As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Farmland Values, Agricultural Prices, and Farm Income

Today’s update looks at a variety of information sources that highlight recent developments relating to the U.S. farm economy, including variables associated with farmland values, agricultural prices, and farm income.

Farmland Values

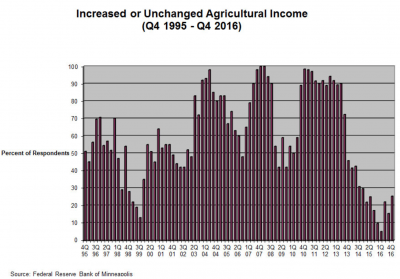

An update on March 23rd from the Federal Reserve Bank of Minneapolis stated that, “Farm incomes and capital spending continued to decrease, according to lenders responding to the Minneapolis Fed’s fourth-quarter (January) agricultural credit conditions survey.

Falling incomes also led to decreased loan repayment rates, while loan demand, renewals and extensions increased.

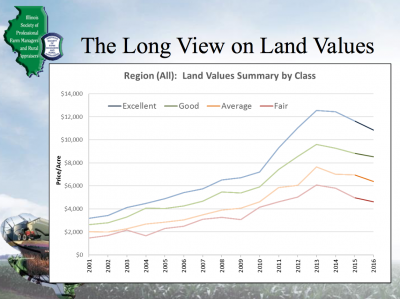

“The rapid growth of farmland values and rents continued to decline from record levels of a few years ago.”

The Minneapolis Fed also explained that, “Consistent with weak incomes, loan repayment rates decreased, while renewals ticked up.”

And with respect to farmland values, the Fed report stated that, “As in other recent quarterly surveys, farmland values continued to decrease somewhat in the final three months of 2016, with cash rents following suit. Average land values and cash rents for nonirrigated land, irrigated land and ranchland all fell from the previous year districtwide. Nonirrigated farmland saw the biggest drop, with the district average value decreasing 5.4 percent, while rents fell 6.6 percent over last year. Decreases for irrigated farmland and ranchland were similar, with values down 4.3 percent and 5 percent, respectively, while rents fell 8.4 percent and 0.5 percent.”

Business sect today's @DMRegister Iowa farmland values inch higher. Is the ag downturn bottoming out?, by @DonnelleE https://t.co/21sHNamLLl pic.twitter.com/w9VP4B3sWm

— Farm Policy (@FarmPolicy) March 28, 2017

Meanwhile, Donnelle Eller reported in The Des Moines Register on March 28th that, “Iowa farmland values inched nearly 1 percent higher the past six months, the first increase since September 2013, a new report says.

The hike offers a glimmer of hope that the ag downturn could be hitting bottom.

“Iowa farmland values climbed 0.9 percent to $6,545 per acre from September to March, according to a report from the Iowa Realtors Land Institute Chapter No. 2.”

The Register article pointed out that, “Despite the slight improvement, farmland values are still 2.8 percent lower for the year, the group said, with values falling 3.7 percent from March 2016 to September.

“In March 2016, the average value of all tillable acres was $6,732 per acre.”

Ms. Eller added that, “An Iowa State University report showed in November average farmland values had fallen 5.9 percent to $7,183 per acre over the past year.”

And more specifically for Illinois, Phyllis Coulter reported on March 24th at Illinois Farmer Today Online that:

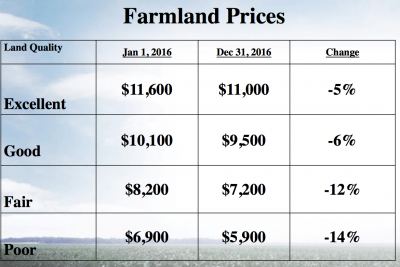

The price of excellent land in Illinois fell from $11,600 to $11,000, about a 5 percent drop from the previous year, according to the 2017 Farmland Values and Lease Trend report released March 23.

“Illinois farmland prices decreased between 5 and 14 percent in 2016, depending on land productivity, according to Gary Schnitkey, University of Illinois agricultural economist, who spoke at the meeting in Bloomington where the report was released.”

The article noted that, “‘2017 could be a repeat of the last couple of years,’ Schnitkey said. However, he noted that respondents weren’t worried there would be a big drop in land values of 20 percent or more.

“Rent and lease prices continued their downward trend. Cash rents for 2016 declined by roughly $25 per acre to a $325 average on excellent quality farmland. The survey showed landlords received $200 per acre for traditional crop share; $250 for cash rent and $235 for custom farming on excellent quality land.

“But there is a great deal of variability in cash rents, even for a specific level of land productivity. In Central Illinois, for example, most leases were down less than 10 percent and many were unchanged.”

Broader Market Considerations- Ag Prices, Farm Income

Looking ahead, Financial Times writer David Sheppard reported on March 28th that, “Some of the world’s biggest agricultural companies have said that key food markets are likely to remain oversupplied for at least three more years, in a likely boon for consumers facing higher inflation but a possible crimp on margins for growers, processors and traders.

“Gonzalo Ramirez Martiarena, chief executive of Louis Dreyfus Company, told the Financial Times Commodities Global Summit that last decade’s period of high prices, triggered by fast-growing emerging market demand, was unlikely to be revisited anytime soon.”

And Emiko Terazono reported on at The Financial Times Online on March 30 that, “World grain production is forecast to fall 3 per cent in the coming crop year as the record harvest in 2016 has taken its toll on corn and wheat prices, according the International Grains Council.

“Despite the output decline, the high level of inventories is expected to keep grain markets well supplied.

The IGC said: ‘Although some retreat in production is projected, the elevated level of opening stocks will almost offset the fall.’

“The predictions from the intergovernmental organisation echoes expectations of leading agricultural traders, whose bosses told the Financial Times Commodities Global Summit in Lausanne, Switzerland, this week that key food markets are likely to remain oversupplied for at least three more years.”

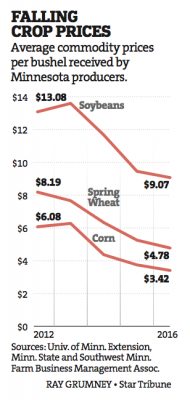

And Tom Meersman reported on the front page of the Minneapolis Star Tribune on March 29th that, “More than 30 percent of Minnesota farmers lost money in 2016, according to a new analysis by the University of Minnesota Extension and Minnesota State.

“The average Minnesota farm’s balance sheets are still strong — mainly because of record corn and soybean yields and farmers banking some surplus dollars from a few years ago — but there are obvious signs of financial stress, said Extension Economist Dale Nordquist.

Nordquist said there are always some farmers that struggle to stay in business, but the number in that category grew larger again last year.

The Star Tribune article noted that, “Requests have increased to the extension-run Farmer-Lender Mediation program, where debtors and creditors negotiate with a mediator, Nordquist said, and many farms have turned to restructured equipment or land debt to lengthen payoff terms and free up cash flow.”

The front page article added that, “Minnesota Corn Growers Association President Harold Wolle said that overall debt-to-asset ratios for most farmers are not a problem yet, but he acknowledged that ‘times are slimmer‘ because of the surplus of grain and continued low prices.

“‘Our ag banking community is working with farmers right now,’ Wolle said. ‘If there’s a place where they can stretch out a loan and get a lower payment for the current year, some of that is happening.'”