A package of funding bills assembled by House and Senate appropriators that needs to pass before the end of January does not contain any more aid for farmers. It's also…

Federal Reserve Ag Credit Surveys- 2018 First Quarter Farm Economy Conditions in the Midwest

On Thursday, the Federal Reserve Banks of Chicago and St. Louis released updates regarding farm income, farmland values and agricultural credit conditions from the first quarter of 2018. Recall that the Federal Reserve Bank of Dallas issued a similar update last month. Today’s update highlights core findings from Thursday’s reports.

Federal Reserve Bank of Chicago

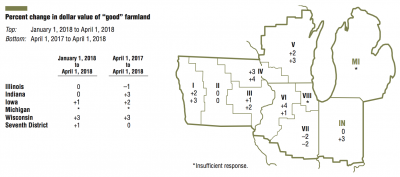

David Oppedahl, a Senior Business Economist at the Chicago Fed, explained in The AgLetter that, “Agricultural land values for the Seventh Federal Reserve District showed signs of stabilizing in the first quarter of 2018, as farmland values were unchanged from a year ago. On average, ‘good’ farmland values in the first quarter of 2018 rose 1 percent from the fourth quarter of 2017, according to the survey responses of 181 District agricultural bankers.”

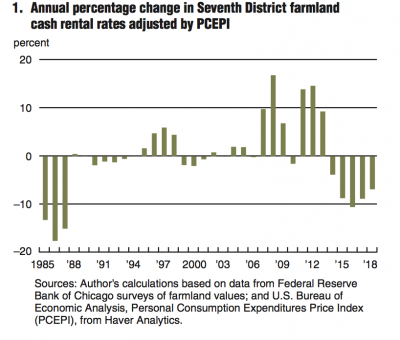

“Additionally, cash rental rates for District farmland decreased again in 2018; however, their year-over-year decline of 5 percent was smaller than the decline recorded for 2017.”

The Fed report explained that, “District agricultural credit conditions tightened further during the first quarter of 2018.

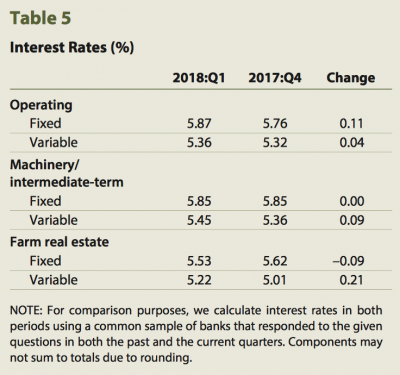

Once more, repayment rates for non-real-estate farm loans were down from a year ago, and renewals and extensions of these loans were up from a year earlier…Average nominal and real interest rates on farm loans increased in the first quarter of 2018 from the previous quarter.

More narrowly on cash rents, Thursday’s update stated that, “With cash rentals making up 80 percent of District agricultural land operated by someone other than the owner, changes in their terms are a key indicator of agricultural conditions. Cash rental rates for farmland in the District decreased 5 percent for 2018 relative to 2017—the smallest decline in four years. For 2018, average annual cash rents to lease farmland were down 5 percent in Illinois, 3 percent in Indiana, 6 percent in Iowa, 3 percent in Michigan, and 7 percent in Wisconsin. After being adjusted for inflation using the PCEPI, District cash rental rates were down 7 percent from 2017 (see chart below).”

“There seemed to be enough farmers willing to take on more acres to plant, such that cash rents did not fall as much as they would have otherwise,” the Fed update said.

The AgLetter also pointed out that, “Most survey respondents expected agricultural land values to be unchanged in the second quarter of 2018: 75 percent of responding bankers anticipated farmland values to be stable, 19 percent anticipated a decline, and 6 percent anticipated an increase.”

Federal Reserve Bank of St. Louis

The Agricultural Finance Monitor stated on Thursday, “For the seventeenth consecutive quarter, agricultural bankers in the Eighth Federal Reserve District, on net, reported that farm income had declined compared with a year earlier.”

With respect to farmland values, the report noted that, “Quality farmland values fell slightly in the first quarter from a year earlier, as did cash rents on quality farmland.”

More specifically, the St. Louis Fed pointed out that, “Table 2 (below) reports year-to-year changes in current-quarter land values and cash rents, as well as banker expectations for the trend in land values and cash rents over the following three months.

Quality farmland values fell 1.4 percent in the first quarter from a year earlier.

“Similar to the pattern for land values in the first quarter, cash rents for quality farmland values declined slightly in the first quarter from a year earlier, while cash rents for ranchland or pastureland rose sharply.”

Thursday’s report also explained that, “Interest rates on four of the six fixed and variable-rate loan categories rose slightly in the first quarter (Table 5- below).”

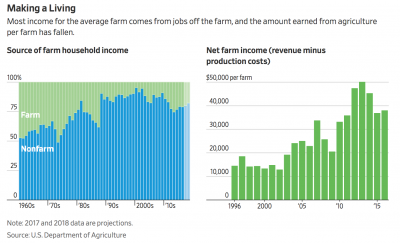

Regarding special questions in its latest survey, the Fed update noted that, “The second and third special questions asked agricultural bankers to assess the extent that farmers they lend to rely on off-farm income—that is, farmers with full-or part-time off-farm jobs—and whether these borrowers would face financial difficulty without this off-farm income. In question two, 41 percent of the bankers reported that up to one-quarter of their agricultural borrowers (farmers) had off-farm income, with another 38 percent reporting that between a quarter and half of farmers had off-farm income. Roughly one of five (22 percent) bankers reported that more than half of their farmer borrowers had off-farm income.”

The third special question asked bankers to estimate what percentage of farmers they lend to would have severe difficulty servicing their farm-related debts (making principle and interest payments) without off-farm income.

“A little more than half of the bankers reported that between zero percent and 25 percent would have severe financial difficulty without off-farm income. One of five bankers (22 percent) indicated that between a quarter and a half of their farmers would face severe financial difficulty. The remainder of respondents (22 percent) indicated that more than half of their farm borrowers would face severe financial difficulty without off-farm income.”