Congress has quickly engaged in putting together potential aid packages for farmers that would more than double the Trump administration's $12 billion under the Farmer Bridge Assistance (FBA) Program.

Corn Belt Farmers Uneasy Over Potential Policy Impacts

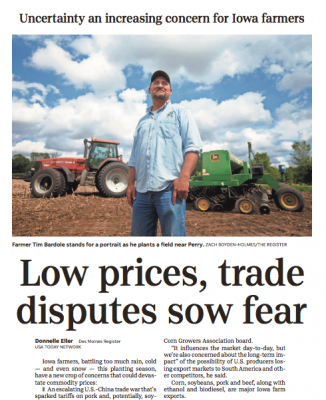

Donnelle Eller reported on the front page of Tuesday’s Des Moines Register that, “Iowa farmers, battling too much rain, cold — and even snow — this planting season, have a new crop of concerns that could devastate commodity prices:

- An escalating U.S.-China trade war that’s sparked tariffs on pork and, potentially, soybeans.

- Trade negotiations with Canada and Mexico that exploded last week following U.S. tariffs on steel imports.

- EPA ethanol waivers for oil refiners that undermine demand for ethanol and corn.

- And divisions over a new farm bill intended to provide protection to farmers.”

The Register article noted, “‘There are a lot of stresses for farmers — more than we’ve had in a long while,’ said Tim Bardole, who farms near Rippey in central Iowa.”

‘One day, it’s NAFTA negotiations … The next, it’s what Scott Pruitt at EPA is doing on ethanol waivers or trade negotiations with China,’ said [Mark Recker, a northeast Iowa farmer, and] president of the Iowa Corn Growers Association board.

Tuesday’s article pointed out, “Bardole said he understands the Trump administration’s desire to get better trade deals with China, Mexico and Canada. But he struggles with the EPA’s decision to grant waivers to refiners that must blend ethanol and biodiesel into the nation’s fuel supply.

“Ethanol advocates estimate the waivers cut 1.6 billion gallons in ethanol and biodiesel demand in 2016 and 2017.”

Meanwhile, Bloomberg writers Alan Bjerga and Mario Parker reported on Monday that, “Even as Donald Trump tweets his support for U.S. agriculture, farmer loyalty for the president looks like it’s starting to waver over moves that may undermine corn-based ethanol and escalate trade disputes with countries that import American crops.”

It should be noted that on the ethanol issue, Iowa GOP Senators Chuck Grassley and Joni Ernst tweeted the following on Tuesday evening:

@realDonaldTrump Pres Trump helped farmers by rejecting bad ethanol deal. I appreciate. GREAT NEWS

— ChuckGrassley (@ChuckGrassley) June 5, 2018

. @realDonaldTrump has said he “looovves the farmers!” #Iowa is feeling that love today, as the President just assured me he “won’t sign a deal that’s bad for farmers!” Thank you, Mr. President!

— Joni Ernst (@SenJoniErnst) June 5, 2018

And Reuters News reported on Tuesday that, “The Trump administration has indefinitely delayed a proposed overhaul of U.S. biofuels policy aimed at reducing costs for the oil industry, under pressure from corn state lawmakers who worry the move would undermine demand for ethanol, according to two sources familiar with the matter.”

Perhaps adding to farmer uncertainty on NAFTA, Bloomberg writers Terrence Dopp, Josh Wingrove, and Jenny Leonard reported on Tuesday that, “President Donald Trump is seriously considering separate trade negotiations with Canada and Mexico but he doesn’t plan to withdraw from the North American Free Trade Agreement, White House economic adviser Larry Kudlow said.

“‘His preference now, he asked me to convey this, is to actually negotiate with Mexico and Canada separately,’ Kudlow said Tuesday during an interview on Fox News. ‘I know this is just three countries but still, you know, oftentimes when you have to compromise with a whole bunch of countries you get the worst of the deals.'”

.@larry_kudlow: President Trump is very seriously contemplating a shift in NAFTA negotiations, moving towards bilateral talks pic.twitter.com/ak1t3V6WmE

— FOX & friends (@foxandfriends) June 5, 2018

The Bloomberg writers added, “‘The president’s not going to leave Nafta. He’s not going to withdraw from Nafta,’ said Kudlow. ‘He’s just going to try a different approach. I can’t offer timing here, but judging from what he told us yesterday, I think he’d like to start that approach rather quickly.’

“Negotiators have reached agreement on about nine of 30 chapters for an updated Nafta, and the U.S. had been pushing to get a deal passed in this Congress, which would require an agreement around now. A key Republican senator, John Cornyn, said on Monday that window is now closed and talks are expected to proceed more slowly going forward.”

