As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Kansas City Fed: As Interest Rates Climb, Farm Lending Activity at Commercial Banks Slowed

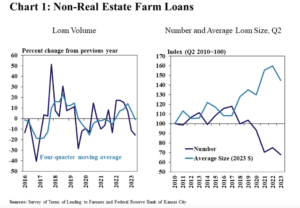

Earlier this month, in an update from the Federal Reserve Bank of Kansas City (“Farm Lending Slows as Interest Rates Rise“), Nate Kauffman and Ty Kreitman indicated that, “Farm lending activity at commercial banks slowed through the first half of 2023 as interest rates continued to push higher.

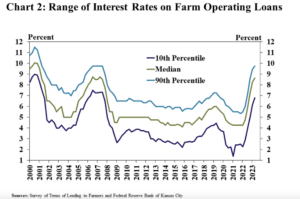

“The volume of non-real estate farm loans at commercial banks declined for the second consecutive quarter and average interest rates on agricultural loans increased for the sixth consecutive quarter. The rise in interest rates was generally consistent across loans and lenders of all sizes, but rates remained slightly lower for bigger loans and at the largest banks. As rate terms have moved up rapidly over the past year, variable rate notes have become more prevalent.”

Kauffman and Kreitman pointed out that, “Agricultural lending has slowed as interest rates on farm loans have increased considerably. The median rate on non-real estate loans doubled from the beginning of 2021 and half of all new operating loans in the second quarter garnered a rate above 8.5%.

“Moreover, one tenth of new farm operating loans carried an interest rate of nearly 10% according to the second quarter survey. In contrast, at the beginning of 2022, more than half of all loans had a rate less than 4.5% and the sharp change has likely influenced operational and financing decisions for many producers.”