A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

FAPRI Baseline: Financial Pressure on Farms Likely to Continue

A news release last week from the Food and Agricultural Policy Research Institute (FAPRI) at the University of Missouri indicated that, “The latest analysis of national and global agricultural trends from the University of Missouri indicates continued financial pressure on United States farm sector. Good news in the report includes a modest recovery in grain prices in 2017.”

The release noted that, “The March 2017 U.S. Baseline Briefing Book by economists at the University of Missouri provides projections for agricultural and biofuel markets, based on market information available in January. The report’s macroeconomic assumptions are based primarily on forecasts by IHS Global Insight, which suggest moderate growth in the U.S. and global economies.”

Our 2017 U.S. Baseline Briefing Book is now available online! https://t.co/Zm0oYfZr47

— FAPRI-MU (@FAPRI_MU) March 13, 2017

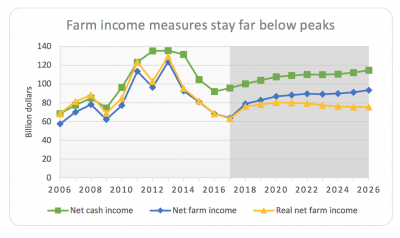

The release added that, “Net farm income has declined by 48 percent since peaking in 2013. It is projected to increase in 2018 and later years, but is expected to remain below 2015 levels in real terms.

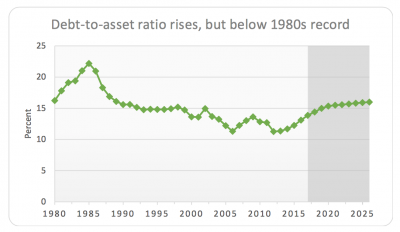

Declining farm income and rising interest rates result in lower projected land prices and farm asset values, which contribute to the increase in debt‐to‐asset ratios.

Before getting into additional details of the FAPRI report, recall that earlier this year USDA released its 2017 Farm Income forecast, as well as it’s 10-year projections; and USDA Chief Economist Robert C. Johansson provided a broad outlook for U.S. agriculture in late February. Also in February, the Federal Reserve Banks of Chicago, St. Louis and Kansas City each released updates regarding farmland values and agricultural credit conditions from the fourth quarter of last year.

Briefed the House staff today on the 2017 Baseline Briefing Book despite the snow in DC pic.twitter.com/MNve32Pmi5

— FAPRI-MU (@FAPRI_MU) March 14, 2017

The FAPRI report stated that, “Net farm income could fall for the fourth straight year in 2017, and the farm debt-to-asset ratio is rising. Even with a modest recovery in farm income in 2018 and beyond, pressure on farm finances is expected to continue.”

“Different measures of net income for the farm sector all show sharp declines from recent peaks…Net cash income increases slightly in 2017, with inventory changes explaining most of the difference between the two measures. Both measures indicate rising nominal income beginning in 2018. Correcting for inflation, average real net farm income never exceeds the 2015 level,” the report said.

The FAPRI update also noted that, “The farm debt-to-asset ratio peaked in 1985 during the farm financial crisis. The rate was cut in half between 1985 and 2012 as asset values increased more rapidly than debt. Rising debt has increased the debt-to-asset ratio from 11 percent in 2012 to 14 percent in 2017. Projected reductions in farm real estate values and further increases in debt increase the projected ratio to 16 percent in 2026. If interest rates rise as projected, servicing debt will become more difficult for some producers.”

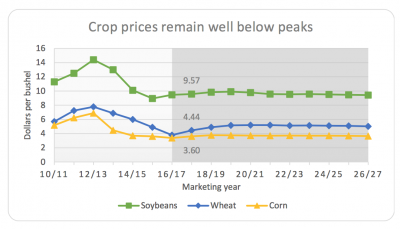

With respect to crop prices, last week’s report explained that, “Average prices for major crops recover, but remain well below recent peak levels. After the record yields of 2016, prices could increase for crops harvested in 2017 if yields return to more normal levels. Projected 2017/18 corn prices average $3.60 per bushel, with wheat at $4.44 and soybeans at $9.57.”

In turn, while looking at federal commodity program payments, FAPRI indicated that, “Agricultural risk coverage (ARC) payments peaked in 2015/16, but then fall as benchmarks adjust to a declining moving average of prices. Wheat accounts for most of the increase in [Price Loss Coverage] PLC payments in 2016/17. In 2019, it is assumed that producers will be able to make new ARC/PLC elections and that most corn, soybean and wheat producers will choose PLC given projected payment rates.”

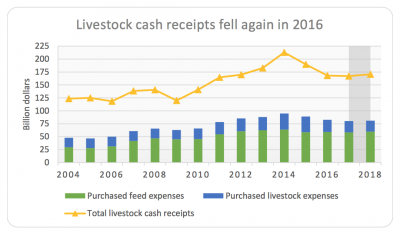

The FAPRI report also covered issues associated with the livestock sector, noting in part that, “Cash receipts for livestock endured a second consecutive sharp drop in 2016. Last year’s receipts of $168.1 billion were down 21 percent from the 2014 peak. However, last year’s level was still higher than any year prior to 2012. Some relief has been found with lower input costs, as purchased feed and purchased livestock expenses have dropped more than $12 billion in the past two years. Receipts are projected fairly flat for the next two years.”

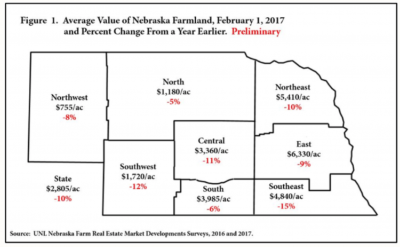

In other recent news regarding the U.S. agricultural economy, a recent update from the University of Nebraska (“2017 Trends in Nebraska Farmland Markets: Declining Agricultural Land Values and Rental Rates,” by Jim Jansen) stated that, “Preliminary findings from the 2017 Nebraska Farm Real Estate Market Survey conducted by the University of Nebraska–Lincoln, indicate that as of February 1, 2017, the weighted average farmland value declined by about 10 percent over the prior 12-month period to $2,805 per acre. This decline marks the third year of consecutive downward pressure totaling to approximately 15 percent for the weighted average farmland value in Nebraska which peaked in 2014 at $3,315 per acre.”

The update noted that, “Rental rates for agricultural land in Nebraska declined for another year as commodity prices for the major commodities raised across the state experienced an additional year of lower prices (Table 2). Agricultural land ownership expenses remain high as property tax levels continued to rise on average across the state. Negotiating an equitable rental rate remains a challenge for landlords and tenants. For the second year in a row, survey participants noted this dynamic in negotiating rental rates centered on these concerns.”

The House Agriculture Committee will take a closer look at the agricultural economy this week as the Subcommittee on Livestock and Foreign Agriculture holds a hearing on Tuesday regarding the next Farm Bill and livestock producer perspectives; while the full Committee examines dairy policy issues on Wednesday.