China has bought about 12 million metric tons of U.S. soybeans, fulfilling a U.S.-stated pledge to purchase that volume by the end of February, three traders told Reuters on Tuesday,…

ERS: U.S. Hard Red Winter Wheat Exports, “Lowest Since Records Started in 1973/74”

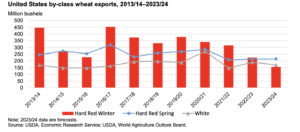

In its monthly Wheat Outlook report yesterday, the USDA’s Economic Research Service (ERS) indicated that, “U.S. Hard Red Winter (HRW) exports are forecast down 10 million bushels this month to 155 million bushels, the lowest since records started in 1973/74. HRW supplies have seen a long-term downturn in U.S. acreage as corn and soy have gained acreage in many locations. At the same time, international wheat competition has surged, resulting in exports of this class being less competitive on the global market.

“Recently, U.S. HRW supplies have been affected by drought in consecutive years, which has dented crop prospects and contributed to exports of this class being uncompetitive with other suppliers such as Russia and the European Union (EU). Historically, HRW was the leading class of U.S. exports, but in this season, it is forecast as the third largest class of U.S. exports, being surpassed by both Hard Red Spring (HRS) and White wheat. Production of HRS and White are down year-over-year with lower yields, but drought has not affected those classes to the same extent as HRW.”

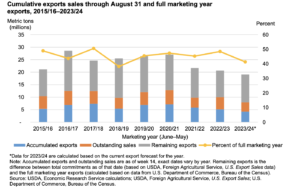

ERS pointed out that, “U.S. exports continue to be priced uncompetitively on the global market, resulting in a slow pace of sales. U.S. export sales, as reported in the USDA, Foreign Agricultural Service (FAS) U.S. Export Sales report, are well behind last year’s pace through August 31. Total U.S. commitments (the sum of accumulated exports and outstanding sales) are at 7.9 million metric tons as of August 31, down 21 percent from the same point last year.

“The full marketing year (MY) forecast at 700 million bushels is 8 percent below the 759 million bushels exported in the previous year. Total commitments at this point account for 41 percent of the full estimate, compared with 48 percent at this point last year. In the previous 8 years, only 2018/19 (38 percent) had a lower percent of accounted for at this point in the year.”

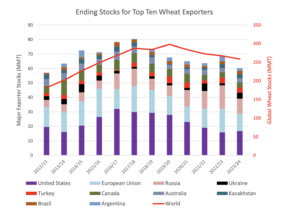

Also this week, the USDA’s Foreign Agricultural Service (FAS) explained in its monthly Grain: World Markets and Trade report, that, “Following 3 years of record production, 2023/24 global wheat production is now forecast down as crops are trimmed in several key exporting countries. Of the top ten exporters, year-over-year crop reductions are forecast in the EU, Russia, Canada, Australia, Kazakhstan, and Brazil. With tightening supplies in these major exporters, global trade is now forecast down 6.0 million tons from last year, but still the second highest on record.

FAS stated that, “Meanwhile, global wheat consumption is forecast at a record in 2023/24, exceeding global production. To satisfy this demand amidst tightening supplies, many major exporters will dip into wheat stocks, with the largest year-to-year declines in the EU and Russia.

The 2023/24 global wheat ending stocks are forecast to reach the lowest level since 2015/16 due to consistent global demand with reduced production from major exporters.

“For the top ten wheat exporters highlighted above, combined ending stocks are forecast at the lowest level since 2012/13. Exporter stocks are a key metric in determining availability of supplies for the global market.”

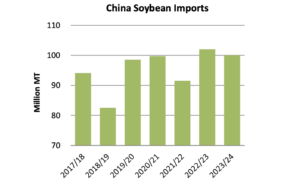

Elsewhere, FAS also pointed out this week in its monthly Oilseeds: World Markets and Trade report that, “This month, USDA raised 2022/23 China soybean imports (Oct-Sep) by 2.0 million tons to a new record of 102.0 million tons on strong end-of-year shipments, primarily from Brazil.”

And Dow Jones writer Kirk Maltais reported yesterday that, “Export sales of U.S. wheat fell on the high end of forecasts by analysts surveyed this week.

“The Department of Agriculture said in its weekly export sales report Thursday that sales of wheat for the 2023/24 marketing year totaled 437,900 metric tons. That’s up 18% from the prior four-week average and up 20% from the previous week, with leading buyers including Mexico, Thailand and Japan.

“Corn and soybean sales fell within the forecasts of analysts surveyed by The Wall Street Journal this week–with corn sales totaling 753,300 tons and soybean sales totaling 703,900 tons. Soybean sales were on the lower end of estimates, while corn sales fell in the middle.”

Maltais added that, “China was the leading buyer of U.S. corn and soybean exports for the week.”

Today, Reuters News reported that, “A Canadian government report on Thursday showed that local farmers will harvest 29.8 million metric tons of wheat, slightly more than previously expected but short of the average industry expectation of 30.4 million tons.

“In Europe, meanwhile, consultants Strategie Grains cut their forecast for European Union soft wheat exports by 700,000 tons to 30.1 million metric tons this season, citing EU wheat was proving uncompetitive against Russian grain.

“Cheap Russian wheat supply has dominated the market, pushing down prices despite expectations that global exportable stocks will approach historic lows by mid-2024.”