A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

USDA Outlines Trade Assistance; While President Trump Touts U.S., Mexico Trade Agreement

On Monday, the U.S. Department of Agriculture provided additional details on its trade assistance package for farmers. Meanwhile, President Trump indicated that the U.S. and Mexico had reached an agreement on trade, which he described as a replacement of NAFTA, in what some observers saw as an effort to pressure Canada in ongoing trade negotiations.

USDA Details Trade Assistance Package

Wall Street Journal writers Jesse Newman and Heather Haddon reported on Monday that, “The Trump administration pledged to pay farmers $4.7 billion to offset losses from trade disputes with foreign buyers of U.S. agricultural products.

“Agriculture Secretary Sonny Perdue said the payments would help protect farmers from ‘unjustified tariffs’ some nations have applied in response to President Trump’s trade policies. China, Mexico, the European Union and other trade partners have levied tariffs on U.S. farm goods from soybeans to pork to apples, leaving growers vulnerable during a downturn in the agricultural economy.

“Farmers have been awaiting the details of the up to $12 billion in aid the U.S. Department of Agriculture promised to provide them in July.”

The Journal writers explained that,

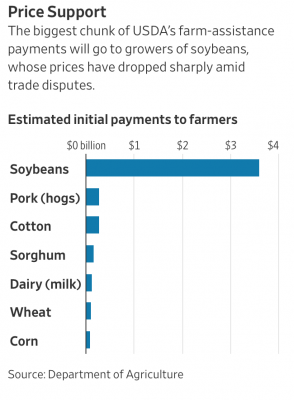

Soybean farmers are in line to get roughly three-fourths of the direct payments, or $3.6 billion, followed by producers of pork, cotton, sorghum, dairy and wheat.

“Pork products will benefit the most from a second form of assistance, which will buy up excess commodities—$558 million out of an estimated $1.2 billion. The USDA will also purchase roughly $90 million each of apples, dairy products and pistachios among the more than two dozen products targeted.”

Newman and Haddon added, “USDA officials said they could decide by December to make a second wave of direct payments to farmers if damages from trade penalties persist.

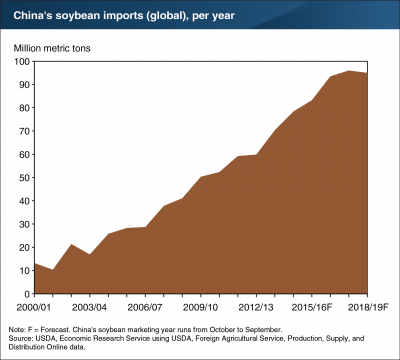

“Soybean futures prices have fallen 18% since the end of May to a decade- low as tariffs took effect in China, the largest customer for that crop. Corn prices have dropped 12% and wheat has declined 5%. Lean hog futures have tumbled 29% as China and Mexico, big buyers of U.S. pork, levied duties on those products.”

.@SecretarySonny Overview of #Trade Mitigation Package https://t.co/eChm30mEas

— Farm Policy (@FarmPolicy) August 27, 2018

Reuters writer Michael Hirtzer reported on Monday that, “The bulk of the payments, $3.6 billion, would be made to soybean farmers. That amounts to $1.65 per bushel multiplied by 50 percent of production, Undersecretary for Farm Production and Conservation Bill Northey said on a conference call.”

The Reuters article also pointed out that, “The aid package, announced at $12 billion in July, will also include payments for sorghum of 86 cents per bushel multiplied by 50 percent of production, 1 cent per bushel of corn, 14 cents per bushel of wheat, and 6 cents per pound of cotton.

“Payments for hog farmers will be $8 per pig multiplied by 50 percent of Aug. 1 production, while dairy farmers will receive 12 cents per hundred weight of production, Northey said.”

.@CommerceGov @SecretaryRoss: "The farmers had nothing to do with the imposition of the tariffs that caused the retaliation. It's not fair for the farmers to bear the brunt of retaliation." pic.twitter.com/lEG3Zqa16K

— FOX Business (@FoxBusiness) August 28, 2018

Also Monday, Bloomberg writers Alan Bjerga and Megan Durisin reported that,

Payments may start going out as soon as mid-September.

