The world's farmers face soaring fertilizer and fuel prices as the war in the Middle East escalates, leaving some scrambling for supplies as the spring planting season approaches and causing…

USDA-FAS Report: China’s Meat and Poultry Import Forecast, 2018

On Thursday, the U.S. Department of Agriculture’s Foreign Agricultural Service (FAS) released its biannual “Livestock and Poultry: World Markets and Trade” report. Published in April and October, the report is “designed to give a snapshot of the current situation among the major players in world beef, pork, and broiler meat trade.”

Today’s update provides a recap of some of the highlights from the FAS report, which is titled, “China’s Meat and Poultry Import Forecast 2018: Decline and Constrained Growth.”

Overview: Beef, Broiler Meat, and Pork

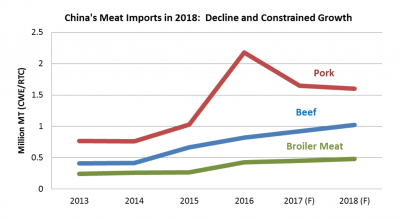

The FAS report indicated that, “China’s beef and broiler meat imports are forecast to rise 11 and 7 percent, respectively, in 2018.

Despite robust Chinese demand coupled with stagnant or declining production, additional growth in imports is constrained by restrictions which limit supplies from the United States, a key global trader.

“The United States is currently not eligible to export broiler meat to China due to highly pathogenic avian influenza (HPAI) restrictions. Even though the United States regained access to China’s beef market in May 2017, shipments are likely to be constrained in the short term due to market requirements which limit the ability of the United States to maximize trade opportunities. China is the world’s second and seventh largest beef and broiler meat importer, respectively, accounting for 13 and 5 percent of forecast trade.

“Alternatively, China’s pork imports are forecast to decline for the second consecutive year in 2018 as domestic production gains reduce demand of imported pork. The European Union, United States, and Canada will remain the principal suppliers, competing primarily on price.

With relatively strong demand for processing, imports are unlikely to retreat to past levels, maintaining China as the world’s top importer of pork accounting for nearly one-fifth of forecast trade.

Beef

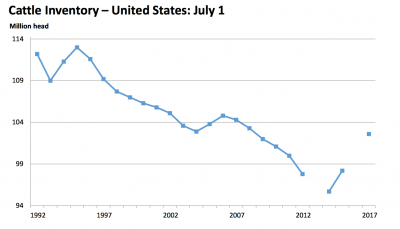

More specifically, Thursday’s report stated that, “U.S. production and exports: Production is expected up nearly 3 percent in 2018 to a record 12.4 million tons, as the United States enters the fourth year of its herd expansion.”

“Sustained elevated supplies and lower U.S. beef prices will boost exports to Mexico, Canada, and major markets in East Asia. The United States will face renewed competition in Asian markets from Australia as its herd expands. In Japan, the United States will also have to contend with Australia’s widening tariff advantage. However, a relatively weaker U.S. dollar in 2018 could further buoy U.S. beef exports.”

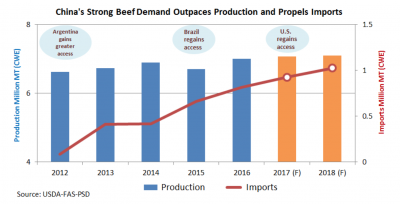

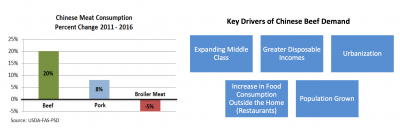

Regarding China and beef imports, FAS explained that, “From 2011 to 2016, China’s domestic beef production grew 8 percent to 7.0 million tons (carcass weight equivalent), but was outpaced by even stronger consumption growth, which rose 20 percent to 7.8 million tons during the same period…Unable to fully satisfy demand with domestic production, the country has increasingly looked to the international market.”

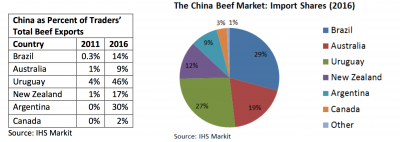

Additionally, FAS pointed out that, “The United States was the lead supplier with a two-thirds market share of the then-small $15 million China beef market when it lost access in 2003.

During the following 13 years, China’s consumers steadily consumed more red meat and poultry, owing to both higher individual income levels and population growth.

“Although traditionally the least consumed meat, beef consumption grew faster compared to pork and broiler meat over the past 5 years as rising prices for broiler meat and pork (due to lower production) made beef relatively more affordable.”

The report added that, “The China beef market that the United States reenters is not only larger by several orders of magnitude, but it has also become much more competitive. Over the past 5 years, most major beef exporters have increased the share of their total trade sold to China and will work to maintain these gains.”

Thursday’s report also indicated that, “South American countries will remain the top suppliers, as Brazil, Uruguay, and Argentina maintain their strong export growth. Australia, previously the largest exporter to China, will remain limited by its reduced supplies as herd rebuilding continues. U.S. beef will compete with other high-end beef supplies from Australia and Canada, but will be constrained by the terms stipulated in the protocol. However, U.S. beef has a good reputation in China and may find success in upscale markets.”

Pork

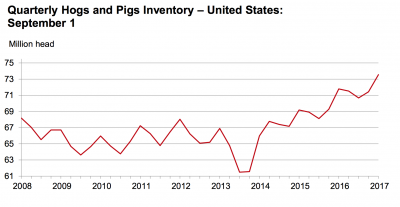

When addressing pork export issues, FAS noted that, “U.S. production and exports: Production is expected to grow 4 percent in 2018, continuing strong growth in 2017.”

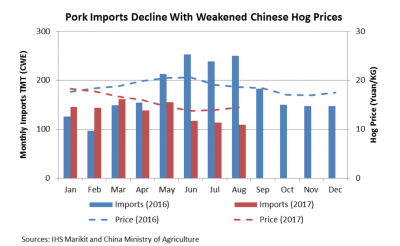

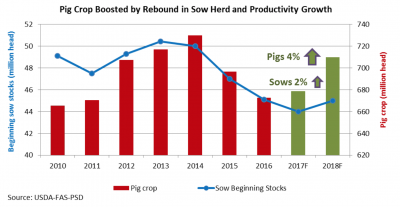

Regarding China and pork imports, FAS explained that, “Buoyed by strong returns over the past few years, Chinese hog producers entered an expansionary period during 2017 which is forecast to continue during 2018. The industry continues to undergo significant consolidation, hastened by new and stepped-up enforcement of environmental regulations aimed at curbing pollution from swine farms.

Producers are fewer in number but larger, as producers respond to growing production costs with increased scale efficiencies.

“Expansion is expected to drive pork production up during 2017 and 2018 after 2 consecutive years of declining output. China’s pork imports are forecast to decline considerably over the same period, but remain far above historical levels.”

And, the FAS report added that, “[Chinese] imports are forecast to decline for the second consecutive year in 2018 as production gains reduce demand for imported pork. Although pork production is expected to recover in 2018, demand strength will support increased imports. However, imports are expected to fall short of the peak reached in 2014. With production growing in most major exporting countries, declines in international pork prices will keep imports relatively competitive. The European Union, United States, and Canada will remain the principal suppliers, competing primarily on price. With relatively strong demand for processing, imports are unlikely to retreat to past levels, maintaining China as the top importer of pork.”