A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Federal Reserve Ag Credit Surveys- Second Quarter Farm Economy Conditions in the Midwest

On Thursday, the Federal Reserve Banks of Chicago, St. Louis and Kansas City each released updates regarding farm income, farmland values and agricultural credit conditions from the second quarter of this year. Today’s update provides a brief overview of yesterday’s reports.

Federal Reserve Bank of Chicago

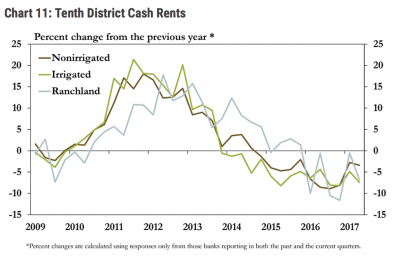

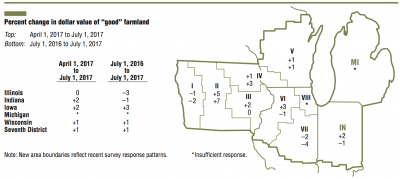

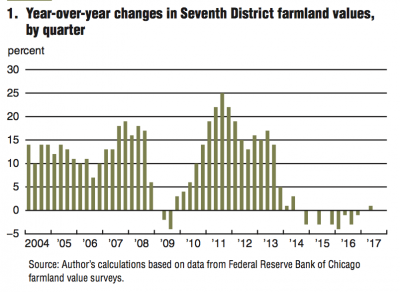

David Oppedahl, Senior Business Economist at the Chicago Fed, explained yesterday in The AgLetter that, “Farmland values for the Seventh Federal Reserve District increased 1 percent from a year ago during the second quarter of 2017.

This was the first year-over-year gain in three years. Additionally, ‘good’ agricultural land values in the District moved up 1 percent from the first quarter to the second quarter of 2017, according to a survey of 186 agricultural bankers.

“District farmland values seemed to stabilize in the first half of 2017, despite lower prices for corn and soybeans relative to a year ago.”

Mr. Oppedahl pointed out that, “For the second quarter of 2017, there was a year-over-year increase of 1 percent in District agricultural land values—which was the first such upward movement since mid-2014. Although the District’s overall farmland values were up from a year ago, those of both Illinois and Indiana experienced year-over-year decreases.”

Note also on the issue of Indiana farmland values that the Purdue Agricultural Economics Report indicated this month that, “On a state-wide basis, year to year comparisons indicate top quality land remained steady (an increase of 0.2%), while average and poor quality farmland experienced modest declines of 1.6% and 1.4%, respectively. This is a much different outcome than reported last year with a state-wide decline of 8.2% to 8.7% across farmland qualities.”

Recall that USDA’s annual Land Values summary from last week indicated that Illinois farmland values dropped 1.3% from last year, while Indiana farmland values fell 4.3%.

The USDA report also indicated that farmland values in Wisconsin increased 6.1% from 2016, while Iowa farmland values were up by 1.3%.

Iowa cropland value increased 1 percent from last year to $8,100 per acre, @usda_nass pic.twitter.com/xcAGEOXiN6

— Farm Policy (@FarmPolicy) August 10, 2017

With respect to credit conditions in the Seventh Federal Reserve District, yesterday’s AgLetter update stated that, “While agricultural credit conditions in the second quarter of 2017 again deteriorated relative to 12 months ago, they seemed to do so more slowly than in recent quarters. Repayment rates for non-real-estate farm loans relative to a year ago were still down during the second quarter of 2017, but less so than in the first quarter.”

Federal Reserve Bank of St. Louis

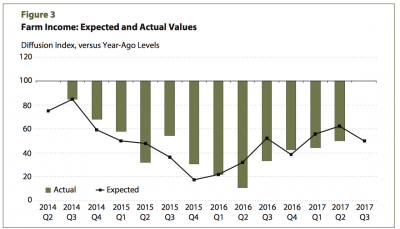

The Agricultural Finance Monitor, released yesterday by the St. Louis Fed, stated that, “Survey results indicate that proportionately more bankers continue to report year-over-year declines in farm income. This is reflected in the diffusion index value of 50 and marks the 14th consecutive quarter with a value below 100. [NOTE: An index value of 100 would indicate an equal percentage of bankers reported increases and decreases in farm income relative to a year earlier.] The value for the current quarter is only slightly worse than the value of 55 from the first quarter of 2017.”