U.S. allies are criticizing the Trump administration over its latest round of tariffs ahead of the G7 summit. Farmers are among the hardest hit because of the tariffs so far. @connellmcshane is at a soybean farm in Ogden, IA with reaction. pic.twitter.com/hwaow7lhQS

— FOX Business (@FoxBusiness) June 4, 2018

Separately on Tuesday, Reuters writers David Alire Garcia and Miguel Gutierrez reported that, “Mexico put tariffs on American products ranging from steel to pork and bourbon on Tuesday, retaliating against import duties on metals imposed by President Donald Trump and taking aim at Republican strongholds ahead of U.S. congressional elections in November.

“Mexico’s response further raises trade tensions between the two countries and adds a new complication to efforts to renegotiate the NAFTA trade deal between Canada, the United States and Mexico.

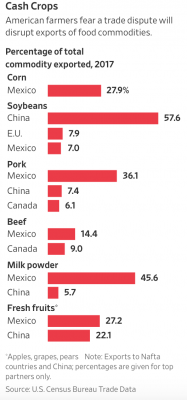

American pork producers, for whom Mexico is the largest export market, were dismayed by the move.

This is a gut punch to Virginia farmers, who exported more than $68 million in pork to Mexico last year. The President’s trade war is going to cost Virginia ag jobs. https://t.co/mJlDHJOSmA

— Mark Warner (@MarkWarner) June 5, 2018

Also with respect to trade, Lingling Wei and Bob Davis reported on Tuesday at The Wall Street Journal Online that, “China offered to purchase nearly $70 billion of U.S. farm, manufacturing and energy products if the Trump administration abandons threatened tariffs, according to people briefed on the latest negotiations with American trade officials.

“In weekend talks in Beijing, Chinese negotiators led by Liu He, President Xi Jinping’s economic envoy, presented a U.S. team headed by Commerce Secretary Wilbur Ross a package that includes Chinese companies buying more U.S. soybeans, corn, natural gas, crude oil, coal and manufactured goods.”

The Journal writers explained, “Throughout the negotiations, Mr. Liu made clear to Mr. Ross that the offer would be void if Washington proceeds with its plan to impose tariffs on $50 billion of China-made products, the people briefed on the talks said.

“That proviso could make the deal a non-starter in Washington, where the White House has said it plans to move ahead with the tariffs shortly after June 15, as a way to pressure China to make more sweeping changes in its economy.”

And Jacob Bunge, Heather Haddon and Benjamin Parkin reported on Wednesday at The Wall Street Journal Online that, “U.S. farmers, already losing sales to China, are facing new threats to sales in other big overseas markets as trade tensions spread globally.”

“The rapid-fire exchange of tariffs and trade threats leaves U.S. farmers and agricultural groups fearing tougher sells in their most important overseas markets, with duties adding to the cost of U.S. goods in markets that imported $70 billion worth of U.S. farm products last year, according to the U.S. Department of Agriculture.”

The Journal writers also pointed out that,

Still, the uncertainty over trade talks is affecting business decisions in the Farm Belt and could linger even if the current tariff threats recede.

“In Missouri, some ranchers are shrinking herds, fearing tariffs could further pressure sliding cattle prices.”

Interest Rate Concerns

Beyond the policy concerns of the executive and legislative branches, Heather Long reported on the front page of the Business section in Sunday’s Washington Post that, “Shane Merrill lives in a small town in South Dakota that’s 1,400 miles from Wall Street, but he watches the numbers as avidly as the traders.

“Merrill isn’t an investment manager. He’s a family farmer. Right now, as he drives a tractor and planter to get soybeans in the ground, he’s also checking financial news on his smartphone. He’s worried, he says, about interest rates shooting up.

“To keep his farm going, he has to borrow about $1 million a year from the bank, a common scenario for family farmers. Merrill takes out a loan in the early spring to buy seeds, fertilizer and fuel and aims to pay it back, with interest, after the fall harvest.”

Many U.S. farmers borrow enormous sums of money in order to plant cash crops. Insights via @CMEGroup pic.twitter.com/nSrGgUjyqB

— TicToc by Bloomberg (@tictoc) May 24, 2018

The Post article stated, “His local bank currently charges him 5.75 percent interest on the loan, a bit higher than the national average on a home mortgage. But his rate is almost certainly going to rise, an extra expense as farmers are getting the lowest prices in years for their crops.

“The Federal Reserve has signaled that it will probably raise its benchmark interest rate at least five more times by the end of 2019. As the Fed boosts rates, banks charge more for credit card debt, car loans and home mortgages. Farmers like Merrill could soon face rates of more than 7 percent.”