Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

“Drowning In Grain”- Reuters Special Report on the Global Grains Glut

Reuters writer Rod Nickel reported yesterday that, “On Canada’s fertile Prairies, dominated by the yellows and golds of canola and wheat, summers are too short to grow corn on a major scale.

“But Monsanto Co is working to develop what it hopes will be North America’s fastest-maturing corn, allowing farmers to grow more in Western Canada and other inhospitable climates, such as Ukraine.

“The seed and chemical giant projects that western Canadian corn plantings could multiply 20 times to 10 million acres by 2025 – adding some 1.1 billion bushels, or nearly 3 percent to current global production.”

Yesterday’s article indicated that,

The question, amid historically high supplies and low grain prices, is whether the world really needs more corn.

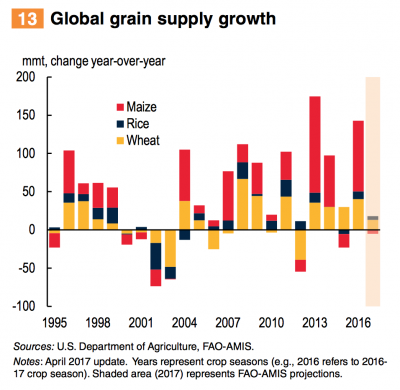

Mr. Nickel explained that, “A global grains glut is now in its fourth year, with supplies bloated by favorable weather, increasingly high-tech farm practices and tougher plant breeds.”

“The bin-busting harvests of cheap corn, wheat and soybeans are undermining the business models of the world’s largest agriculture firms and the farmers who use their products and services.

Some analysts say the firms have effectively innovated their way into a stubbornly oversupplied market.

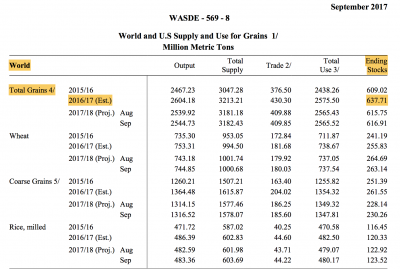

The Reuters article noted that, “Never has the world produced so much more food than can be consumed in one season. World ending stocks of total grains – the leftover supplies before a new harvest – have climbed for four straight years and are poised to reach a record 638 million tonnes in 2016/17, according to USDA data.”

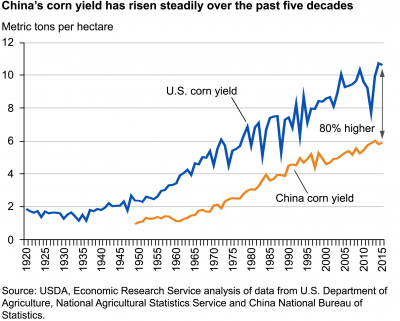

“Another key factor: China – the world’s second-biggest corn grower – adopted stockpiling policies a decade ago when crop supplies ran thin, resulting in greater production than the world needs.”

With respect to the impacts of large global food supplies on and food prices, Mr. Nickel stated that, “Abundant supplies have helped lower food prices across the world, but the benefit to consumers and impoverished nations is muted by several factors, including problems with corruption and distribution of food in developing regions, said Sylvain Charlebois, professor of food distribution and policy at Canada’s Dalhousie University.” (Note that a recent FAO report pointed out that world hunger is actually on the rise).

And when focusing on U.S. farmers, the Reuters article explained that, “Even as farmers reap bountiful harvests, U.S. net farm incomes this year will total $63.4 billion – about half of their earnings in 2013, according to a U.S. Department of Agriculture forecast.

Lower incomes mean farmers cannot spend as much on seed, fertilizer and machinery, extending their pain to firms across the agriculture sector.

Later, the Reuters article explained that, “Even if U.S. or Brazilian corn crops suffered major weather damage, the world would still have the expanding Black Sea corn region to tap, not to mention China’s enormous supplies, said [Paul Bertels, vice-president of production and sustainability at U.S.-based National Corn Growers Association].”

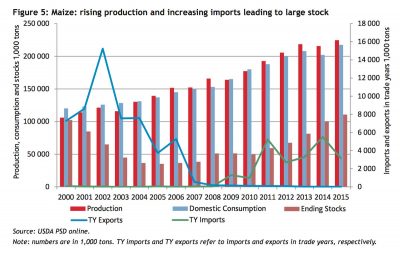

“China’s stockpiling policies, enacted in 2007 when corn supplies were tight, also stimulated oversupply. Aiming for self-sufficiency in grains, Beijing bought virtually the entire domestic crop each year and paid farmers as much as 60 percent more than global prices.”

“The program stuffed Chinese warehouses with some 250 million tonnes of corn by the time Beijing scrapped it last year. China is now boosting incentives for farmers to switch to soybeans from corn.”

Also with respect to China and corn, Wall Street Journal writer Lucy Craymer reported yesterday that, China’s agricultural exports to North Korea rose sharply in July and August, amid rising geopolitical tensions and at a time of year when the food supply in the isolated nation is usually at its lowest.”

China’s Food Exports to North Korea Surge https://t.co/7GwJsRzI1W by @Lucy_Craymer pic.twitter.com/xJ2XebdoZl

— Farm Policy (@FarmPolicy) September 27, 2017

“In July and August, China corn exports jumped to a total of 34,964 metric tons, nearly 100 times the levels seen in the year-earlier period. Rice exports increased 79% to 17,875 metric tons, while exports of wheat flour surged more than elevenfold to 8,383 metric tons, according to China’s Customs data.”

Ms. Craymer noted that, “Meanwhile, the jump in corn exports to North Korea comes as China has been trying to sell down its overflowing corn stockpiles, which are estimated by the U.S. Department of Agriculture at around 110.8 million metric tons. Those efforts have been met with limited success since China began overhauling the sector in early 2016.

“Beijing doesn’t release information on its stocks, but market players think much of the corn is no longer fit for consumption. Some of it is four years old and might be fit only to be made into ethanol.”