In a sign of growing stress for U.S. farmers, the Agriculture Department forecast on Thursday that U.S. net farm income would fall 0.7% this year, despite near-record government payments that…

Drought Takes Toll on EU and Australian Wheat Production

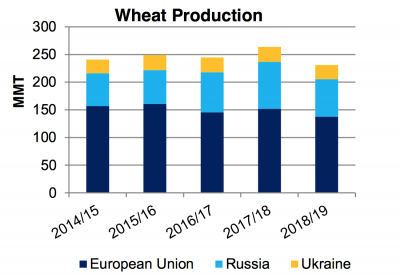

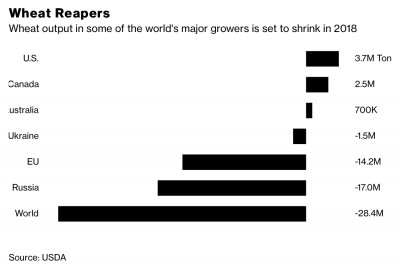

In its August Grain: World Markets and Trade report on Friday, USDA’s Foreign Agricultural Service (FAS) stated that, “Combined wheat production in the European Union, Russia, and Ukraine is forecast down 12 percent from last year to the lowest level in 5 years. The EU wheat crop is down 9 percent from last year on hot, dry weather in the northern Member States, while production in Russia and Ukraine is down from recent bumper crops on a return to normal yields.”

“With global wheat production down substantially from last year, prices are rising,” the FAS update said; while adding that, “U.S. wheat prices for the month of July were mostly up due to concerns regarding production prospects in several other major wheat-exporting countries and the consequent tightening of global supplies.”

In addition, Friday’s World Agricultural Supply and Demand Estimates report from the World Agricultural Outlook Board pointed out that, “Projected [U.S.] wheat exports are raised 50 million bushels to 1,025 million on substantially lower exportable supplies for the EU and limited additional export capacity of several other major competitors.”

The projected season-average farm price is up $0.10 per bushel at the midpoint with the range at $4.60 to $5.60.

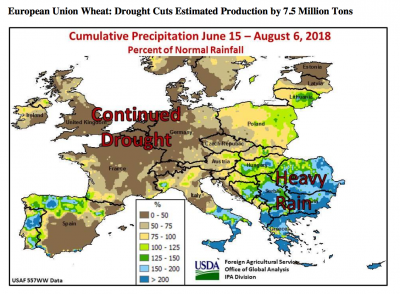

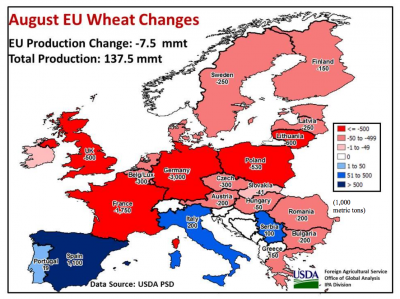

More broadly, in its World Agricultural Production report Friday, FAS explained that, “Drought and higher-than-normal temperatures continued in July throughout most of northern Europe. This unfavorable combination has been ongoing since June, further depleting scant soil moisture, accelerating crop development and lowering yields.”

FAS stated, “Specifically, wheat production is estimated down 3.0 million tons in Germany due to very poor conditions in the north. Estimated wheat production in France is down 1.75 million tons based on harvest reports. Meanwhile in Spain, estimated production increased 1.1 million tons due to beneficial rainfall. Estimated production in Romania and Bulgaria were lowered due to excessive rain.”

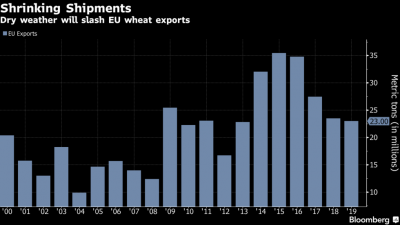

Bloomberg writers Isis Almeida and Jen Skerritt reported Friday that, “After a scorching summer fried wheat crops across the European Union, the bloc is set to lose its position as the world’s third-largest exporter as Canada usurps the title, according to the U.S. Department of Agriculture.”

The Bloomberg article added, “Wheat exports from the EU will drop to 23 million metric tons in the 2018-2019 season, 1.5 million tons below the USDA’s estimate for Canadian shipments.”

"@EU_Commission Introduces Measures to Help #EU Farmers Tackle #Drought," https://t.co/IaZYjZyQVp @USDAForeignAg "The reduction in animal feed supplies is hitting #livestock farmers’ incomes hard as their input costs will increase with a fodder shortage later in the year." pic.twitter.com/xvwIl7bcoc

— Farm Policy (@FarmPolicy) August 13, 2018

On Tuesday, Bloomberg writer Agnieszka De Sousa reported that, “Russia said it has no plans to limit exports and the country is still poised for the third-highest crop on record. On top of that, the U.S. harvests are turning out not as bad as previously expected, raising prospects of higher exports. But there are some concerns. Ukraine is reducing exports and has emphasized the importance of keeping local food prices stable. And if harvests disappoint again next year, there could be more serious consequences.”

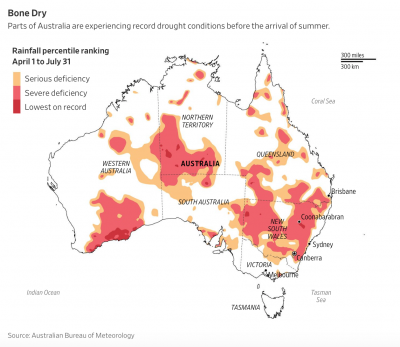

Meanwhile, Reuters writers Jonathan Barrett and Colin Packham reported last week that,

The drought in Australia’s east, one of the worst on record, is impacting every area of rural life, often with global trade and price implications.

The article noted that, “Australia – the world’s fourth-largest wheat exporter – is expect production of its staple grain fall to a decade low as dry condition stymie yields.

“Quality is also low as the dry weather bites, a key driver in benchmark global prices soaring to a three-year high this week.”

And Wall Street Journal writer Rob Taylor reported Tuesday that, “A severe drought has gripped an area of Australia more than twice the size of Texas, turning normally fertile crop areas into dust bowls, draining water reserves and leaving wine-producing regions parched. Hungry kangaroos are turning up in cities.

Millions of dollars of farm equipment is idle across vast expanses of agricultural land in the continent’s east, and farmers are wondering if they should bother planting summer crops.

The Journal article noted, “The drought could cut Australia’s wheat harvest by a fifth, according to Nathan Cattle, managing director of online grains trader Clear Grain Exchange, even as winter rain shields Western Australia, which produces half of the national harvest.”

The article added, “Meanwhile, global wheat prices have soared to multiyear highs as a heat wave in Europe and the Black Sea slashes forecasts for this year’s harvest. The U.S. Department of Agriculture this month forecast global wheat stockpiles to fall for the first time since 2013.”