A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Federal Reserve Ag Surveys Provide Updated Look at the U.S. Farm Economy

On Thursday, the Federal Reserve Banks of Chicago, St. Louis and Kansas City each released updates regarding farm income, farmland values and agricultural credit conditions from the first quarter of this year. Today’s update provides a brief overview of yesterday’s reports.

Federal Reserve Bank of Chicago First Quarter Report

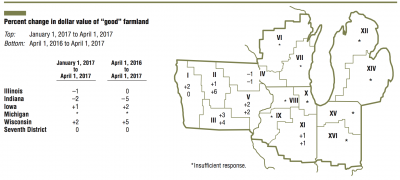

David Oppedahl, Senior Business Economist at the Chicago Fed, explained yesterday in The AgLetter that, “District farmland values were unchanged in the first quarter of 2017 relative to both the first and fourth quarters of 2016.

With no year-over-year change in agricultural land values, the District saw an end to five straight quarters of declines. One survey respondent commented that ‘prices of farmland have stayed surprisingly steady.’

“Also, Iowa had its first year-over-year increase in farmland values since the third quarter of 2013. In contrast, Indiana experienced its sharpest year-over-year decrease (–5 percent) of the current downturn.”

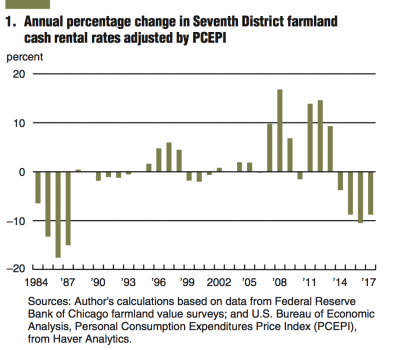

Mr. Oppedahl pointed out that, “Around 80 percent of District farmland operated by someone other than the owner was rented out on a cash basis; 15 percent, on a crop-share basis; 2 percent, on a bushel basis; and 3 percent, on other terms.

Cash rental rates for agricultural land in the District fell 7 percent for 2017 relative to 2016—somewhat less than the decline seen a year ago.

“For 2017, average annual cash rates to lease farmland were down 6 percent in Illinois, 8 percent in Indiana, 8 percent in Iowa, 5 percent in Michigan, and 4 percent in Wisconsin.”

Yesterday’s update from the Chicago Fed added that, “Survey respondents anticipated agricultural land values to remain stable in the second quarter of 2017: 69 percent of responding bankers expected farmland values to be steady, 29 percent expected a decline, and a few Iowa bankers expected an increase.”

Recall that last month, in the Fed’s Beige Book, the Chicago District pointed out that, “Expectations of low incomes for 2017 led to lower farmland values and cash rents for cropland compared with last year. However, land values for higher quality ground and recreational tracts were steady on balance.”

Federal Reserve Bank of St. Louis First Quarter Report

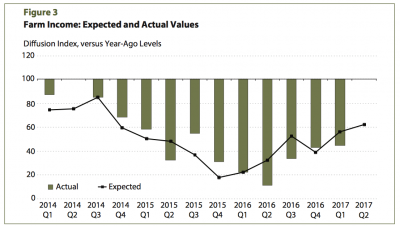

The Agricultural Finance Monitor, released yesterday by the St. Louis Fed, indicated that, “Similar to the past several reports, proportionately more bankers continue to report year-over-year declines in farm income. In the first quarter of 2017, the farm income diffusion index measured 55. [NOTE: An index value of 100 would indicate that an equal percentage of bankers reported increases and decreases in farm income relative to a year earlier.] However, the percentage reporting falling farm incomes has been declining modestly since the second quarter of 2016, as evidenced by a steady rise in the diffusion index. The index is projected to increase modestly further in the second quarter of 2017, from 55 to 62.

This development is heartening because it suggests that a rising number of bankers—though still a minority—are noting that farm income has stopped declining from year-earlier levels.

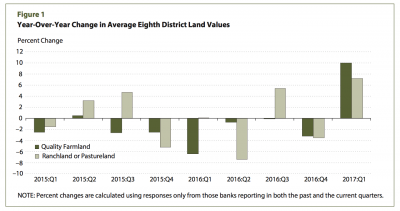

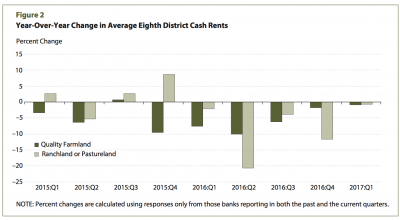

Yesterday’s update also pointed out that, “Perhaps somewhat surprisingly, quality farmland and ranchland or pastureland values posted healthy increases in the first quarter of 2017. Compared with four quarters earlier, quality farmland values increased by 10 percent in the first quarter, while ranchland or pastureland values rose by 7.2 percent.”

“By contrast, cash rents for quality farmland and ranchland or pastureland declined slightly in the first quarter—but the declines were the smallest in more than a year. As evidenced by the diffusion indexes expected in the second quarter (below 100), proportionately more bankers believe that the first-quarter increase in both types of land values will not carry forward into the second quarter of 2017.”

