Federation once again effectively stopped the Grain Initiative by refusing to register incoming vessels and carry out their inspections. This approach contradicts the terms of the current agreement,’ the ministry said in a statement.

Meanwhile, Reuters writer Jonathan Saul reported late last week that, “The pace of shipments from Ukraine under a U.N.-backed initiative has slowed as concerns grow over ships getting stuck if a deal is not renewed later this month, according to sources and data.

“Russia, which is one of the key parties involved, said it will keep talking although Moscow has threatened to quit on May 18, which has created more uncertainty for traders and shipping companies trying to plan ahead.”

Saul indicated that, “Under the accord, Ukraine has been able to export some 29.5 million tonnes of agricultural products, including 14.9 million tonnes of corn and 8.1 million tonnes of wheat.

“However, the number of ships coming in to pick up cargoes has dropped this week to two vessels a day from three to four ships on average daily in the past three weeks, data from the agreement’s joint coordination centre showed.”

Regarding insurance, the Reuters article pointed out that, “Insurance for ships going in has been vital, and the war-cover policies need to be renewed every seven days, costing thousands of dollars.

“Rates have remained stable around 1% of the value of a ship for weeks, according to market estimates.

“Insurance industry sources say that for now there is no change in cover arrangements although conditions could alter quickly.

“‘We would expect a significant re-addressing of what is currently charged and the way it’s underwritten if the grain corridor agreement is not extended and if there is an escalation of the conflict,’ one industry source said.”

Also last week, Reuters writer Michelle Nichols reported that, “Ukraine, Russia, Turkey and the United Nations on Friday failed to authorize any new ships under a deal allowing safe Black Sea exports of Ukraine grain, which Moscow has threatened to quit on May 18 over obstacles to its own grain and fertilizer exports.”

Reuters writer Cassandra Garrison reported late last week that, “Chicago grains and soy ended the week higher on Friday as hopes dimmed for the renewal of a U.N.-brokered deal allowing the safe Black Sea exports of Ukraine grain.”

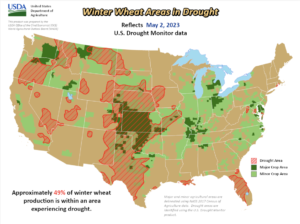

Dow Jones writer Kirk Maltais reported on Friday that, “Along with expanding drought conditions seen in the Southern Plains, wheat futures got a lift from agitation surrounding the next extension of the Black Sea Grain Initiative, if such an extension takes place at all.”

And Reuters writer Naveen Thukral reported today that, “Russia is still not satisfied with how the issue of Russian agricultural exports as part of the Black Sea grain deal is being resolved, TASS news agency quoted Deputy Foreign Minister Sergei Vershinin as saying on Saturday after the latest talks with a top U.N. official.”

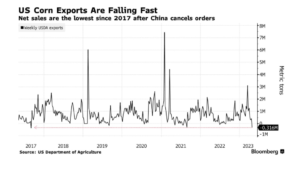

Elsewhere, Bloomberg writer Sophie Caronello reported yesterday that, “American corn exports will be in focus on Friday when the US Department of Agriculture releases its first outlook for the upcoming 2023-24 season as part of the monthly World Agricultural Supply and Demand Estimates (WASDE) report.

“A massive Brazilian corn harvest has meant product from the US — traditionally the biggest corn producer and exporter — is more expensive than shipments from South America, making it less attractive for buyers. The cancellation of US sales by China could force the USDA to trim its outlook for exports.”