A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Drought Plagues Kansas Winter Wheat Farmers, but “Global Wheat Market Seems to be Well-Supplied”

Reuters writer Tom Polansek reported on Monday that, “Farmers in Kansas, the biggest U.S. producer of wheat used to make bread, are abandoning their crops after a severe drought and damaging cold ravaged farms.

“They are intentionally spraying wheat fields with crop-killing chemicals and claiming insurance payouts more than normal, betting the grain is not worth harvesting, Reuters found on a three-day tour of the state. Other growers are turning over dismal-looking fields to cattle for grazing.”

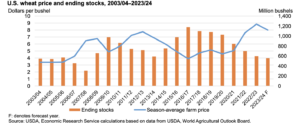

Polansek explained that, “Abandoning fields will lead to a smaller U.S. wheat supply in the world’s No. 5 wheat exporter, with stocks seen falling to a 16-year low. High rates of abandonment deal an economic blow to farm towns and force wheat buyers to adjust procurement plans by buying the staple grain elsewhere.

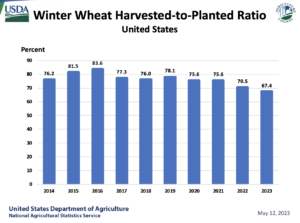

“Nationally, winter-wheat farmers plan to abandon 33% of the acres they planted, the highest percentage since World War I, the U.S. Department of Agriculture said in a May 12 report.

“Kansas farmers are expected to abandon about 19% of the acres planted last autumn, up from 10% last year and 4% in 2021, according to the report. But farmers, grain traders and representatives of major food companies who traversed the state on an annual crop tour last week warn of an even greater percentage of unharvested acres.”

The Reuters article added that, “Some farmers with dead wheat will plant sorghum in another attempt at crop production this spring.”

Also Monday, Reuters writer Naveen Thukral reported that, “Chicago wheat futures fell below $6 a bushel for the first time in more than two years on Monday, as expectations of ample global supplies weighed on prices after a deal to ship Ukrainian grains was extended last week.

“Corn and soybeans inched lower with commodity market facing additional pressure on caution around the U.S. debt ceiling talks.

“‘Global wheat market seems to be well-supplied even though there are some worries around the U.S. winter crop,’ said one Singapore-based grains trader.”

Elsewhere, Reuters writer Sybille de La Hamaide reported this week that, “Despite low groundwater levels in most of France, there is no major drought problem threatening crops, in particular cereals, as this stage, French Agriculture Minister Marc Fesneau said on Monday.”

Turning to China, Bloomberg writer Hallie Gu reported this week that,

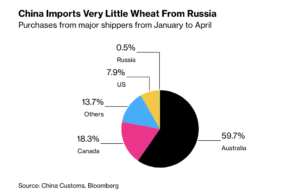

China’s wheat imports are booming, but one top supplier is missing out: Russia.

“The Asian nation is on track to be the largest buyer of the food staple this season, and Russia is the biggest exporter. While Beijing said last year that it would allow imports from all parts of Russia, trade has been hampered by a slew of issues, including phytosanitary regulations and transport challenges.”

The Bloomberg article pointed out that, “The future of wheat and meat shipments is likely to feature on the agenda when Russian government officials and executives attend a business forum in China this week, according to Agriculture Minister Dmitry Patrushev.

“There is work to do. China has been buying a lot of wheat, with total imports surging more than 60% from a year earlier to about 6 million tons in the first four months of the year. Of that, Russia supplied just a trickle — 30,000 tons.”

And Reuters writers Dominique Patton and Ningwei Qin reported this week that, “China’s soybean imports from Brazil fell 16% in April compared with the same month a year ago, data showed on Saturday, keeping supplies from the South American nation well behind last year’s level after delays to its harvest.

“The world’s top buyer of soybeans imported 5.3 million tonnes of the oilseed from Brazil, its largest supplier, versus 6.3 million tonnes a year earlier, General Administration of Customs data showed.”

The Reuters writers pointed out that, “Imports from the United States continue to edge higher, rising by 11% in April from the year before to 1.82 million tonnes.

“U.S. shipments for this year so far stand at 18.24 million tonnes, compared with 15 million tonnes last year.

“For corn, arrivals from the United States fell to 53,099 tonnes, down from 1.51 million tonnes a year ago. Total Chinese corn imports in April contracted 55% on a year ago to 1 million tonnes, with Ukraine the dominant supplier.”

In more detailed news regarding Ukrainian agricultural production, Associated Press writer Samya Kullab reported in Sunday’s Los Angeles Times that, “Across Ukraine, the Russian invasion early last year has forced grain growers into a vicious dilemma. Farmers in areas now free from Russian occupation must decide whether it’s worth risking their lives to strip land of explosives before the critical spring planting season.

“They have soaring production and transportation costs caused by Russia’s blockade of many Black Sea ports, and several neighboring European countries imposed import restrictions on Ukrainian grain to prevent a glut.

“The dual crisis is causing many farmers to cut back on sowing crops. Bottlenecks in shipping grain by land and sea are creating losses, with expectations of a 20% to 30% reduction in grain output, poorer quality crops and potentially thousands of bankruptcies next year, according to industry insiders, Ukrainian government officials and international organizations.”