DTN Ag Policy Editor Chris Clayton noted Monday that, “To pencil out a payment, for example, a farmer with 1,000 acres of soybeans that yield 50 bushels per acre this fall would calculate 25,000 bushels x $1.65 for a payment, resulting in a payment of $41,250 on those soybean acres.”

Mr. Clayton also explained that, “To be eligible, a farmer must have an adjusted gross income under $900,000 and be in conservation compliance. The aid payments will have a cap of $125,000 per person, but that payment cap will also be separate from any payments a farmer might receive this year from the Agricultural Revenue Coverage (ARC) or Price Loss Coverage (PLC) programs.”

U.S., Mexico Agreement on Trade

Bloomberg writers Eric Martin, Jennifer Jacobs, Josh Wingrove, and Andrew Mayeda reported Monday that, “President Donald Trump said the U.S. is pursuing a new trade accord with Mexico to replace the North American Free Trade Agreement and called on Canada to join the deal soon or risk being left out.

“Trump announced the agreement with Mexico in a hastily arranged Oval Office event Monday with Mexican President Enrique Pena Nieto joining by conference call. Pena Nieto said he is ‘quite hopeful’ Canada would soon be incorporated in the revised agreement, while Trump said that remains to be seen but that he wanted those negotiations to begin quickly.”

“We’ll get rid of the name Nafta, it has a bad connotation because the U.S. was hurt very badly by it,” Trump says from the Oval Office after reaching a trade deal with Mexico #tictocnews pic.twitter.com/DSem2bbeWF

— TicToc by Bloomberg (@tictoc) August 27, 2018

Also Monday, Wall Street Journal writers Jacob Schlesinger and Josh Zumbrun reported that, “Mr. Trump immediately sought to use the agreement with Mexico as a way to pressure Canada in future negotiations, saying ‘we’ll see‘ if Canada can also join a proposed trade deal between the two other Nafta signatories. The president, hinting at affixing tariffs on auto imports from Canada, among other measures, added that negotiations with Canada would resume soon.”

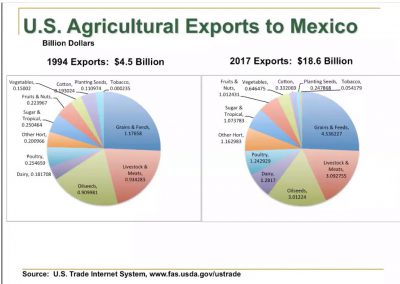

More narrowly with respect to agriculture, DTN Ag Policy Editor Chris Clayton pointed out on Monday that, “The president said the agreement would be good for U.S. manufacturers and farmers.

‘Our farmers are going to be so happy,’ Trump said. ‘Farmers have stuck with me. Mexico has promised to immediately start purchasing as much farm product as they can.’

Mr. Clayton added, “Canadian officials are expected to arrive in Washington to begin talks as early as Tuesday. Agriculture could play a larger factor in these talks, as Trump has repeatedly complained about Canadian dairy tariffs and restrictions on U.S. dairy exports to Canada.”

The U.S. Trade Representatives Office released a “Fact Sheet” on Monday titled, “Strengthening NAFTA for Agriculture,” which stated in part that, “Under a modernized agreement, tariffs on agricultural products traded between the United States and Mexico will remain at zero.”

Meanwhile, Benjamin Parkin reported Monday at The Wall Street Journal Online that, “Prices for livestock, dairy and other agricultural goods climbed on Monday after the U.S. and Mexico reached a trade agreement, alleviating one source of uncertainty that has dragged on those markets since President Trump’s election.

“Hog futures for October delivery bounced 5.8% to 54.775 cents a pound at the Chicago Mercantile Exchange, soaring to their upper daily limit after trading at 18-month lows last week. Cattle futures gained 1.8%, and prices for cotton, cheese and milk rose as well.”

Hog futures up after news of US-Mexico Nafta deal #OATT pic.twitter.com/jfUchgSL6N

— Simon Casey (@sjcasey) August 27, 2018

And Bloomberg writer Megan Durisin reported Monday that, “The agriculture markets are getting a lift as U.S. trade relations improve with Mexico, one of the largest foreign buyers of American meat and grain.

“President Donald Trump on Monday announced that the U.S. and Mexico have a trade agreement. Hog futures jumped earlier and corn erased most of its losses after Bloomberg News reported that a deal was coming. Mexico imports more pork from American farmers than any other country and is a major destination for corn.”