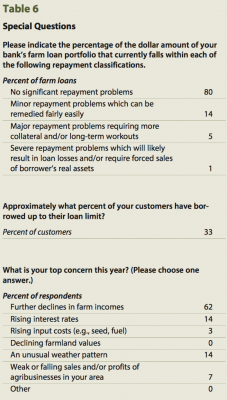

More specifically with respect to farm lenders, yesterday’s St. Louis Fed report stated that, “Table 6 [see below] reports the results of three special questions posed to our agricultural bankers. The first question asked each banker to rate their farm loan portfolio based on repayment rates, while the second question asked bankers about the borrowing capacity of their customers. These same two questions were posed to bankers four quarters earlier. In general, not much has changed over the past year. In the first quarter of 2017, 80 percent of all farm loans were current or had no significant repayment problems; a year earlier, the percentage was 78 percent. Only 14 percent of farm loans had minor repayment problems, the same percentage as a year earlier. According to the results from the second question, bankers reported that one-third of their customers had borrowed up to their loan limit. This percentage was also little changed from four quarters earlier (34%)”

Federal Reserve Bank of Kansas City First Quarter Report

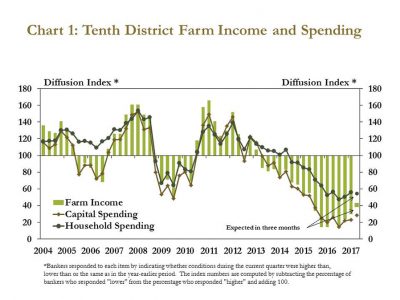

Nathan Kauffman and Matt Clark writing in Thursday’s Ag Credit Survey from the Kansas City Fed, noted that, “Farm income in the Tenth District continued to decline in the first quarter, but at a slightly slower pace than in recent quarters. According to the survey, 73 percent of bankers reported farm income was lower than the year before. The decline in the first quarter marked the fourth consecutive year that District bankers reported farm income was lower than a year earlier. Despite the persistent decline, the pace of softening appeared to slow in the first quarter. For example, 24 percent of bankers indicated farm income remained unchanged from the previous year, the largest share since the third quarter of 2015. Bankers expected farm income to decline further in the coming months, but also at a slower pace than in recent quarters.”

Yesterday’s update added that, “More generally, farm income has declined at a stronger pace in the western part of the District. Since 2014, following a drop in the prices of major row crops, farm income has fallen more sharply in the Mountain States and the western portions of Nebraska, Kansas and Oklahoma.”

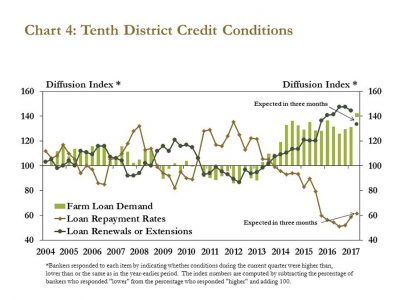

When discussing ag credit conditions, Kauffman and Clark pointed out that, “A prolonged downturn in the farm economy continued to weigh on agricultural credit conditions in the District, but also at a softer pace than in recent quarters. Loan demand remained high in the first quarter and was expected to continue to rise in the coming months. Bankers also reported farm loan repayment rates continued to weaken, but not as sharply as in 2016.

In fact, similar to farm income, 49 percent of bankers indicated loan repayment rates were unchanged from a year ago, a larger share than the previous two quarters.

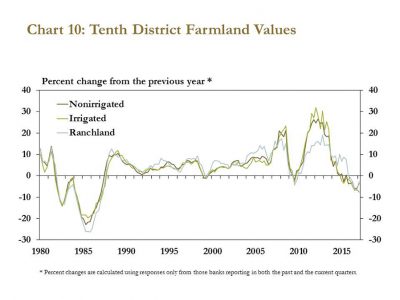

Regarding farmland values, the Kansas City Fed update explained that, “As expected, based on recent surveys, District farmland values trended lower in response to conditions in the regional farm economy. The value of nonirrigated cropland declined 3 percent in the first quarter, following similar declines in 2016. The value of irrigated cropland and ranchland also decreased in the first quarter. Although farmland values continued to trend lower alongside ongoing weakness in the farm economy, the declines have remained relatively modest in comparison to the crisis of the 1980s.”

Meanwhile, a news release last week from CoBank indicated that, “‘Lower commodity prices are affecting some of our agribusiness borrowers, which is starting to impact credit quality in that portion of our loan portfolio,” said David P. Burlage, CoBank’s chief financial officer. ‘Further modest deterioration in credit quality is anticipated as long as commodity prices remain low. Overall, however, the risk-bearing capacity of the bank is strong and we remain well-positioned to meet the borrowing needs of our customers.'”

Note also that on Wednesday, the House Agriculture Committee is scheduled to hold a hearing titled, “State of the Rural Economy: Secretary of Agriculture Sonny Perdue.” Committee Chairman Mike Conaway (R., Tex.) indicated that, “Secretary Perdue will share his perspective on the economic outlook in rural America along with his vision for USDA and the role it will play in ensuring that our country continues to enjoy the safest, most abundant, and most affordable food supply in the world.”