Congress has quickly engaged in putting together potential aid packages for farmers that would more than double the Trump administration's $12 billion under the Farmer Bridge Assistance (FBA) Program.

Record U.S. Corn Harvest Expected, While Ukraine Grain Exports Fall- “Despite Recent Improvements”

Reuters writer Tom Polansek reported yesterday that, “U.S. farmers will produce a record corn crop this year, the government said on Thursday, sending futures prices to a three-year low.

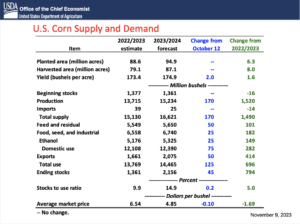

“The U.S. Department of Agriculture (USDA) raised its estimate for the nation’s 2023-24 corn crop to 15.234 billion bushels in a monthly report, from 15.064 billion in October.”

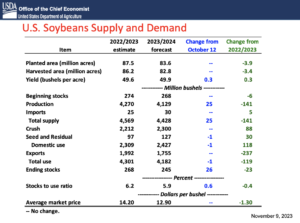

Polansek noted that, “The USDA also increased its forecast for soybean production to 4.129 billion bushels from its October estimate of 4.104 billion. It estimated average yields at 174.9 bushels per acre for corn and 49.9 bushels per acre for soybeans.

“Some farmers and analysts reported stronger corn yields across the Midwest recently, fueling expectations that the USDA could increase its forecasts. A month ago, the government reduced its estimates for the corn and soybean harvests.”

November 2023 #Corn pic.twitter.com/3dqG1t8zpj

— FarmPolicy (@FarmPolicy) November 9, 2023

The Reuters article added that, “Higher corn production will increase the amount of grain left in storage after all the corn has been delivered for customer and exporter needs. Corn stocks are projected to swell to 2.156 billion bushels for 2023-24, up from USDA’s previous estimate for 2.111 billion.

“The government pegged global corn stocks at 314.99 million metric tons, up from 312.40 million.

“U.S. soybean ending stocks were estimated at 245 million bushels, compared to 220 million last month.”

November 2023 #Soybeans Acreage, Yield, and Production pic.twitter.com/zse1K2AsVZ

— FarmPolicy (@FarmPolicy) November 9, 2023

Wall Street Journal writer Ryan Dezember reported yesterday that, “Corn futures—which dropped Thursday following the Agriculture Department’s monthly crop report—have been trading at their lowest prices since late 2020, when the pandemic’s broad rally in raw materials was just revving up.”

Meanwhile, Dow Jones writer Kirk Maltais reported yesterday that, “Following the release of its weekly export sales report Thursday morning, USDA confirmed large flash sales of U.S. soybeans with 1.04 million metric tons sold to China for delivery in the 2023-24 marketing year, and another 662,500 tons sold for delivery to unknown destinations.

“Grain traders and analysts generally consider ‘unknown destinations’ to typically signal China, meaning the market speculates the country purchased roughly 1.7 million tons of soybeans. The flash sales announcement came ahead of the WASDE report.”

Reuters writer Naveen Thukral reported today that, “The soybean market has received some support from strong Chinese demand in recent days.”

The article added that, “Brazil, the world’s top soybean grower and exporter, will produce an estimated 162.420 million tons of the oilseed in the 2023/24 cycle even as erratic weather disrupts some planting, crop agency Conab said in a new, higher forecast on Thursday.”

Thukral also noted that, “Ukraine’s alternative Black Sea export corridor is working despite a recent Russian attack on a civilian vessel, Deputy Prime Minister Oleksandr Kubrakov said on Thursday.”

#Ukrainian_Corridor: vessel traffic continues both to and from the ports of Big Odesa.

— Oleksandr Kubrakov (@OlKubrakov) November 9, 2023

6 vessels with 231K tons of agricultural products on board have left the ports of Big Odesa and are heading towards the Bosphorus. 5 vessels are waiting to enter ports for loading. Traffic… pic.twitter.com/KDoIREvZIH

Also today, Reuters writer Pavel Polityuk reported that, “The number of rail wagons heading to the ports of Ukraine’s Odesa region continued to rise over the past week thanks to the successful operation of the alternative Black Sea exports corridor, a senior railways official said late on Thursday.

“Valeriy Tkachov, deputy director of the commercial department at Ukrainian Railways, said on Facebook that over the last week the number of grain wagons heading to Odesa ports increased by more than 26% to 5,341 from 4,227.”

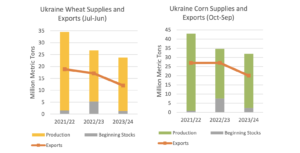

In its monthly Grain: World Markets and Trade report yesterday, the USDA’s Foreign Agricultural Service indicated that, “As Ukraine continues to leverage export routes outside of its major Black Sea ports, 2023/24 grain exports are forecast up 1.7 million tons this month to 34.1 million on upward adjustments for wheat, corn, and to a lesser extent barley. Despite this, grain exports are still forecast down 27 percent from the prior year and 28 percent from the pre-war 5-year average owing to limited seaborne export capacity following the expiration of the Black Sea Grain Initiative (BGSI).

“The expected decline in exports is also partially due to smaller carry-in stocks. Though grain production is forecast up 3.5 million tons in 2023/24, carry-in stocks are 9.5 million tons lower than the prior year.”