Congress has quickly engaged in putting together potential aid packages for farmers that would more than double the Trump administration's $12 billion under the Farmer Bridge Assistance (FBA) Program.

Chicago Fed: Farmland Values Climb 5% Year-Over-Year in Third Quarter

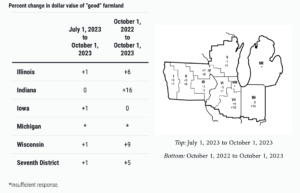

On Thursday, in the Federal Reserve Bank of Chicago’s quarterly AgLetter, David Oppedahl explained that, “The District had a year-over-year gain of only 5 percent in its agricultural land values in the third quarter of 2023. This was the lowest year-over-year increase for District farmland values since the third quarter of 2020. Indiana led the way with a year-over-year gain in farmland values of 16 percent; Illinois and Wisconsin had year-over-year growth in farmland values of 6 percent and 9 percent, respectively. Growth in Iowa’s farmland values was stagnant in nominal terms.”

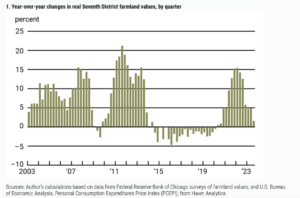

“After being adjusted for inflation with the Personal Consumption Expenditures Price Index (PCEPI), District farmland values were up less than 2 percent in the third quarter of 2023 relative to a year ago.

“In nominal terms, the District’s agricultural land values in the third quarter of 2023 were 1 percent higher than in the second quarter.”

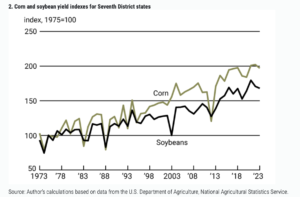

The AgLetter stated that, “An Illinois banker reported that ‘crop yields are surprisingly very good; however, net farm income levels will be lower than 2022 due to lower commodity prices.’ Despite a widespread drought across the District, corn and soybean yields for its five states in 2023 dipped just a bit from 2022 and stayed close to their historically highest levels, based on U.S. Department of Agriculture (USDA) data.

“With timely rains in many areas, both corn and soybean yields for the five District states in 2023 were the fourth highest of all time, according to October USDA data.”

In the third quarter, crop yields in the Seventh District were fairly strong, despite #drought conditions. Learn more about the Midwest’s #harvest and timely rains in the latest edition of the AgLetter from policy advisor David Oppedahl. https://t.co/mfbESNylHJ pic.twitter.com/tOF1dYr3u6

— ChicagoFed (@ChicagoFed) November 10, 2023

Mr. Oppedahl added that, “Agricultural credit conditions for the District softened in the third quarter of 2023.

Agricultural interest rates—in both nominal and real terms—jumped higher during the third quarter of this year.

“As of October 1, 2023, the District’s average nominal interest rates on new operating loans (8.50 percent) and feeder cattle loans (8.47 percent) were at their highest levels since the second quarter of 2007; its average nominal interest rate on farm real estate loans (7.70 percent) was last as high in the second quarter of 2007. In real terms (after being adjusted for inflation with the PCEPI), the average interest rates on farm operating loans and feeder cattle loans were last higher in the third and fourth quarters of 2009, respectively; the average real interest rate on farm real estate loans was last higher in the fourth quarter of 2015.”

And the Chicago Fed indicated that, “Net cash earnings (which include government payments) for crop and dairy farmers were expected to be down during the fall and winter from their levels of a year earlier, according to the responding bankers.”