Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

Crop Farmers: Faint Hope For a Rebound in Ag Economy

Cole Epley and Barbara Soderlin reported on the front page of the Money section in Friday’s Omaha World-Herald that, “Farmers heading into harvest season have reason to believe the nation’s struggling agriculture economy won’t get much worse.

“Still, there is only faint hope that it will get much better anytime soon.

“Recent government data and surveys of farmers are sending mixed signals about whether a rebound is on the way after more than three years of plunging farm income, said University of Nebraska-Lincoln ag economist Brad Lubben.”

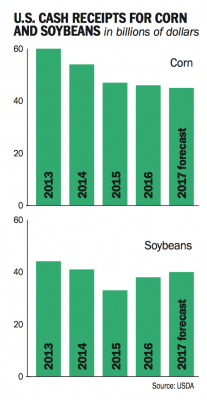

The article noted that, “Crop farmers especially are stretched thin and are looking for any sign of a boost in commodity prices that would put their businesses into profitable territory. Prices for corn, for instance, are down more than 50 percent in the past four years.”

‘Many of us won’t be able to survive much longer if we don’t have a recovery in market prices,’ said Myles Ramsey, who represents the fourth generation on his family’s farm, growing corn and soybeans on about 2,600 acres near Kenesaw in south-central Nebraska.

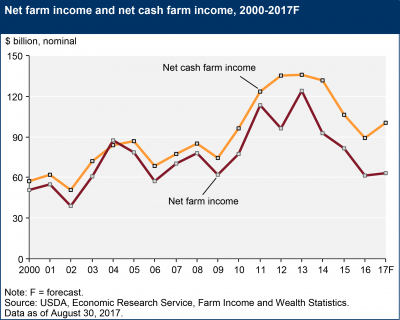

Epley and Soderlin explained that, “Even with a government forecast showing net farm income in 2017 expected to inch higher, there isn’t much optimism for a full-fledged rebound, UNL’s Lubben said. At best, this might simply be the start of a long climb back from tough times on the farm, he said.”

The World-Herald article added that, “Today, prices have fallen faster than costs, pinching profits. Last year’s net farm income for producers across the U.S. came in at $61.5 billion, down more than half from 2013 highs of $129 billion. Nebraska saw a similar percentage decline; meanwhile, Iowa farm profits, without the buffer of a spike in cattle sales that Nebraska saw, fell even more sharply.”

In addition, last week’s article pointed out that, “Farm credit conditions weakened further this spring in a region including Nebraska, the Federal Reserve Bank of Kansas City said in an August report, but the pace of deterioration has slowed. For example, loan repayment problems worsened, but not as much as a year ago.”

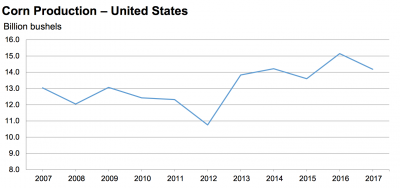

Meanwhile, Benjamin Parkin and Jesse Newman reported yesterday at The Wall Street Journal Online that, “Corn and soybean prices fell after forecasters said this year’s U.S. harvest will be bigger than expected, setting up farmers for another year of large crops and low prices.

“Analysts had expected the U.S. Department of Agriculture to trim the corn and soybean harvest forecasts it made last month. Instead, the agency raised them on Tuesday, putting farmers on track for another year of big supplies amid a global grain glut.”

The Journal article noted that, “That has many crop farmers poised for another year of financial strain. The USDA said in August that income from crops would be largely steady this year even as income from livestock and animal products rises.”

Reuters writer Mark Weinraub reported yesterday that, The U.S. Agriculture Department unexpectedly raised its U.S. corn and soybean harvest forecasts on Tuesday, adding further bearish pressure to a market already struggling with massive global supplies.”

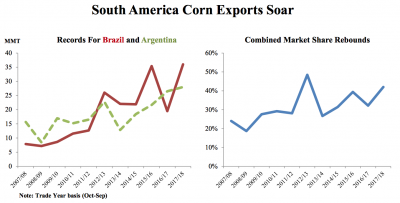

With this background in mind, USDA’s Foreign Agricultural Service (FAS) pointed out yesterday that, “Brazil and Argentina have doubled their share of global corn exports over the past decade and are expected to garner nearly half in 2017/18. Both countries are forecast to have record exports while U.S. exports and market share are expected to decline in 2017/18.”

The FAS report explained that, “Brazil and Argentina’s rise to prominence has altered U.S. marketing behavior and dampened U.S. competitiveness. For example, U.S. merchants often delay sales when South American supplies hit the market at the start of the U.S. harvest. Producers have incentives and the infrastructure to store corn and manage risk in order to seek higher prices later in the marketing year.

Competition between these South American countries and the United States is expected to be fierce in key import markets such as East Asia and Egypt.

“Nonetheless, all three major exporters are expected to support record global corn trade, boosted by low corn prices, and satisfy the world’s projected record corn consumption.”

And with respect to U.S. soybean exports, FAS indicated yesterday that, “The U.S. soybean export forecast for 2017/18 is projected to exceed this year’s record volume as low prices and ample supplies continue to drive export sales. U.S. export volume for the May to August period was significantly above historic levels, and similar to the quantities attained in 2016 when supplies in Brazil were more limited. Additionally, new-crop sales, which started slowly, have picked up the pace in the last few weeks; matching last season’s accelerated pace.”

Top 10 U.S. export markets for #soybeans by volume, @USDA_ERS pic.twitter.com/dq8acApnKX

— Farm Policy (@FarmPolicy) September 7, 2017

The FAS update added that, “While the Brazilian dynamic is similar to the situation in 2015, a key difference is that the United States is not facing a weakening real that allowed Brazilian beans to be priced more competitively. With large supplies available in Brazil and the United States, coupled with a stronger real, U.S. soybeans have remained competitive in export markets.

“Given the ability of U.S. soybeans to remain competitive prior to harvest, there is nothing to indicate the situation will change post-harvest.”