Reuters reported Wednesday that "production capacity of sustainable aviation fuel in the United States could jump by 1400% in 2024 if all announced capacity additions come on line, the U.S.…

USDA- ERS: Opportunities for U.S. Ethanol Exports

A report earlier this month from USDA’s Economic Research Service (ERS) (“Global Ethanol Mandates: Opportunities for U.S. Exports of Ethanol and DDGS,” by Jayson Beckman and Getachew Nigatu) noted that, “The increased use of ethanol globally could provide strong and diverse export market opportunities for U.S. ethanol and ethanol byproducts.” Parts of the ERS report are highlighted in this update.

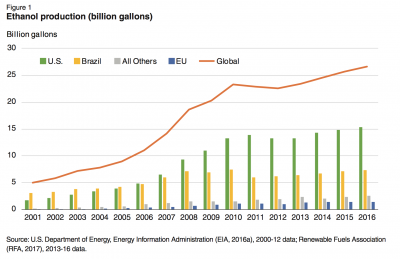

The ERS report noted that, “The United States is the world’s largest producer of ethanol. Although most U.S.-produced ethanol is consumed domestically, the United States exported 1.05 billion gallons of ethanol in 2016, the second-highest amount on record.”

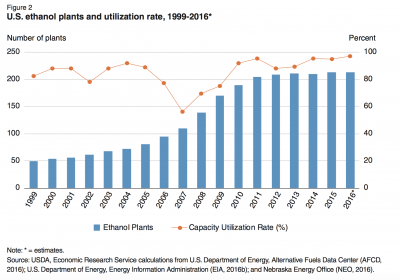

“The opportunity to export stems partly from ethanol plant capacity exceeding blend wall limits (the physical limit to how much ethanol can be blended with gasoline). In 2016, production capacity at U.S. plants was almost 16 billion gallons, about 1.6 billion gallons more than 2016 domestic consumption (fig. 2).”

Beckman and NIgatu explained that, “As domestic consumption is constrained by the blend wall, as well as by the limit on the amount of corn-based ethanol that can be applied to the ethanol mandate under RFS2, U.S. ethanol producers have found abundant export opportunities. In 2015, U.S. ethanol was exported to more than 50 countries. And in the past 5 years, more than 100 countries have imported U.S. fuel ethanol.

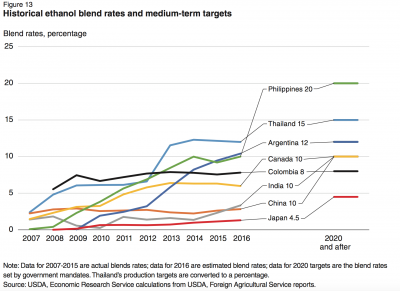

If major economies start implementing their existing target blend rates, U.S. ethanol producers would have much larger foreign market opportunities, as domestic production in some countries (e.g., China and India) may not be sufficient to meet the required ethanol levels.

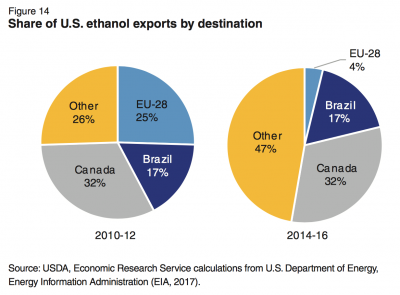

“Traditionally, Canada, Brazil, and the EU were the main importers of U.S. ethanol. Today, Canada continues to be the leading destination for U.S. ethanol exports, with a 32-percent share in 2014-16 (fig. 14). Brazil’s share of exports dropped in 2012-15, when the price of gasoline compared to ethanol fell, but rose again in 2016. However, Brazil introduced a tariff-rate quota (TRQ) on ethanol imports in August 2017, which could impact U.S. exports. In 2016, the U.S. exported 267 million gallons of ethanol to Brazil; however, the TRQ would apply a 20-percent tariff on Brazilian imports above 159 million gallons. After the EU imposed an antidumping duty on U.S ethanol imports for 5 years starting in 2013, U.S. ethanol exports to the EU fell from a 25-percent share in 2010-12 to around 4 percent in 2014-16.”

The ERS report indicated that, “The amount of U.S. ethanol exported to other countries has increased between 2010-12 and 2014-16. The top 10 in 2014-16 were China, the Philippines, India, South Korea, the United Arab Emirates, Mexico, Peru, Jamaica, Nigeria, and Singapore. Some may not have blending mandates or targets, but use ethanol as an additive to increase octane in gasoline. Some may be importing ethanol for nonfuel uses, even when the product shipped is identified as fuel ethanol.

“An increase in global demand for ethanol and the opening of borders could lead to export opportunities for the United States.

However, two factors could limit the ability of the United States to increase the rate of exports: ethanol plant capacity and feedstock availability.

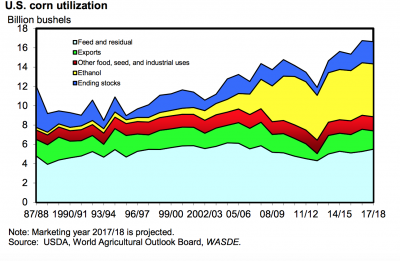

“U.S ethanol plants have been operating at more than 90 percent of capacity since 2013 (fig. 3), so short-term expansion could be limited. However, given the rapid expansion that took place in 2006-08, growth in the number of ethanol plants is possible if the mandate is increased or if the export market is attractive. Then the question of feedstock availability comes into play. In 2016, 38 percent of U.S. corn production was used for feed and residual, 15 percent for export, and 38 for feedstocks for ethanol production. If corn production remains constant, further expansion of ethanol production could be achieved by increasing the share going to ethanol production, improving efficiency, or using stocks. An increase in the availability of DDGS for animal feed could partially offset a reduction in the amount of corn used for feed.”

This month’s report also pointed out that, “Adoption of adverse trade policies, such as the 30-percent tariff imposed in China or the recent Brazilian ethanol TRQ, could also restrict U.S. exports. And the United States could face fierce competition for export markets, particularly from Brazil, the second-biggest producer and exporter of fuel ethanol.”

In conclusion, the ERS report stated that, “Favorable market conditions and government policies led to a large global expansion in ethanol production from 2001-10. Although much of this growth was in Brazil, the European Union, and the United States, these regions have experienced a slowing rate of production growth caused by policy changes and infrastructure limitations.

At the same time, 26 other countries have implemented blending mandates, although most have not met them. If these countries actively strive to fulfill their mandates, strong export market opportunities for U.S. ethanol could be possible, assuming that the United States can sufficiently expand production.

“At the same time, the blend wall has become a real presence in the United States, limiting how much ethanol can be consumed. Stagnant domestic growth could present further export opportunities.”