Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

U.S. Ag Exports: USDA Data Update, NAFTA Worries Persist

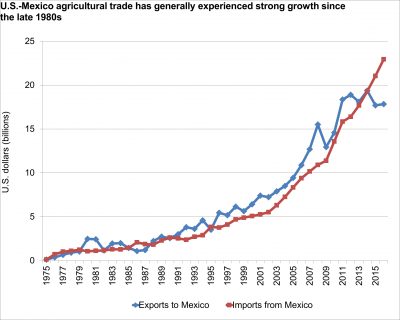

Last week, USDA updated portions of its monthly agricultural trade data. Despite some positive indications, news reports demonstrate that concerns over the renegotiation of the North American Free Trade Agreement (NAFTA) persist in both Mexico and the U.S. agricultural sector.

Background- USDA Data

In its latest quarterly export forecast in August, USDA stated that, “Fiscal 2018 agricultural exports are projected at $139.0 billion, down $800 million from the revised fiscal 2017 forecast of $139.8 billion, largely due to reductions in corn and cotton export forecasts.”

U.S. agricultural exports forecast up in 2017 and slightly down in 2018, @USDA_ERS pic.twitter.com/vH5LXXxl1a

— Farm Policy (@FarmPolicy) September 12, 2017

In October, trade data for the first 11 months of the fiscal year showed that the $139.8 billion export estimate for fiscal 2017 was on target.

And in its most recent update from Friday, USDA data showed that in September, the U.S. exported about $10.5 billion worth of agricultural products, which brought the total for the 2017 fiscal year to $140.5 billion.

Latest U.S. agricultural trade data (fiscal year and calendar year), @USDA_ERS pic.twitter.com/wj19EDQBZr

— Farm Policy (@FarmPolicy) November 4, 2017

This is almost $11 billion more worth of agricultural exports than fiscal year 2016.

Meanwhile, on Thursday, the USDA’s Foreign Agricultural Service (FAS) noted that, “Private exporters reported to the U.S. Department of Agriculture export sales of 1,356,360 metric tons of corn for delivery to Mexico.”

In a tweet Friday, FAS explained that this corn sale to Mexico ranks as the 10th largest daily corn sale on record since 1977.

NAFTA Concerns

Despite these positive trade developments, Sean Higgins reported on Tuesday at The Washington Examiner Online that, “Mexico is looking toward strengthening trading deals with other countries should the talks to renegotiate the North America Free Trade Agreement fail, said a source with knowledge of the country’s plans who requested anonymity.”

The article stated that,

“‘It’s very simple: If today I’m the top buyer of yellow corn, of fructose, rice, chicken, pork from the U.S., I need to open a space for trade with Brazil and Argentina so that at the table people realize that we have options,’ [Mexican Economic Minister Ildefonso Guajardo] said last week in Mexican city of San Luis Potosi, according to a Bloomberg report.”

And Politico reported last week that, “After the last four rounds of NAFTA talks, the U.S. agricultural industry is worried that the Trump administration is positioning itself to withdraw from the trade deal, American Soybean Association [ASA] officials told reporters during a roundtable on Monday.”

The update added that, “ASA signed onto the letter that a coalition of more than 80 food and farm groups sent to Commerce Secretary Wilbur Ross last week warning that the White House sending Congress its notice to withdraw from NAFTA would cause immediate harm to the ag economy.”

Mary Anastasia O’Grady pointed out in a recent Wall Street Journal column that, “The ‘walk-away’ strategy worries Sen. Pat Roberts of Kansas, who told Inside Trade ‘that if you start the clock on NAFTA [withdrawal] that’s going to send very bad signals throughout the entire farm economy.’ America’s farmers and ranchers exported $17.9 billion to Mexico in 2016.

“Mr. Roberts added: ‘And then to restitch that and put it all back together it’s like Humpty Dumpty. You push Mr. Humpty Dumpty trade off the wall and it’s very hard to put him back together.'”

Chairman @SenPatRoberts Calls on Members of @USChamber to Help Set Record Straight: #NAFTA Benefits Aghttps://t.co/DCbWHQKkRO pic.twitter.com/5UfrhQmXNe

— Sen. Ag Republicans (@SenateAgGOP) October 31, 2017

William Mauldin reported on Thursday at The Wall Street Journal Online that, “Nebraska cattle rancher Craig Uden is taking President Donald Trump at his word.

“Mr. Trump’s threat to withdraw from the North American Free Trade Agreement strikes some as tough talk aimed at winning concessions from Canada and Mexico. But the 56-year-old Mr. Uden, who heads the National Cattlemen’s Beef Association, has decided to freeze his own cow herd at 1,500 head.

“A Nafta breakup and tariffs that could follow, he said, could curtail Mexico’s demand for American beef, valued at around $700 million a year—in part because Mexican consumers like cuts, such as oxtail and tripe, that Americans generally pass up.”

Mr. Mauldin noted that, “The U.S., Canada and Mexico are set to resume Nafta renegotiations, instigated by Mr. Trump, on Nov. 17 in Mexico City with the goal of wrapping up by March.”

The Journal article stated that, “In agriculture, Mexico is looking to buy wheat from Argentina and limit dependence on grain from U.S. Midwestern states. Chip Councell, chairman of the U.S. Grains Council, said his family hedged its entire 2017 corn harvest for the first time ever to protect against the risk of Mexican buyers shifting purchases to Latin America.”