Bloomberg's Hallie Gu reported that "China’s grain supply won’t be affected by a loss of US feed grain and oilseed imports, thanks to abundantly available substitutes on the global market…

Federal Reserve Bank of Dallas Ag Credit Survey- Third Quarter

Earlier this week, the Federal Reserve Bank of Dallas released its Agricultural Credit Survey for the third quarter of 2017.

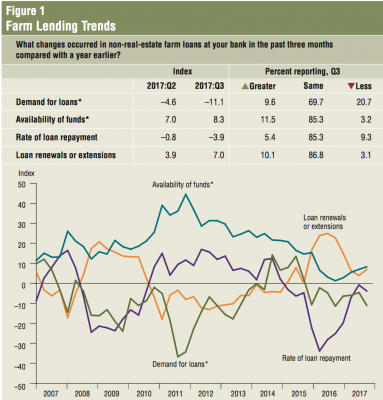

The Fed update indicated that, “Demand for agricultural loans overall decreased for the eighth consecutive quarter.

Loan renewals and extensions continued to increase.

“The rate of loan repayment declined slightly after stabilizing last quarter. Overall, the volume of non-real-estate farm loans was lower than a year ago, as was the volume of farm real estate loans. The volume of operating loans increased; all other loan categories’ volumes fell year-over- year this quarter.”

The survey pointed out that, “District real ranchland and dryland values decreased this quarter, while irrigated cropland values increased.”

“According to bankers who responded in both this quarter and third quarter 2016, nominal district cropland values increased year over year while ranchland values held steady.

“The anticipated trend in the farmland values index remained positive for a second consecutive quarter, suggesting respondents expect farmland values to trend up in the upcoming months. The credit standards index indicated continued tightening of standards on net.”

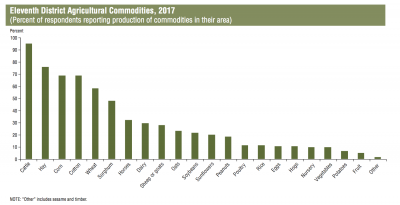

The Fed update also noted that, “As part of the third-quarter Agricultural Survey, Eleventh District bankers were asked to list agricultural commodities produced in their lending region. Cattle was again the most widespread response, followed by hay, with more than three-fourths of respondents reporting production of these commodities in their region.”

“Corn and cotton production were reported by equal shares, almost 70 percent, of respondents, and while fewer bankers indicated that wheat is produced in their region than in 2015, still more than half noted some wheat production. The prevalence of sorghum production declined slightly from 2015, with just under half of respondents noting some production of sorghum in their region, down from over 60 percent in 2015.”

The update added that, “The survey asked Eleventh District bankers to rank the top three commodities produced in their lending region. The top five commodities in 2015 remained in the top five again in 2017; however, the rankings changed. Cattle continued to maintain the top position.

Cotton and corn traded places, with cotton coming in second.

In other developments regarding farmland values, a news release last month from Kansas State University (KSU) stated that, “Kansas farmland values have dropped an average of 11 percent over the past two years, pulled down by lower grain and livestock prices and a dramatic drop in farm and ranch income. The downward trend is likely to continue through 2017, and the news likely won’t be much better next year, according to a Kansas State University agricultural economist.

“‘We’ve seen incredible volatility in land values in the last six years,’ said Mykel Taylor, associate professor and farm management specialist with K-State Research and Extension. During that time, historic high prices were recorded in 2014-2015 followed by sliding values in 2016 and so far this year.”

The KSU release pointed out that, “Values for non-irrigated or dryland cropland in Kansas have fallen the most – 17 percent since 2015 – said Taylor, who gave a presentation on the topic at the recent K-State Risk and Profit Conference in Manhattan. Prices for irrigated cropland dropped 9 percent, and pasture land values fell 5 percent in that period.”