President Donald Trump on Friday signed an executive order temporarily expanding the amount of beef the U.S. can import from Argentina, a move the White House says is aimed at…

Growing Price Gap in U.S. Corn Export Prices Could Further Limit U.S. Exports

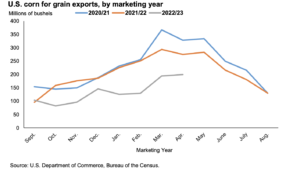

In its monthly Feed Outlook report yesterday, the USDA’s Economic Research Service (ERS) indicated that, “U.S. corn exports for 2022/23 are lowered to 1.725 billion bushels, down 50 million bushels from the May World Agricultural Supply and Demand Estimates (WASDE) report. Corn export sales, as reported in the USDA’s Foreign Agricultural Service’s Grains Inspected for Export report, reflect the diminished prospects for U.S. corn exports over the remainder of the marketing year.

Total commitments of corn exports (accumulated exports shipped, combined with remaining outstanding sales) show 1.509 billion bushels as of June 1, down from 2.343 billion bushels in 2021/22.

“Through April, U.S. corn exports totaled 1.077 billion bushels, according to data from the U.S. Department of Commerce, Bureau of the of the Census. Corn exports through April are 35 percent down from last year’s 1.662 billion bushels.

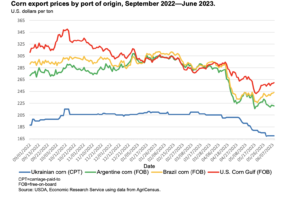

“From June to the end of the marketing year, U.S. corn intended for export enters a period of direct competition with South American crops, in particular Brazil’s large second (safrinha) crop. At present, U.S. corn prices in export markets sit well above South American competitors.”

The ERS report added that, “At the beginning of June 2023, outstanding sales were 6.5 million tons, the smallest level since 2019 and less than 50 percent of outstanding sales from a year ago. An increase in projected corn supplies, exports from Brazil and a growing gap in prices between South American (as well as Ukrainian) and U.S. corn are all projected to further limit U.S. exports during the latter part of the 2022/23 marketing and trade year.”

Yesterday’s Outlook also noted that, “With limited remaining corn supplies in the later part of the marketing year, the impact of recent price movements is minimal and the season-average farm price for corn remains estimated at $6.60 per bushel.”

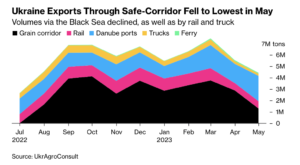

Elsewhere, Bloomberg writer Aine Quinn reported yesterday that, “Russia is considering leaving the deal that allows Ukraine to ship grain exports from Black Sea ports, President Vladimir Putin said at a televised meeting.”

Quinn pointed out that, “Russia and Ukraine are both major agricultural exporters, and mixed messages over the fate of the deal have contributed to volatility in grain prices. In May, total agricultural shipments through the safe-corridor hit the lowest since it was agreed, according to UkrAgroConsult.”

Reuters writer Guy Faulconbridge reported yesterday that, “United Nations Secretary-General Antonio Guterres said on Monday he was concerned Russia would on July 17 quit the grain deal.”

Also yesterday, Reuters writer Andrea Shalal reported that, “The White House on Tuesday called on Russia to stop threatening global food supplies, calling the situation ‘unfortunate’ as Putin earlier said Moscow may withdraw from the Black Sea grain deal.”

In other developments, Dow Jones writer Jeffrey T. Lewis reported yesterday that, “Brazilian crop agency Conab raised its estimate for soybean production for the 2022-2023 growing season as good weather boosted productivity.

“Brazilian farmers produced a record 155.7 million metric tons of soybeans this season, the agency said Tuesday. In May, the agency forecast a crop of 154.8 million tons. Brazil produced 125.5 million tons of soybeans in 2021-2022, Conab said.”

And in news regarding China, Financial Times writers Thomas Hale, Cheng Leng and Joe Leahy reported yesterday that, “With a swath of tax breaks and hints at more loans for small businesses, Chinese state planners this week started to respond to a problem already felt by many consumers and investors: the country’s economic recovery is in trouble.

“After months of disappointing data, economists and traders expect China’s government on Thursday to cut the headline policy interest rate for the first time in almost a year.”

The FT article noted that, “Such a step has been heralded by a stream of recent easing measures. Policymakers on Tuesday trimmed a short-term bank lending rate to boost financial sector liquidity, while last week the six largest banks slashed deposit rates.

“But many economists believe stronger action will be needed to reinvigorate the world’s second-biggest economy, weighed down by a lingering property slowdown, weaker trade, record youth unemployment and a dearth of optimism at a time when many hoped it would rebound.”

Chris Flood and Harry Dempsey reported yesterday at The Financial Times Online that, “Fund managers have cut commodities allocations to their lowest levels for three years in a shift that illustrates declining confidence in the outlook for Chinese demand for raw materials and fears that the global economy will enter recession.”