Agriculture Secretary Brooke Rollins said on Tuesday that the Trump administration will announce a 'bridge payment' for farmers next week that is designed to provide short-term relief while longer trade…

The 2018 Outlook for U.S. Agriculture From USDA’s Chief Economist

Speaking on Thursday at USDA’s Agricultural Outlook Forum in Arlington, Virginia, USDA Chief Economist Robert C. Johansson provided a broad outlook for U.S. agriculture. Today’s update provides an overview of key aspects of Dr. Johansson’s presentation.

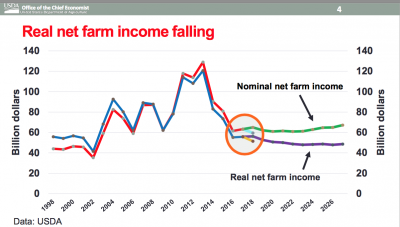

In his speech Thursday (transcript / slides), Dr. Johansson noted that, “Falling net farm income is largely the result of falling commodity prices, productivity is outpacing population growth and food demand.”

“Looking forward net farm income is expected to remain flat over the next ten years and when accounting for inflation, to fall in real terms.

“The most recent update to this outlook for 2018, released two weeks ago by ERS, shows the expectation for 2018 to be even lower, with a fall in net farm income in 2018 to $59.5 billion.”

Chief Economist Robert Johansson presents the 2018 Agricultural Economic & Foreign Trade Outlook. #AgOutlook pic.twitter.com/o8SqvUgG2d

— Dept. of Agriculture (@USDA) February 22, 2018

With respect to prospects for potential improvement in the farm income outlook, Dr. Johansson explained that, “First, improved global economic growth would draw more households into the middle-class boosting overall food demand.

“Similarly, trading agreements can open up new markets to U.S. producers, which would also boost demand for US products.

“Second, weather conditions will affect global production and push up or draw down prices. For example, dryness in Argentina has pulled down the soybean crop, whereas beneficial rains in Brazil—have pushed up estimates.”

More specifically on export market demand, Dr. Johansson pointed out that, “FY 2018 exports are projected near FY 2017 levels, at $139.5 billion, and the agricultural trade surplus is forecast to narrow slightly to $21 billion from $21.3 billion.”

U.S. agriculture exports continue to be dominated by China and our NAFTA partners Canada and Mexico. U.S. exports to China are projected at $21.6 billion.

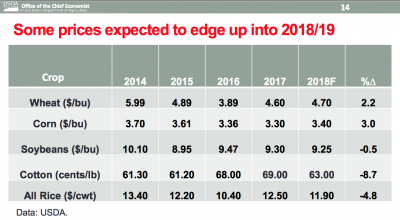

While addressing price prospects for key commodities, Dr. Johansson stated that, “The combination of rising stocks and continuing large global production have limited upside potential for prices; however, we do expect increase in demand relative to production in the upcoming year.

“Wheat prices are expected to rise modestly to $4.70 per bushel, up 2 percent from last year, in part as last year’s drought in the Northern Plains and current dry conditions across much of the winter wheat areas have supported prices despite large U.S. and global stocks.

Approximately 42% of winter #wheat production is w/i an area experiencing #drought, @USDA OCE Percentage of Crops and Livestock Located in Drought report. pic.twitter.com/5D23JUHwVt

— Farm Policy (@FarmPolicy) February 22, 2018

“Soybean prices, forecast at $9.25 a bushel, are expected to be down fractionally next year, as large U.S. stocks hold prices in check.”

“Driven by record yields in 2017, corn prices ended the year down at $3.30. Looking forward, we expect a small rebound in prices and a return to trend yields.”

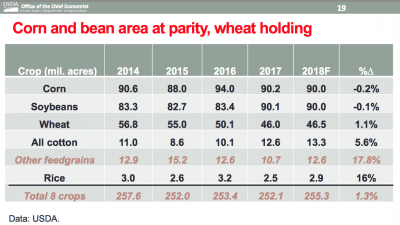

Dr. Johansson turned to discuss acreage allocations for 2018 and stated that, “With commodity prices flat to rising slightly from last year we expect acreage to respond similarly.

For corn and soybeans, current price expectations and rotational constraints again push the combined area to 180 million acres, evenly split between the two crops.

“Our latest long-term baseline suggests soybean area will match or exceed corn area for much of the next decade supported by import demand from China.”

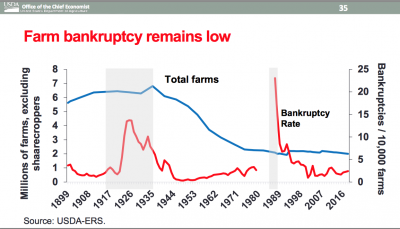

In more detail on the farm sector financial picture, Dr. Johansson noted that, “While farm income is expected to remain flat, the debt-to- asset ratio for U.S. farms continues to be relatively low, held down by steadily increasing asset values which reflect, in part, continuing firm land values.”

And he added that, “While low interest rates have limited the burden of that debt for producers, interest payments as a share of net farm income have been increasing more steeply than the debt-to- asset ratio. Still, at the current 26 percent of net farm income, interest payments remain well below the 60 percent share seen in the mid-1980s.”

Dr. Johansson also stated that, “Despite the increase in debt levels and the rise in non- performing loans, we still do not see anything like the farm bankruptcies associated with the 1980s crisis.”

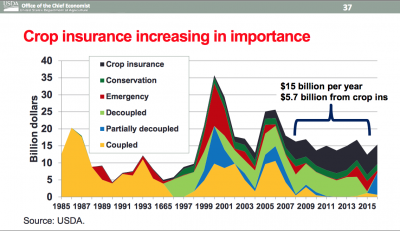

Dr. Johansson also discussed farm programs and farm policy on Thursday, and pointed out that, “We’ve seen a movement from programs that controlled how much and what producers could plant to an array of programs leaving producers the chance to make decisions based on market signals and their own risk management preferences.”

“As part of that shift, crop insurance has become increasingly important.”