The world's farmers face soaring fertilizer and fuel prices as the war in the Middle East escalates, leaving some scrambling for supplies as the spring planting season approaches and causing…

China Grain Companies Sign Agreement to Purchase U.S. Farm Goods

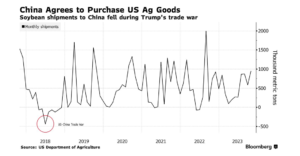

Bloomberg writers Michael Hirtzer and Tarso Veloso Ribeiro reported yesterday that, “Chinese grain companies participated in a formal contract-signing ceremony for the purchase of US farm goods for the first time since the Trump-era trade dispute.

“Buyers including Sinograin and COFCO International signed 11 agreements with crop traders such as Archer-Daniels-Midland Co., Bunge Ltd. and Cargill Inc. during a forum in Iowa, according to a statement from the US Soybean Export Council on Tuesday.”

The Bloomberg article noted that, “Such ceremonies were commonplace prior to the trade dispute that erupted during former US President Donald Trump’s tenure, with the last occurring in 2017. Although Chinese imports of US farm goods have rebounded in the ensuing years, the Asian nation has diversified sourcing and has been buying more from countries such as Brazil.”

Also yesterday, Reuters writers Tom Polansek and Karl Plume reported that, “The deals were signed as ‘frame contracts,’ which are typically non-binding letters of intent to buy at a later date, without formal sales terms.

“‘These contracts illustrate the gains from trade: food is moving from surplus regions to deficit,’ said Jason Hafemeister, the U.S. Department of Agriculture’s acting deputy undersecretary for trade and foreign agricultural affairs.

“As of Oct. 19, soybean purchases by China from the latest U.S. harvest were down 39% from the same time last year, according to USDA data. Its corn purchases were down 73% from a year prior.”

Polansek and Plume added that, “Chinese soybean buyers attending a large U.S. soy export conference in August said that they do not see import volumes growing much more in the coming years as demand for the ingredient that is mostly used to make animal feed stabilizes.

“China recently made rare purchases of U.S. soft red winter wheat, however, after rains damaged the quality of the Chinese harvest.”

Dow Jones writer Kirk Maltais reported yesterday that, “Soybeans got a lift from a set of purchasing agreements signed between Chinese agricultural companies and U.S. commodity exporters at a ceremony organized by the U.S. Soybean Export Council and a number of other trade groups, which was held in Des Moines, Iowa. Archer Daniels Midland signed agreements with three different Chinese companies, with other major U.S. suppliers like Bunge, CHS, and Cargill also making agreements with Chinese companies like Sinograin Oils, according to the USSEC– which has representatives of ADM and Cargill on its Board of Directors. Traders and analysts now anticipate when these purchases will be announced by the USDA.”

Reuters market analyst Karen Braun pointed out today that,

The agreements are nonbinding letters of intent to buy at a later date, so the signing does not necessarily suggest a sale has occurred. Therefore, large daily sales announcements from the U.S. Department of Agriculture are not guaranteed to follow.

Also today, Reuters writer Naveen Thukral reported that, “Traders will look for USDA to confirm U.S. soybean export sales in the coming days, after an industry group said a Chinese delegation of commodity importers signed agreements to buy billions of dollars’ worth of agricultural goods.”

Elsewhere, Mike Cherney reported in today’s Wall Street Journal that, “[China’s] prolonged real-estate downturn has hit demand for iron ore, copper and other commodities, pressuring global prices and sapping export earnings for major producers in Latin America and Australia. The value of China’s imports, including consumer products, fell 6.2% in September compared with the same month last year. Everything from cosmetics to cars to dairy has taken a hit.

“In New Zealand, the world’s biggest dairy exporter, farmers are now feeling the pain. As is the case with other countries, New Zealand’s economy has become more intertwined with China’s because of the country’s heft and strong growth in recent decades. To meet demand from its expanding middle class, China imports billions of dollars of dairy products each year, with New Zealand sending more than 30% of its dairy exports by value there.

Today’s article pointed out that, “But Chinese demand for milk, which historically has been viewed as a bit of a luxury, has also slumped amid the economic slowdown, as Chinese dairy companies have been ramping up production. The resulting supply glut has reduced China’s need to get milk from overseas. One measure of New Zealand’s dairy exports to China, which includes fresh milk, milk powder, butter and cheese, fell 31% by value in September compared with the same month last year.

“The weak demand from China is driving dairy prices lower. They are now down nearly 40% compared with March last year. A few weeks ago, they were down nearly 50%.”