A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

USDA Releases Agricultural Projections, Focus on Corn and Soybeans

On Thursday, the U.S. Department of Agriculture released its 10-year projections for the food and agriculture sector. The report noted that, “Over the next several years, the agricultural sector continues to adjust to lower prices for most farm commodities. Although reduced energy prices have decreased energy-related agricultural production costs, lower crop prices result in declines in planted acreage. Lower feed costs provide economic incentives for expansion in the livestock sector.” Today’s update highlights aspects of the report that focused on corn and soybeans.

Corn

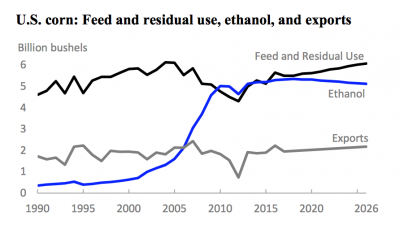

After establishing a set of macroeconomic and policy assumptions, USDA indicated that, “Demand for U.S. corn is projected to grow steadily over the next decade. Rising yields boost production and support the growing demand. Planted area, however, falls as real prices and returns fall over time, in part due to large stock buildups. Over the next 10 years, stocks decline slowly yet are projected to remain above 2015 levels.”

More specifically, the report noted that, “Demand for corn to produce ethanol remains strong, with just over 5 billion bushels used annually. In ten years, corn used for ethanol production is projected to make up almost 35 percent of total use, compared to almost 42 percent at its peak in 2012/13.”

Corn exports will be boosted by increased incomes and additional demand for protein from developing countries that use corn for feeding livestock.

And, USDA pointed out that:

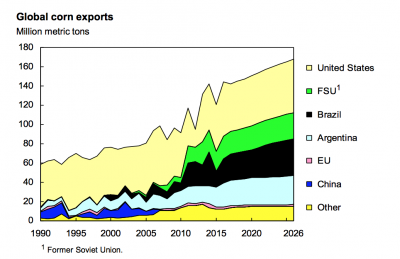

Increasing competition, particularly from Brazil, Argentina, and Ukraine, results in a declining U.S. share of global corn trade over the projection period.

For the 2017-2018 marketing year, USDA pointed to an estimate of 90 million acres of corn planted in the U.S. with a projected yield of 170.8 bushels per acre resulting in a farm price of $3.30.

Farmdoc team member Todd Hubbs, in an update on Monday at the farmdoc daily blog, noted that, “The trend estimate for 2017 is 166.8 bushels per acre. By adjusting the trend estimation for weather influences, we generate a national corn yield expectation of 169 bushels to use in this analysis.”

Dr. Hubbs added that, “Based on the analysis of corn production and consumption expectations, season average market price comes in at the $3.65 – $3.75 range for the 2017-18 marketing year.”

Soybeans

Turning to soybeans, USDA explained that, “Slowly increasing prices and higher producer returns provide incentives to increase plantings, and producers are expected to plant roughly 85 million acres through the projection period.”

With respect to demand, the report stated that:

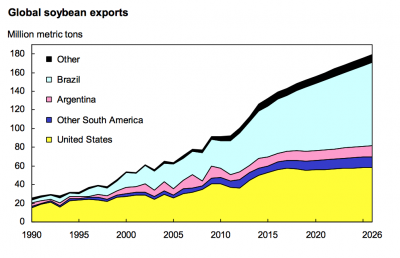

Strong global demand for soybeans—particularly in China—boosts U.S. soybean trade over the projection period. While soybean exports are projected to rise, competition from South America—primarily Brazil—will lead to a reduced U.S. share of global soybean trade.

Increased demand for soybeans from China, and strong demand for domestic soybean products, provide a small lift to nominal soybean prices over the projection period.

For the 2017-2018 marketing year, USDA pointed to an estimate of 85.5 acres of soybeans planted in the U.S. with a projected yield of 47.9 bushels per acre resulting in a farm price of $9.35.

In a farmdoc daily update back on February 13th, Dr. Hubbs stated that, “Given the number of factors pointing toward greater soybean planted acreage in 2017, planted acreage near 87.4 million is a reasonable expectation.”

He added that, “Based on the growth in soybean yields in the last three years, normal weather during 2017 could provide an average U.S. soybean yield near 48 bushels per acre.”

On soybean prices, Dr. Hubbs indicated that, “The scenario discussed places average farm prices for soybeans in a range of $8.90 – $9.10 for the 2017-18 marketing year.”

Closer Look at Corn, Soybean Trade Issues

Looking more closely at corn and soybean trade issues, the USDA report stated that, “U.S. corn exports are expected to increase by 5.7 million tons over the projection period and reach 55.2 million tons in 2026/27.”

With respect to corn exporting competitors, USDA noted that, “Argentina is the third-largest corn exporter. Argentina’s corn production is projected to increase dramatically, reflecting a large increase in area in 2016/17 and continued yield growth throughout the projection period.”

The report added that, “Brazil’s annual corn exports have more than tripled over the past decade and averaged 24.5 million tons in the past 5-years. Production of second-crop corn following soybeans, much of which takes place in the Center West, continues with expansion onto new cropland.”

In more detail on soybean export issues, last week’s update stated that:

The three leading soybean exporters—the United States, Brazil, and Argentina—are projected to account for about 89 percent of world soybean trade over the next decade.

“Brazil’s soybean exports are projected to rise 28.4 million tons (47 percent) to 89 million tons during the projection period (2017/18 to 2026/27), enabling the country to strengthen its position as the world’s leading soybean exporter.”

In more specifics on Argentina, USDA indicated that, “Argentina’s export tax rates are higher for soybeans than for soybean products, a policy that favors domestic crushing of soybeans and exporting the resulting products. In response to increasing world demand for soybeans for crushing, Argentina’s soybean exports are projected to grow 3 percent annually, rising about 31 percent to more than 12.1 million tons by 2026/27. Most of Argentina’s soybean exports go to China. Nonetheless, Argentina remains a distant third to Brazil and the United States as a soybean exporter as most of the country’s crop is processed domestically.”

.@usda Ag Projections- https://t.co/yVOOhku4nl Global trade in soybeans has risen rapidly since early '90s; surpassed wheat, coarse grains pic.twitter.com/abKQWEcCXX

— Farm Policy (@FarmPolicy) February 16, 2017

Meanwhile, USDA also explained that, “The U.S. share of global soybean exports is about 40 percent in 2017/18 and projected to decrease to 33 percent by 2026/27. U.S. soybean exports are projected to increase slightly from 57.2 million tons in 2017/18 to 58.5 million tons by 2026/27.”