Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

U.S. Ag Exports Remain Strong, But Global Share Declines as Destinations Have Changed (NAFTA, China)

U.S. agricultural exports in fiscal year 2017 increased over $10 billion to the third-highest level on record. Although the U.S. remains the second largest exporter of agricultural goods in the world, the share of U.S. agricultural exports has fallen from 23 percent of global value in 1995 to 12.5 percent in 2013. Nonetheless, U.S. agricultural exports to NAFTA countries and to China have increased since 1995, highlighting the importance of these regions to U.S. agricultural trade. Today’s update looks at these issues in more detail, along with a brief update on the NAFTA renegotiations.

U.S. Agricultural Exports Strong in FY 2017

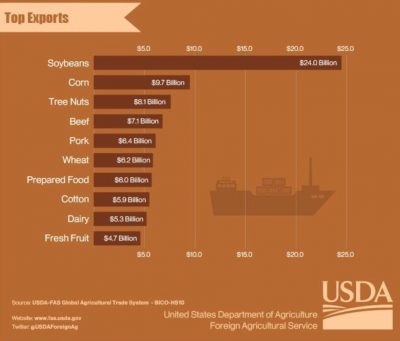

A news release from USDA on Thursday stated that, “U.S. agricultural exports totaled $140.5 billion in fiscal year (FY) 2017, climbing nearly $10.9 billion from the previous year to the third-highest level on record, U.S. Secretary of Agriculture Sonny Perdue announced today. As it has done for well over 50 years, the U.S. agricultural sector once again posted an annual trade surplus, which reached $21.3 billion, up almost 30 percent from last year’s $16.6 billion.”

The USDA update added that, “Exports are responsible for 20 percent of U.S. farm income, also driving rural economic activity and supporting more than one million American jobs both on and off the farm.”

U.S. Share of Ag Exports Declines, as Destinations Change (NAFTA, China)

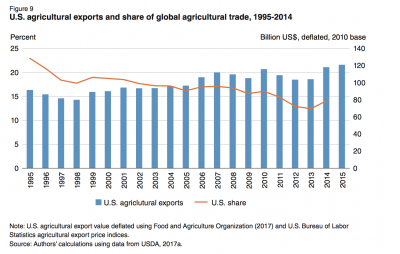

More broadly, USDA’s Economic Research Service (ERS) released a report on November 13th (“The Global Landscape of Agricultural Trade, 1995-2014” which pointed out that the U.S. share of global agricultural trade has decreased since 1995. The report stated that,

“The evolution of U.S. trade patterns reflects changes observed at the global level. Perhaps most striking is the drop in the U.S. share of agricultural exports—from 23 percent of global value in 1995 to 12.5 percent in 2013 (see fig. 9)—as exports by BRIIC [Brazil, Russia, India, Indonesia, and China] and other emerging markets have risen. Still, the United States remained the second-largest exporter in 2012-14 [behind the European Union].”

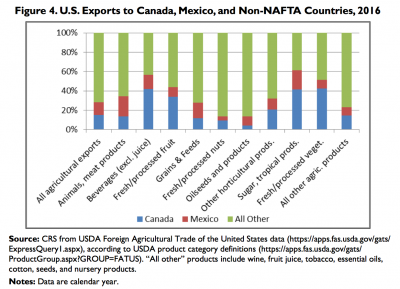

The ERS report explained that, “The decline in the U.S. share of total agricultural exports conceals a marked shift in destinations for U.S. products. Elimination of agricultural trade barriers within North America boosted exports to Canada and Mexico—partners with the United States in the North American Free Trade Agreement (NAFTA). Rising household incomes and changing trade policies in developing East Asia (China and Southeast Asia, except Singapore) led to a near tripling in its share of U.S. agricultural exports.

“The strong growth in demand for U.S. exports in Asia and North America has been offset by a sharp decline in the share going to Europe and high-income East Asia, particularly Japan. In the EU, a number of barriers—including concerns over genetically modified products—continue to hamper U.S. agricultural trade.

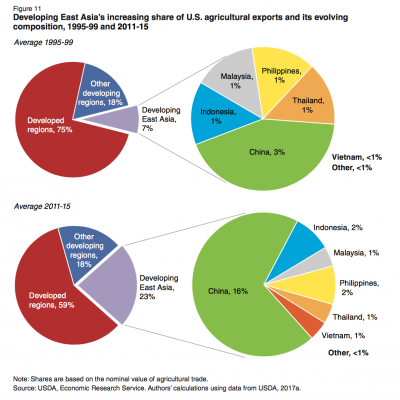

The increase in U.S. exports to Asia is driven by China, whose share of U.S. agricultural exports swelled from 3 percent, on average, in 1995-99 to 16 percent in 2011-15 [see fig. 11]. Over half of this increase can be attributed to a single product: soybeans.

