Republican U.S. lawmakers plan to create a task force to study potential year-round sales of higher-ethanol E15 gasoline blends in the U.S., after an attempt to pass such legislation in…

U.S. Winter Wheat Harvest Slows, as Dry Weather Remerges as a Concern for Corn, Soybeans

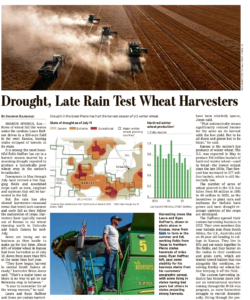

Shannon Najmabadi reported in today’s Wall Street Journal that, “Rows of wheat fall like waves under the combine Laura Haffnerdrives in a 320-acre field in far west Kansas, leaving stalks stripped of kernels in its wake.

“It is among the most bountiful fields Haffner has cut in a harvest season marred by a yearslong drought expected to produce a historically poor wheat crop in the nation’s breadbasket.

“Downpours in May through July have revived a few flagging fields and nourished crops such as corn, sorghum and soybeans that will be harvested in the fall.

But the rain has also slowed harvesters—seasonal crews that travel through the heartland each summer and early fall as they follow the maturation of crops. Harvesters have typically moved out of Kansas to cut wheat ripening north in Colorado and South Dakota by mid-July.

“Some are losing out on business as they hustle to make up for lost time. About 60% of the winter wheat in Kansas had been harvested as of July 10, down from more than 90% at the same time last year.”

Today’s article pointed out that, “Kansas is the country’s top producer of winter wheat. The U.S. was expected in May to produce 514 million bushels of hard red winter wheat—used in bread—the lowest output since the late 1950s. That forecast has increased to 577 million bushels, which is still historically low.”

“The number of acres of wheat planted in the U.S. also has fallen from 88 million in 1981 to 46 million in 2022, as the incentives to plant corn and soybeans for biofuels have grown and more drought-resistant varieties of the crops are developed,” the Journal article said.

Meanwhile, Dow Jones writer Kirk Maltais reported yesterday that, “Rainfall in the Midwest looks to be tapering out, giving way to a drier and hotter conclusion to the month – which in turn may damage U.S. crops, particularly corn.”

July 24th to 28th, Outlook. pic.twitter.com/EcfrgOc5Na

— FarmPolicy (@FarmPolicy) July 18, 2023

“The heat comes as corn is in the pollination phase – and, if interrupted, could significantly impact yields.”

Maltais added that, “An attack on the Ukrainian port city of Odesa is adding to concerns that Russia is elevating its aggression in the war, which is lifting CBOT grain futures.”

Reuters writer Naveen Thukral reported today that, “Chicago soybean and corn futures gained more ground on Wednesday, with forecasts of dry weather in the U.S. Midwest supporting prices.”

“‘Forecasts of dryness for rest of July and early August for U.S. for corn and beans is supporting prices,’ said one Singapore-based trader. ‘The situation in Russia and Ukraine is expected to reduce grain and oilseed shipments.'”

“The market is worried about the potential for warmer, drier weather to trim yields in late July and in August, which are critical months for soybean and corn development,” the Reuters article said.

Elsewhere, Reuters writer Ana Mano reported yesterday that, “Brazil is poised to export a record 18.3 million metric tons of soybeans, soymeal, corn and wheat in July, revised data from exporters association Anec showed on Tuesday, even though soybean shipment projections fell from last week.

“The previous record for July was set in 2020 for the four commodities, when 14.8 million metric tons were exported, Anec said.”