As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Survey Sheds Light on Farm Profitability, While Producers Cut Costs

A news release on Tuesday from the American Bankers Association (ABA) stated that, “Eighty-two percent of agricultural lenders reported a decline in farm profitability in the last 12 months, according to a joint survey by the [ABA] and the Federal Agricultural Mortgage Corporation [Farmer Mac]. Despite the continued decline, the survey of more than 580 agricultural lenders revealed that the agricultural loan approval rate is 84 percent.”

More specifically, the ABA- Farmer Mac survey explained that, “During the first half of 2017, agricultural lenders report improving sentiments on the overall agricultural economy.

While a high percentage of respondents reported an overall decline in farm profitability in the last six months (82 percent), that percentage is down more than seven points since the December 2016 ABA-Farmer Mac survey.

“Similar improvements were recorded in most categories, including the percentage reporting higher levels of operating leverage (79 percent down from 84 percent reported in 2016) as well as increased usage of the Farm Service Agency’s (FSA) Guaranteed Loan program (59 percent down from 63 percent reported in 2016). Lenders also reported a shrinking percentage of farms expanding (38 percent down from 45 percent reported in 2016), but also a declining proportion of farm operations contracting (17 percent down from 19 percent reported in 2016). The responses indicate that a portion of lenders are sensing improving economic conditions, while at the same time observing an increasing number of farm operators delaying major structural decisions.”

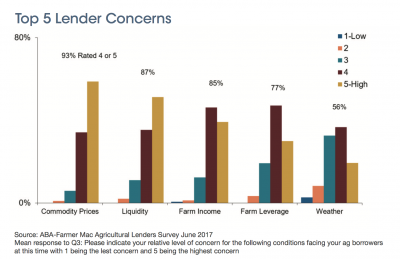

The survey stated that, “At the commodity sector level, commodity crops and dairy products are a top concern for lenders. When asked to rate their level of concern on a scale of one (lowest concern) to five (highest concern) for each of the major farm sectors, respondents consistently rank grains, dairy, and beef cattle among their top concerns.”

And, the survey added that, “While the overall sentiment may have improved slightly in the first half of 2017, the drivers of industry stress remain the same.

Four of the top five producer-level concerns involve financial metrics: commodity prices, liquidity, farm income, and leverage. The percentage of respondents listing these as a top concern remains virtually unchanged between December and June.

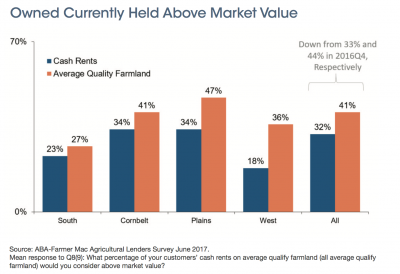

With respect to farmland, the survey indicated that, “The average lender reports that a high percentage of average quality land (41 percent) and cash rents (32 percent) are above fair market value of their area. Land values are perceived as more widely above market values than cash rents, potentially a result of recent declines in negotiated cash rental rates.”

Meanwhile, Reuters writers Mark Weinraub and P.J. Huffstutter reported late last week that, “When Kansas farmer Tom Giessel drove over a deer carcass and punctured a tire on his combine during harvest this fall, he did not have the time or cash to fix it. He borrowed his neighbor’s combine to finish.

“U.S. farmers are cutting costs any way they can to compete against cheaper producers in Argentina and Brazil. Four years of global oversupply have pushed down grain prices, reduced agricultural revenues and put more expensive producers under financial pressure.

“In response, U.S. farmers have bought cheaper seeds, spent less on fertilizers and delayed equipment purchases as they seek to ride out the downturn.

But more bumper harvest forecasts and rising energy prices herald another tough year for farmers in 2018.

Weinraub and Huffstutter pointed out that, “Giessel has cut spending on what he can control – seeds, chemicals, fertilizer, rented land – and chewed through his farm’s savings. He stands to lose $93 an acre, or nearly $15,000, on one corn field alone this year…[S]ome farmers have had to sell assets to keep afloat. Others have gone into bankruptcy.”

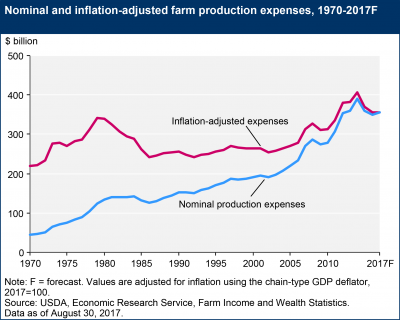

The article noted that, “Farmers cut $40.20 billion to bring total costs down to $350.49 billion between 2014 and 2016, according to the U.S. Agriculture Department’s Economic Research Service.”

Put simply, the Reuters writers stated that, “Falls in crop prices have outpaced the cuts farmers have made in spending.”

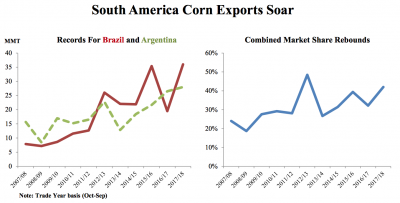

Pointing to the lower production costs of South American competitors, the Reuters article indicated that, “The lower costs have helped Latin American producers take market share from their competitors in the United States. Brazil and Argentina combined are expected to capture nearly 42 percent of the global corn export market in the 2017/2018 crop year, up from under 38 percent in 2014/2015.”

Recall that a report in September by USDA’s Foreign Agricultural Service stated that, “Brazil and Argentina have doubled their share of global corn exports over the past decade and are expected to garner nearly half in 2017/18. Both countries are forecast to have record exports while U.S. exports and market share are expected to decline in 2017/18.”