Congress has quickly engaged in putting together potential aid packages for farmers that would more than double the Trump administration's $12 billion under the Farmer Bridge Assistance (FBA) Program.

Fertilizer Prices Mixed- Urea Climbs, Anhydrous Lower

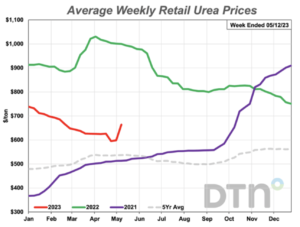

DTN writer Russ Quinn reported last week that, “Retail fertilizer prices moved in opposite directions the second week of May 2023, according to sellers surveyed by DTN.

“Half of the fertilizers are higher compared to last month, while the other half is lower.”

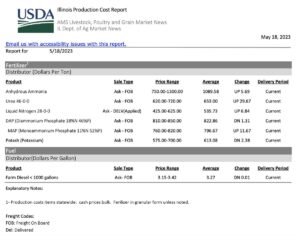

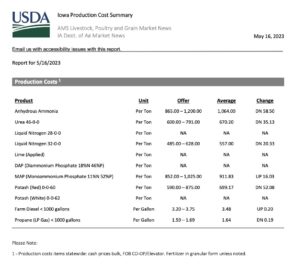

Quinn noted that, “Urea was 6% higher compared to last month. The nitrogen fertilizer had an average price of $664 per ton, back above $600/ton after one week of being below that level for the first time in a year and a half.

“Slightly higher was DAP, MAP and UAN32 looking back to the prior month. DAP had an average price of $828/ton, MAP $826/ton and UAN32 $517/ton.

“Leading fertilizer prices lower was anhydrous. The nitrogen fertilizer was 9% less expensive compared to last month, and it had an average price of $910/ton.

“Three other fertilizers (potash, 10-34-0, UAN28) were slightly lower looking back a month. Potash had an average price of $627/ton, 10-34-0 $739/ton and UAN28 $423/ton.”

The DTN article added that, “All fertilizers are now lower double digits compared to one year ago. 10-34-0 is 18% less expensive, DAP is 22% lower, MAP is 24% less expensive, both potash and UAN32 are 29% lower, UAN28 is 33% less expensive, urea is 34% less expensive and urea is 41% lower compared to a year prior.”

Meanwhile, in its weekly Grain Transportation Report on Thursday, the USDA’s Agricultural Marketing Service (AMS) indicated that, “According to data from the Surface Transportation Board (STB), the total of fertilizer carloads originated by Class I railroads for the week ending May 6, 2023, was 6,550—an all-time high since STB began collecting the data in March 2017. For the first 12 weeks of 2023, fertilizer carloads were 2 percent fewer than the prior 5-year average (Grain Transportation Report (GTR), April 20, 2023). However, in the weeks since then (weeks 13 through 19), fertilizer carloads have risen, and are now 3 percent above the 5-year average. The rise in fertilizer carloads comes amid lower fertilizer prices than last year, higher corn plantings than last year, and restricted upbound barge traffic on the Mississippi River due to flooding.”

In more detail regarding barge traffic on the Mississippi, AMS explained that, “As of May 13, the Upper Mississippi River (UMR) has reopened to barge traffic. Above St. Louis, MO, barge traffic had halted since April 23, when high water from spring flooding forced several locks to close. Lock and Dam 16, near Illinois City, IL, was the last site to reopen on May 13. Barge traffic may take a few weeks to normalize. From June 1 to September 30, three lock-and-dam locations on the Illinois River will close for upgrades and repairs: Brandon Road, Dresden Island, and Marseilles. Given the projects’ significant lead time, impacts to agriculture should be minimal. Grain elevators along the river are well prepared, and the work should be completed before the fall harvest.”

For the week ending May 15, the U.S. average #diesel fuel price decreased 2.5 cents from the previous week to $3.897 per gallon, 171.6 cents below the same week last year, https://t.co/LyASsWJLWS pic.twitter.com/9hVSAVc4xA

— FarmPolicy (@FarmPolicy) May 18, 2023

The AMS report added that, “For the week ending May 15, the U.S. average diesel fuel price decreased 2.5 cents from the previous week to $3.897 per gallon, 171.6 cents below the same week last year.”