Yesterday’s update noted that,

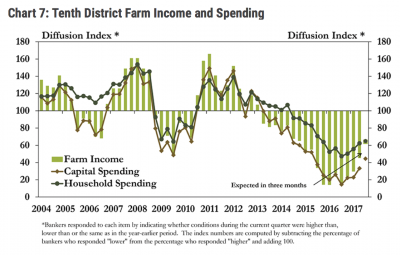

Levels of household spending and capital spending, both closely tied to farm income, reflected stagnant trends.

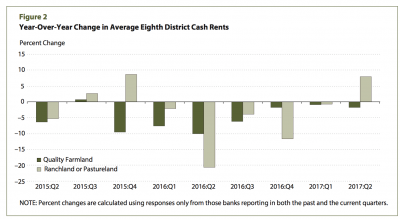

With respect to land values and cash rent levels, the St. Louis Fed indicated that, “Quality farmland values and rents for quality farmland registered small decreases in the second-quarter survey compared with results from four quarters earlier. Quality farmland values decreased by less than 1 percent in the second quarter [Figure 1], while cash rents declined 1.8 percent relative to a year ago [Figure 2].”

In a closer look at farm income, the St. Louis Fed noted that, “[Another special question on the survey] asked bankers about the farm income projections issued in March 2017 by the University of Missouri’s Food and Agricultural Policy Research Institute, which indicated a roughly 8 percent decline in net farm income this year. Three-quarters of bankers felt that number was about right, with the balance of remaining responses evenly split among those that felt the projection was either too optimistic or too pessimistic.”

Federal Reserve Bank of Kansas City

Nathan Kauffman and Matt Clark writing in Thursday’s Ag Credit Survey from the Kansas City Fed, noted that, “Agricultural credit conditions weakened further in the second quarter, but the pace of deterioration has slowed. Although the rate at which farm loans are being repaid continued to decrease, the change from a year ago was not as sharp as in recent years.”

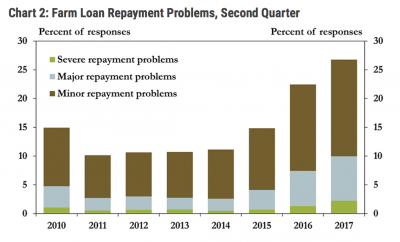

More specifically, when looking at loan repayment issues, the Kansas City Fed explained that,

The severity of loan repayment problems also increased, but not as sharply as a year ago.

“In the second quarter, 27 percent of bankers reported ‘minor repayment problems,’ up from 22.5 percent a year ago. However, the change from 2015 to 2016, an increase from 14.8 percent to 22.5 percent, was more significant. Moreover, only 2.2 percent of bankers reported ‘severe repayment problems’ in the second quarter.”

More generally on farm income, yesterday’s update explained that, “Similar to credit conditions, income in the farm sector continued to weaken but not as rapidly as in recent years. Although 57 percent of bankers reported lower farm income in the second quarter, it was the smallest share in two years.”

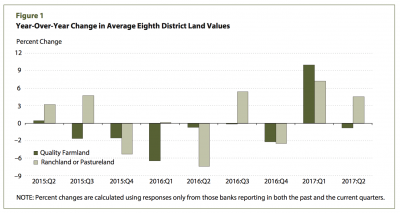

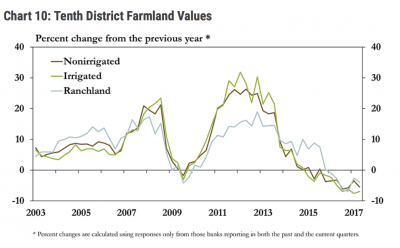

Kauffman and Clark added that, “Farmland values continued to trend lower alongside the reductions in farm income and weaker credit conditions, but the changes have remained modest. For the sixth consecutive quarter, the value of cropland and ranchland in the District decreased from a year ago.”

And with respect to cash rents, the authors stated that, “Similarly, cash rents also declined at a modest pace as farm income continued to weaken. Consistent with changes in the value of farm real estate, cash rental rates for cropland and ranchland have declined for six consecutive quarters.”