As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

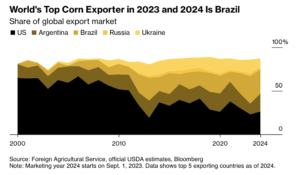

Bloomberg: Brazil Top Corn Exporter in 2023, 2024

Bloomberg writers Michael Hirtzer and Dominic Carey reported today that, “For more than half a century, US farmers dominated the international market for corn, shipping more of the critical crop than any other country to feed the world’s livestock, fill its stockpiles and manufacture its processed foods.

“No more. In the agricultural year ending Aug. 31, the US handed the corn-exporting crown to Brazil. And it might never get it back.

“In the 2023 harvest year, the US will account for about 23% of global corn exports, well below Brazil’s nearly 32%, US Department of Agriculture data show. Brazil is seen holding onto its lead in the 2024 planting year that begins Sept. 1, too. Only once in data going back to the Kennedy administration did America drop out of first place before: for a single year in 2013 following a devastating drought.

The US corn-exporting industry has never before spent two back-to-back years in second place — until now.

Hirtzer and Carey pointed out that, “Losing its lead in corn exports may feel familiar to American farmers, who in the last decade have also relinquished the top spot in both soybean and wheat exports.”

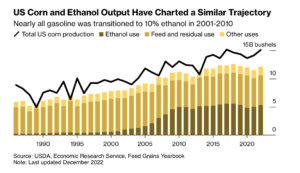

The Bloomberg article explained that, “To be sure, the shift in corn shipments isn’t all that unexpected: For years, the federal government has been incentivizing the use of domestically grown corn for ethanol, which is added to gasoline. About 40% of US corn goes to supply domestic mills making ethanol for use as a transportation fuel — though that demand will be at risk as more electric vehicles hit the road. When mills aren’t buying, the US corn crop can also be stored in massive silos or grain elevators for future use for years at a time, awaiting better prices.”

Hirtzer and Carey also indicated that, “For major agricultural buyer China, Brazil also doesn’t come with any of the US’s political baggage. Last year, China inked an agreement to purchase Brazilian grains to reduce its dependence on the US and replace supplies from Ukraine cut off by the Russian invasion. Brazil’s first shipment of corn under the new deal set sail in November.”

Meanwhile, New York Times writer Julian E. Barnes reported today that, “A newly released U.S. intelligence report warns that disruptions to the world’s grain supply caused by Russia’s invasion of Ukraine mean that poorer countries will probably struggle to provide food to their populations through at least the end of this year, given volatile agricultural prices and rapid rises in the price of fertilizer and fuel across the globe.

“The report was written by the Office of the Director of National Intelligence in June and released on Wednesday by the House Intelligence Committee. It found that the Black Sea Grain Initiative, which had allowed Ukraine to ship millions of tons of grain despite the war, had lowered food prices at the end of 2022 globally.”

Earlier this week, Reuters writer Pavel Polityuk reported that, “Ukrainian farmers are not expected to reduce the area of winter wheat they sow for the 2024 harvest despite higher logistics costs due to the wartime export crisis, a senior farming official told Reuters on Tuesday.

“Ukraine is a major wheat producer and the demise of the Black Sea corridor used to safely export grain during the war spurred speculation that farmers could sow less wheat because of shrinking profit margins due to costlier export routes.”

And a separate Reuters News article this week reported that, “Russian Foreign Minister Sergei Lavrov and Turkish counterpart Hakan Fidan will discuss a proposal by Moscow for an alternative to the Black Sea grain deal when they meet this week, Lavrov’s ministry said on Wednesday.

“Under the plan, Russia would send a million tons of grain to Turkey at a discounted price, with financial support from Qatar, to be processed in Turkey and sent to countries most in need, the Foreign Ministry said.”

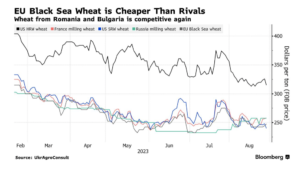

Elsewhere, Bloomberg writer Aine Quinn reported this week that, “Wheat from European Union nations bordering the Black Sea is trading cheaper than rival origins like Russia, raising its relative attractiveness for buyers.

“Russia — the world’s top wheat exporter — has tried to maintain an unofficial price floor while tightening its hold on the world’s wheat supplies following its invasion of Ukraine, but bumper stocks elsewhere have lowered costs. As a result, countries that previously bought wheat mainly from Russia are starting to turn to cheaper competitors.”