Tariffs imposed by the Trump administration collected an estimated $958 million in revenue from selected agricultural inputs from February to October of 2025, according to North Dakota State University's monthly…

U.S. Ag Trade Data Update: Some Interesting Observations

Late last week, the U.S. Department of Agriculture updated its monthly agricultural trade data. The data contained some interesting information with respect to U.S. agricultural exports. The U.S. ran a small, but very rare monthly agricultural trade deficit in May; and, U.S. corn exports to Mexico from January through May of this year were down approximately seven percent from the same time last year. Today’s update also includes recent perspectives on NAFTA renegotiation and agricultural issues.

A Rare Monthly Ag Trade Deficit in May

Gary Crawford, of USDA radio, in an audio update on Thursday, interviewed USDA trade economist Bryce Cooke who noted that, “A monthly trade deficit for agricultural goods is pretty rare.”

Mr. Crawford noted that, “But it did happen during May.”

The trade deficit was very small, $17 million out of about $10.7 billion worth of exports and imports.

Updated U.S. Agricultural Trade Data, @USDA_ERS pic.twitter.com/vCILKE6OFa

— Farm Policy (@FarmPolicy) July 7, 2017

“The last time that there was a trade deficit was actually May of last year,” Mr. Cooke said. “That one was a little bit larger, at over $100 million.”

Nonetheless, exports for the first eight months of this fiscal year are at $98.9 billion, $12 billion more than the same time in 2016. The USDA radio update also explained that the U.S. is still running an agricultural trade surplus of around $19 billion.

In a separate USDA audio report from Friday, Gary Crawford noted that the small May deficit was mostly due to typical patterns in soybean trade. USDA’s Bryce Cooke explained that, “Soybeans are harvested in the fall; the export season for soybeans generally through now has passed and now it’s the competitor countries for that product specifically, like Argentina and Brazil, where they are now starting to sell their soybeans to the rest of the world.”

Top 10 U.S. export markets for soybeans, @USDA_ERS pic.twitter.com/MnVH3MfyJM

— Farm Policy (@FarmPolicy) July 7, 2017

U.S. Corn Exports to Mexico

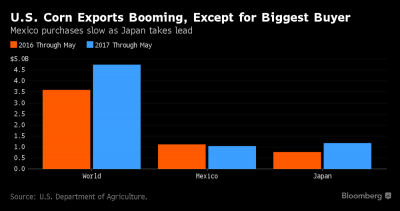

Meanwhile, Bloomberg writer Alan Bjerga reported on Thursday that, “Mexico is no longer the biggest buyer of corn from the U.S., a sign that trade tensions are pushing American grain toward other markets while its southern neighbor lines up new suppliers.”

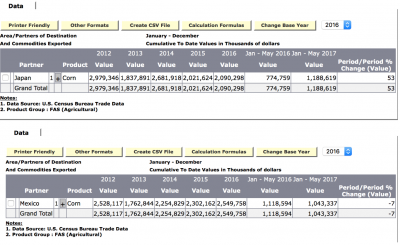

“Sales to Mexico through May were $1.04 billion, down 6.7 percent from a year earlier, the U.S. Department of Agriculture said Thursday in a monthly update. That contrasts with the 32 percent increase for the overall value of U.S. corn exports in the period, during which the average dollar value of the commodity was little changed. Japan boosted its purchases 53 percent to $1.19 billion to become the largest importer of American corn.”

Mr. Bjerga explained that, “Mexico initiated talks with other major corn exporters this year after it was criticized by President Donald Trump, who said the country has taken advantage of its northern neighbor through the North American Free Trade Agreement, taking away jobs and investment. The dispute helped to send the Mexican peso to a record low against the dollar in January.

“Mexican purchases now seem to be rebounding as the peso recovers, said Lesly McNitt, public policy director for the National Corn Growers Association in Washington. Still, the relatively sluggish pace of shipments shows how the bilateral trade relationship in agriculture is at risk, with Nafta heading toward a renegotiation as soon as next month, she said.”

Top 10 U.S. export markets for corn, by volume, @USDA_ERS -- Japan higher than Mexico for May 17-- pic.twitter.com/PqlSMhb5ha

— Farm Policy (@FarmPolicy) July 7, 2017

The Bloomberg article added that, “Mexico, which imported 13.8 million metric tons of U.S. corn in 2016, has been talking to sellers in South America. Buenos Aires-based Adecoagro SA is pursing opportunities to sell Argentinian corn and rice. In May, a Mexican livestock group signed a contract to import 60,000 tons from Brazil. The same month, Francisco Gurria Trevino, a Mexican government official in charge of livestock policy, said his country may import as much as 5 million tons of corn from Brazil in the medium-to-long term.”

Also, recall that last month, Wall Street Journal writer Jacob Bunge reported that, “Friction between the U.S. and Mexico over trade is starting to cut into sales for U.S. farmers and agricultural companies, adding uncertainty for an industry struggling with low commodity prices and excess supply.”

NAFTA Perspectives

A recent article in The Economist regarding NAFTA and agriculture noted that, “On the first day of marathon public hearings on the renegotiation of NAFTA on June 27th, held at the offices of the United States Trade Representative (USTR) in Washington, Kevin Skunes, a leader of the National Corn Growers Association, said that exports account for fully one-third of corn farmers’ income.

American corn exports to Canada and Mexico have increased more than sevenfold since 1994. Last year they supported 25,000 jobs and provided income for 300,000 farmers.

The article added that, “Farmers did not ask for a renegotiation, says David Salmonsen of the American Farm Bureau Federation, America’s largest farm lobby. But he would like it to be updated and tweaked. Easier access to the Canadian dairy and poultry market, which is protected by high tariffs and quotas on production, would be welcome.”

J. Weston Phippen indicated in a recent article in The Atlantic that, “While Canada has taken a more relaxed view of Trump’s campaign against NAFTA, in Mexico it’s provoked self-examination. Mexico signed deals with Brazil to import a record amount of corn this year. It’s talking with Argentina for beef. It’s increased some dairy imports from the European Union by 122 percent, and it’s talking with New Zealand about dairy, too. Granted, one reason NAFTA works so well is because the U.S. and Mexico are neighbors, which cuts down on shipping time and costs, so Mexico would much rather buy from the U.S.

But if that neighborly arrangement ends, Mexico is saying it has options.

And the Chicago Tribune editorial board pointed out last week on the NAFTA issue that, “It’s not just Illinois that has much at stake. Trump might keep in mind that an outsize share of the corn, soybeans and dairy products that ship to Mexico and Canada originate in Midwestern states — including some (Ohio, Michigan and Wisconsin) that were crucial to his Electoral College victory.”

Don Lee reported last month in the Los Angeles Times on the three-day public session on NAFTA held by the USTR and pointed out that, “Manuel Molano, deputy director of the Mexican Institute for Competitiveness, a think tank, flew in from Mexico City to observe and testify. On Thursday, he urged negotiators to strive to boost the North American region’s competitiveness, overall prosperity and opportunities for all three countries while preserving their partnership.

“Before boarding a flight back to Mexico, Molano said the trip was worth it. All the news that he had read in Mexico of Trump’s fiery rhetoric on trade and NAFTA in particular had been discouraging, Molano said.

“But after three days of listening to witnesses and questions asked of them, Molano sounded a more hopeful note about the negotiations.

“‘I think the American institutions are mostly in place and that the USTR and Commerce [Department] understand the importance of trade,’ he said. Everyone talked as if they wanted to see NAFTA improved, not destroyed or canceled, he added. ‘It puts my faith in the U.S. and humanity back again.'”