Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

Farm Lending Variables- Updated Analysis From the Kansas City Fed

On Friday, Nathan Kauffman and Matt Clark, of the Federal Reserve Bank of Kansas City, penned an update titled, “Farm Lending Steady, but Risks Remain,” which noted that, “Agricultural lending at commercial banks was steady in the second quarter, but risks in the farm sector continued to weigh on loan growth and credit conditions.” Today’s post looks at the Kansas City Fed article in more detail.

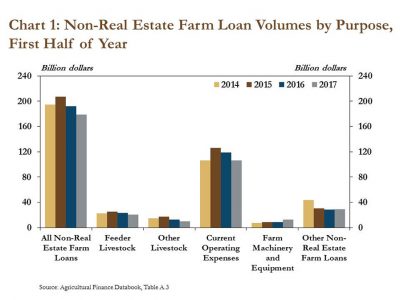

Kauffman and Clark indicated that, “The pace of farm lending at commercial banks remained relatively steady in the second quarter of 2017. The survey of Terms of Bank Lending to Farmers shows the volume of non-real estate farm loans originated in the second quarter increased less than 4 percent.”

“Despite the slight uptick in the second quarter, the total volume of new farm loans in the first half of 2017 remained subdued. The total volume of farm loans originated in that time was 7 percent less than the first half of 2016.”

The authors noted that, “Persistent declines in farm income have likely slowed the volume of new non-real estate loans as bankers and borrowers have sought to manage risk. The U.S. Department of Agriculture’s most recent forecast shows net farm income in 2017 is expected to be about 10 percent less than a year ago and more than 50 percent below the recent peak in 2013. After rising until 2015, non-real estate farm lending has slowed alongside the declines in farm income.”

Last week’s update also provided update information on interest rates for farm loans.

The article stated that, “Interest rates on farm loans have continued to inch higher as risk in the sector has increased. Specifically, interest rates on loans for operating expenses, farm machinery and other livestock have increased about 25 to 50 basis points from a year ago. Moreover, in the second quarter of 2017, fewer loans were made at an interest rate of less than 4 percent.”

Beyond loan volumes and interest rates, Kauffman and Clark explained that:

Bankers also have lengthened maturity periods as an additional risk management strategy.

“The average maturity for non-real estate farm loans, for example, has increased sharply since 2015. After averaging about 23 months from 2007 to 2014, maturities as of the second quarter of 2017 have jumped to 35 months. Bankers likely have increased maturities to improve cash flow and financial flexibility in the near term.”

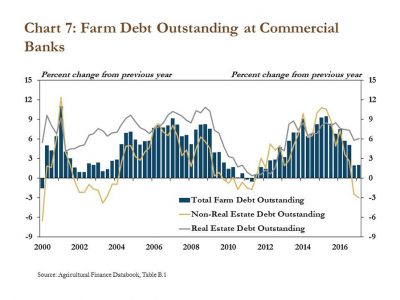

Last week’s article also looked at data associated with total farm debt, within the parameters of real estate and non-real estate borrowing.

“Consistent with the past two quarters, real estate lending over the last 20 years has been stronger and more stable, particularly during downturns in the farm economy. For example, from 2001 to 2002, farm income declined nearly 30 percent and from 2008 to 2009 decreased 21 percent alongside a drop in commodity prices. However, in both time periods, and the years immediately following, farm real estate lending continued to rise while non-real estate lending declined.

As in the past, borrowers appear to be responding to reduced farm income by making significant cuts to production expenses and restructuring some non-real estate debt onto longer-term real estate loans.

The Fed article also pointed out that, “Farm loan delinquency rates increased slightly in the first quarter, but remained historically low. Delinquency rates for both farm real estate and non-real estate farm loans edged above 2 percent.”

In a broader look at regional agricultural credit conditions, Kauffman and Clark explained that, “Demand for farm loan renewals and extensions remained elevated in each Federal Reserve district, marking the ninth consecutive quarter that each district has reported an increase.

In a similar vein, each district also reported a decline in the rate of loan repayments for a ninth consecutive quarter.

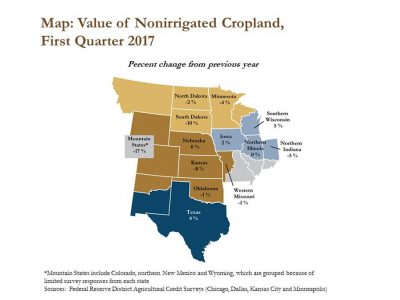

And with respect to farmland values, the article stated that, “Farmland values continued to decline amid slightly weaker credit conditions and a sluggish farm economy. Bankers in states with a heavy reliance on income from wheat and cattle, such as the Mountain States, South Dakota and Kansas, reported relatively large declines in farmland values from the previous year. Bankers in Texas, southern Wisconsin and Iowa reported slight increases, likely due to strong demand for farmland and limited sales. Farmland values in most other states remained flat from the previous year.”