Tariffs imposed by the Trump administration collected an estimated $958 million in revenue from selected agricultural inputs from February to October of 2025, according to North Dakota State University's monthly…

USDA Trade Data: 2017 Calendar Year Highlights; Outlook for 2018 (Corn, Soybeans)

Today’s update looks at recent USDA trade highlights from calendar year 2017, and then turns to USDA’s export projections for corn and soybeans in the 2018-19 marketing year.

USDA Trade Data- 2017 Calendar Year Highlights

Earlier this month, the USDA’s Economic Research Service (ERS) updated some of its monthly agricultural trade data, which showed that the total value of all agricultural exports for calendar year 2017 was $138.4 billion, up about 3 percent from 2016. Due to record high imports, the trade balance for 2017 was a surplus of $17.4 billion, about $2.9 billion lower than 2016.

The value of corn exports was down eight percent from 2016, and the value of soybean exports was down by five percent.

#UnitedStates #agricultural exports, year-to-date and current months, https://t.co/QmbQ2JI0Ol @USDA_ERS pic.twitter.com/JIqvUNWzey

— Farm Policy (@FarmPolicy) February 7, 2018

Meanwhile, in its monthly Livestock, Dairy, and Poultry Outlook report from February, ERS explained that, “In 2017, U.S. beef exports increased 306 million pounds (+12 percent) year-over-year to 2.9 billion pounds.

This is the second consecutive year of double-digit export growth, with volumes reaching record levels.

“Sustained demand in Asian markets contributed to these volumes, with double-digit growth to Japan (26 percent) and Hong Kong (14 percent). The top five export destinations captured about 83 percent of all U.S. beef exports.”

The ERS update also pointed out that, “The expansion of U.S. processing capacity elevates the importance of pork exports as a component of total pork demand.

In 2017, 22 percent of U.S. commercial pork production was exported.

“This year, exports are expected to be 5.9 billion pounds, almost 5 percent above 2017 and 21.9 percent of commercial pork production. For the year 2017, the 10 largest export markets are summarized below. Roughly the same set of countries is expected to account for about 95 percent of U.S exports in 2018. It is anticipated that increased U.S pork production this year, and the lower pork prices that accompany it, will make U.S pork a very good buy in major foreign markets.”

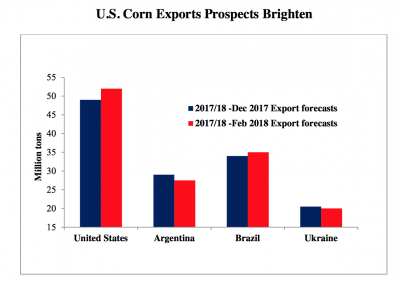

More specially on current corn export issues, USDA’s Foreign Agricultural Service (FAS) indicated in its February Grain:World Markets and Trade report that, “The global corn market is primarily supplied by four countries – Argentina, Ukraine, Brazil, and the United States. Combined, they account for nearly 90 percent of all global exports. While these countries continue their dominance, 2017/18 prospects for each exporting country are changing, influenced by weather and, ultimately, prices.”

The FAS report noted that, “The Argentine corn crop is forecast sharply lower this month reflecting the impact of ongoing heat and dryness. With reduced production, forecast exports are cut substantially. For Ukraine, the preliminary statistics by the State Statistical Service show much smaller production with a lower yield, leading to prospects for smaller exports. For Brazil, the shipping pace of the previous crop (2016/17) has remained slower than anticipated, impacted by heavy rains and road conditions. For 2017/18, exports will depend on the size of the second crop (safrinha) that is currently being planted, as forecast production is still highly tentative and determined largely by the outcome of the rainy season in the Center-West in April and May.”

The FAS update added that,

Meanwhile, sales and shipments of U.S. corn have been brisk in recent weeks as foreign buyers turn to the United States.

“With successive bumper crops, the United States has abundant exportable supplies and prices are expected to remain competitive on an FOB (free on board) basis until Brazil’s second crop comes onto the market.”

USDA Trade Data: 2018-19 Marketing Year Outlook (Corn, Soybeans)

On Friday at USDA’s Agricultural Outlook Forum in Arlington, Virginia, the Department released its Grains and Oilseeds Outlook for 2018, which stated that, “Corn production in 2018 is projected at 14,390 million bushels, 1 percent below a year ago on fractionally lower planted area and a return to trend yield…The national average corn yield is projected at 174.0 bushels per acre, below last year’s record yield of 176.6 bushels.”

Live #AgOutlook: @USDA Hitchner “174 bushels per acre expected yield of corn 2018-2019” #grain #oatt #agriculture pic.twitter.com/s1l6Fu4AXY

— USDA Ag Mktg Service (@USDA_AMS) February 23, 2018

“Corn exports for 2018/19 are projected at 1,900 million bushels, down 150 million from the 2017/18 forecast.

Competition from Argentina, Brazil, and Ukraine is expected to limit U.S. export prospects.

“Argentina is forecast to increase its exports despite the impact of below trend yields in 2017/18 as corn area has expanded substantially in the last 2 years. Planting is underway for Brazil’s second-crop corn and this crop would be expected to compete with U.S. exports starting in the summer of 2018. At the same time, with normal weather conditions Ukraine is expected to continue export expansion to countries in Asia, dampening prospects for the United States in the region. The U.S. market share of global trade is expected to remain in a range of 30 to 35 percent.”

While addressing soybeans, USDA stated on Friday that, “Soybean supplies for 2018/19 are projected at a record 4,875 million bushels, up 3 percent from 2017/18…[t]he national average soybean yield of 48.5 bushels per acre is 0.6 bushels below last year and 3.5 bushels below the 2016 record.”

With respect to soybean exports, Friday’s update stated that, “U.S. 2018/19 soybean exports are projected at 2,300 million bushels, up 200 million from the 2017/18 forecast. Rising global demand, along with a decline in the 2018 South American harvest, is expected to ease competitive pressures that contributed to this year’s lower projected exports. The U.S. global export share is forecast to rise slightly, although a rebound for 2019 production in South America will support additional exports from the region.

Global trade will continue to be driven by China, which currently accounts for nearly two-thirds of world trade.

“Although the year-to-year increase for China’s soybean imports is expected to remain below the 5-year average on a percentage basis, imports are expected to exceed 100 million tons for the first time. Continued demand growth in the rest of Asia and in the Middle East and North Africa region will provide additional support for a rise in global imports.”