For additional perspective on the importance of Chinese soybean imports, this month’s Oil Crops Outlook report from ERS stated that, “Soybean imports by China in 2016/17 totaled 93.5 million tons. This represents an impressive 12-percent increase from the previous year for the world’s largest importer. The gain for China accounted for 91 percent of the 2016/17 increase in global soybean imports.”

NAFTA Developments

With this background in mind, Don Lee reported in Sunday’s Los Angeles Times that, “President Trump’s top trade official has issued new objectives for renegotiating the North American Free Trade Agreement — including some likely to irk Canada and Mexico, as well as the U.S. recording industry and other major business interests, as talks continue this weekend.

“There are few surprises in the 17-page document, given recent revelations and sharp wordsfrom NAFTA negotiators. But the Office of the U.S. Trade Representative, or USTR, made some notable additions and changes to the blueprint it initially outlined in July, a month before talks began, adding a fresh degree of uncertainty to the talks.”

Mr. Lee noted that, “Besides affirming that the Trump administration wants to rewrite key portions of the 23-year-old pact, including access to federal government contracts and minimum local-sourcing requirements, to name two of the more controversial ones, the USTR made clear it wants to pry open Canada’s protected dairy market and eviscerate a process in which foreign firms can sue governments for discrimination or expropriation.

“The amended summary was released quietly late Friday and came after Sen. Ron Wyden (D-Ore.) and civil society groups had criticized the USTR for failing to update the public on NAFTA renegotiations as required by law. Wyden had held up confirmation of two deputy USTR nominees as a result.”

More specially with respect to dairy issues, the LA Times article added that, “U.S. officials explicitly stated, for example, that it would work to eliminate ‘unjustified measures’ limiting U.S. dairy products’ access to Canadian markets. And, for apparent emphasis, the USTR inserted that one of its major goals — along with reducing the trade deficit with NAFTA countries — would be addressing import and export monopolies that distort trade.

“Canada controls imports of milk and other dairy products in this politically sensitive industry through a government supply-management system. Trump personally has railed against the Canadian practice, warning earlier this year that the U.S. ‘would not stand for this.’

“Canadian officials deny their policies are harming U.S. businesses, and insist that the U.S. similarly protects its dairy farmers.”

Also, the article noted that, “Among the most contentious is a U.S. proposal that would allow NAFTA to expire after five years unless all three countries agree to renew it. Mexico and Canada, as well as U.S. businesses, say such a sunset clause would inject uncertainty and undermine the value of the pact. In the summary, the USTR merely states that it wants a mechanism to ‘assess the benefits of the agreement on a periodic basis.'”

Looking ahead, Sunday’s article explained that, “The talks in Mexico City this weekend are the fifth round of negotiations and will last through Tuesday. The three sides had originally hoped to wrap up by year’s end, to avoid the political complications from Mexico’s presidential elections next summer, but there are such wide differences that the talks have been extended to as late as March.”

Meanwhile, Wall Street Journal writer Jacob M. Schlesinger reported last week that, “During his appearance [at the The Wall Street Journal CEO Council on Tuesday], [Commerce Secretary Wilbur Ross] also expressed frustration with the vocal pushback from American business and lawmakers to the administration’s Nafta negotiation strategy.”

“[Sec. Ross] explained that ‘as one special-interest group—agriculture for example—gets nervous, they start screaming and yelling publicly.’ Then ‘Congress people, they start screaming and yelling publicly and that just complicates the negotiations,’ he added. ‘Frankly, it makes the negotiations harder,’ he said.

A news release on Wednesday from Sen. Jerry Moran indicated that the Kansas Republican had authored an open letter “to agricultural organizations regarding the threat of NAFTA withdrawal and urged them to advocate for sound trade policy. With low commodity prices and declining farm revenues, the rural economy cannot afford to lose out on export markets.”

And Reuters writer David Lawder reported on Friday that, “Pro-trade Republicans in the U.S. Congress are growing worried that U.S. President Donald Trump may try to quit the NAFTA free trade deal entirely rather than negotiate a compromise that preserves its core benefits.”

The article added that, “Representative Pete Sessions, a Texas Republican who has long been a supporter of free trade deals, said he disagreed with the Trump approach of ‘trying to beat someone‘ in the NAFTA talks. Texas is the largest U.S. exporting state with nearly half of its $231 billion in exports last year headed to Mexico and Canada, according to Commerce Department data.

“‘We need to offer Mexico a fair deal. If we want them to take our cattle, we need to take their avocados,’ Sessions said.”