Congress has quickly engaged in putting together potential aid packages for farmers that would more than double the Trump administration's $12 billion under the Farmer Bridge Assistance (FBA) Program.

China Shifting From Corn to Wheat in Animal Feed, as U.S. Drought Takes Toll on Hay Market

Reuters writers Dominique Patton and Naveen Thukral reported today that, “A surplus of cheap wheat in China is replacing significant volumes of corn in its huge animal feed market, say feed makers and analysts, curbing consumption of both corn and soymeal and potentially reducing demand for imports.

China’s shift from corn to wheat comes at a bad time for Brazil and the United States, the top soy and corn suppliers to the world’s largest buyer of both crops.

“Brazil has produced a record soybean crop this year but shipments to China are currently behind last year’s rate. Meanwhile, China has cancelled more than 800,000 tonnes of U.S. corn orders in recent weeks as buyers await cheaper options later in the year.”

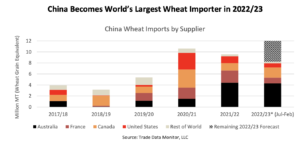

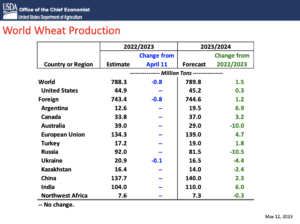

Patton and Thukral explained that, “China, the world’s top wheat producer, started harvesting what is expected to be a bumper crop this month, but it has also bought record volumes of wheat from overseas, particularly Australia.

“Total wheat imports of 6 million tonnes in the first four months – up 61% on a year ago – and the looming domestic harvest have pushed Chinese prices down 15% in the last two months, making the grain a cheaper option than corn in many areas.

“Chinese corn futures have plunged 11% in the same period, said Yuan, the analyst, pressured by mounting stocks of grain.”

The Reuters article added that, “Higher wheat usage will also push down consumption of soymeal, according to feed makers. Wheat has a higher protein content than corn, reducing the need for the protein-rich soy component in feed.”

Also today, Reuters writer Matthew Chye reported that, “Brazilian farmers will reap a large second corn crop in spite of planting some of it outside the ideal growing window, according to data released on Tuesday ahead of a crop tour of the country’s main producing states.”

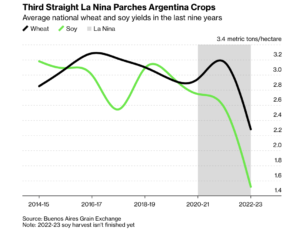

Elsewhere, Bloomberg writer Jonathan Gilbert reported yesterday that, “Argentina’s farmers need precipitation to arrive within the next three weeks to stand any chance of emerging from a disastrous drought that has shriveled harvests and slashed agricultural exports.

“Growers in the heart of the Pampas growing region, the so-called zona nucleo, need fresh rain in the coming days to moisten fields so they can sow wheat, said Cecilia Conde, chief crop analyst at the Buenos Aires Grain Exchange. Failing that, the bourse would have to cut back its forecasts for expanded acreage and higher production, which are predicated on the La Nina climate pattern coming to an end.”

“Farmers are struggling to recover from three consecutive years of drought. Soy fields being harvested now will produce the least in two decades of record-keeping at the grain exchange, while last season’s wretched wheat crop slashed Argentine exports by two thirds,” the Bloomberg article said.

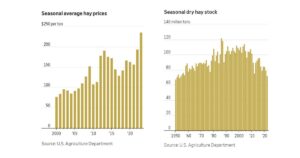

And with respect to drought conditions in the United States, Wall Street Journal writer Shane Shifflett reported yesterday that, “The market for hay is overshadowed by wheat and other crops hit by a drought in the Great Plains, but it can have a similar impact on food prices.

“‘If it don’t rain, there won’t be any hay,’ said Tim Brandyberry, owner of Honeydew Hay in southeastern Kansas.

“Texas, Oklahoma and Kansas are typically among the top 10 hay-producing states, according to U.S. Agriculture Department data, and swaths of each state are experiencing extreme drought, according to the National Drought Mitigation Center, a project from the University of Nebraska-Lincoln, the USDA and other partners.”

The Journal article stated that, “This year’s average seasonal price for all types of alfalfa and grass hay was pegged at $235 a ton, up nearly 22% from last year, USDA data show. The monthly all-time high of $250 a ton was set in October.

“Hay barns were largely empty at the start of the year, putting additional pressure on prices. In December, dry hay stocks were at their lowest levels since 1954 at nearly 72 million tons, down about 9% from a year before, based on USDA data.”

Shifflett pointed out that, “The drought has left about 60% of pastures in Kansas and 51% in Texas in poor or very poor condition, according to the USDA. Some 40% of Kansas is classified as being in exceptional drought status, according to Kansas State University Assistant State Climatologist Matthew Sittel. In nine western counties, the recent 12-month period is the driest in 128 years of record-keeping, he said.

“The drought is so huge lots of ranchers are selling and culling their herds,” Brandyberry said. Cattle inventories across the country are down 3% from 2022, according to the USDA.

U.S. Winter Wheat, Percent Abandonment, 1909-2023, https://t.co/vsAMXrnTEe pic.twitter.com/SOt384Etkz

— FarmPolicy (@FarmPolicy) May 23, 2023

“Wheat farmers are expected to harvest just 67% of their planted acres for grain crucial to the world’s food system, the lowest level since 1917, the USDA said this month.”

And Dow Jones writer Kirk Maltais reported yesterday that, “Flows of grains out of Ukraine are shrinking, even after another extension of the Black Sea export corridor deal. The latest data from Ukraine shows that exports via the initiative stood at 118,300 metric tons through the week ended May 21 – which is down 78% from the previous week.”