As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Ag Economy: 2018 Outlook from CoBank; and Farmland Values

CoBank recently released a new report that explored a variety of issues that will impact the U.S. rural economy in 2018. In addition, recent newspaper articles have discussed reports relating to the value of U.S. farmland. This update briefly highlights core points from the CoBank report, and also looks at the new information on farmland values.

2018 Outlook from CoBank

A new report from CoBank (“The Year Ahead: Forces that will shape the U.S. rural economy in 2018“) outlined ten areas of focus in assessing the year ahead, including a closer look at the U.S. farm economy; trade issues; and grain supply and biofuels.

Which ten key forces will influence the outlook for #rural America in 2018? Find out in a new report from CoBank’s Knowledge Exchange Division: https://t.co/4cJog4wKcg pic.twitter.com/R22hC6TjwE

— CoBank (@CoBank) January 18, 2018

While addressing the U.S. farm economy, Tanner Ehmke indicated in the CoBank report that, “Farmers are bracing for another year of belt tightening as commodity surpluses around the globe continue to depress prices and sap farmers of working capital. While net farm income improved slightly in 2017 thanks to the livestock sector, farm financial stress will remain a common theme across the countryside.

Debt loads among farmers continue to climb as they struggle to cover relatively high production costs amid anemic commodity prices. Ag retailers and cooperatives are also feeling the strain, keeping the topic of mergers and acquisitions on the table in co-op board rooms.

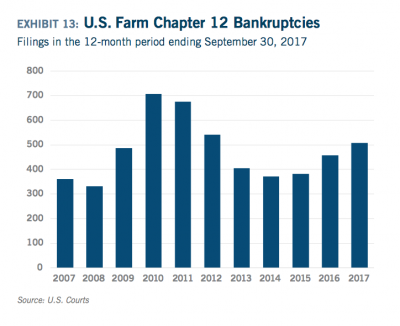

“Farmer solvency is an increasing concern in some regions. Wheat and dairy producers are among the hardest hit in this down cycle, as evidenced by an increase in Chapter 12 bankruptcy filings in Kansas and Wisconsin. Chapter 12 bankruptcies, which last year reached the highest level since 2012, are expected to accelerate in 2018 in the absence of a major upward correction in farmgate prices (See Exhibit 13).”

The report pointed out that, “While concern over financial stress in agriculture grows, comparisons to the 1980s farm crisis abound. However, the industry’s balance sheet is still much stronger than during the prior correction.”

While discussing trade issues in the CoBank report, Dan Kowalski noted that, “Trade has become such a concern for U.S. agriculture that it has stolen center stage during a farm bill year.”

“Roughly 20 percent of U.S. agricultural goods are exported, valued at $135 billion. Both the value and the share have marched higher over the years as the farm sector has become increasingly dependent on foreign markets for demand growth,” the report said.

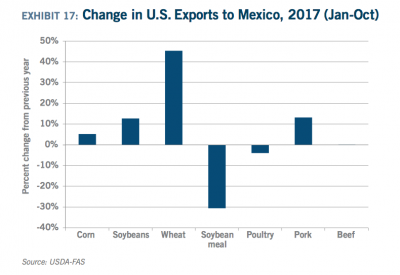

The report noted that, “In 2017, Mexico threatened to pre-empt the [North American Free Trade Agreement] discussion and make arrangements to import its food needs from South America. Mexico did buy grains from South America, but the purchases were relatively small, and imports of most U.S. agricultural products were up year-over-year in 2017 (See Exhibit 17).”

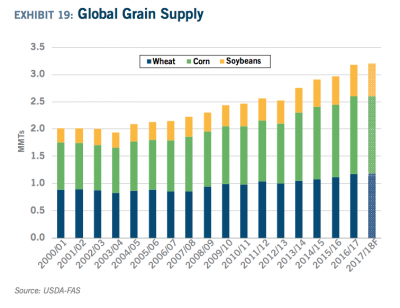

And while discussing grain supplies and issues associated with biofuels, Will Secor and Tanner Ehmke pointed out that, “Prices across both grain and ethanol sectors have been limited by supplies that have outpaced record or near-record demand. For both sectors, export growth will be critical to reducing surpluses. Domestic users offer limited upside for demand growth despite the current expansion in the U.S. livestock and biodiesel sectors.

“Exporters face a wall of abundant grains and oilseeds held by competitors (See Exhibit 19).”

“And, in particular, Brazil, Russia and Argentina have benefitted from relatively weaker currencies against the U.S. dollar. Ethanol exporters also face signicant headwinds from adverse import policies in China and Brazil, and from NAFTA uncertainty that threatens market access to Canada, a top U.S. ethanol export destination.”

Farmland Values

Earlier this month, Omaha World-Herald writer Steve Jordon reported that, “Average prices for high-quality farmland increased over the past year in seven leading agricultural states, held steady in seven others and declined in Nebraska and three others, an Omaha farm management company said.”

FrtPg today's @OWHmoney, "'A stabilizing time' for #farmland prices amid slight decline overall," https://t.co/tPlkYfjW1f pic.twitter.com/0vCVYKEf65

— Farm Policy (@FarmPolicy) January 12, 2018

Mr. Jordon explained, “Counting all crop and ranch land in the 18 states, including less-productive land, prices are down slightly but more stable than over the previous several years, said Randy Dickhut, senior vice president of real estate operations for Farmers National Co.”

The World-Herald article added, “The report said prices for irrigated cropland in Nebraska averaged $9,000 an acre in 2017, down from $9,500 in 2016 and $10,000 in 2015. The average for high-quality Iowa farmland was $10,500 last year, up from $10,100 in 2016 and 2015.

“Sam Kain, a sales manager for Farmers National in West Des Moines, said prices for good farmland increased slightly after the 2017 harvest.”

Prices have been low, but farmland has remained strong. @ScottIrwinUI says those buying may believe his contrarian view. pic.twitter.com/rpCKeSEKoe

— Todd E. Gleason (@commodityweek) January 22, 2018

Meanwhile, Donnelle Eller reported on Monday at The Des Moines Register Online that, “Iowa’s farmland values ticked slightly higher over the past year, even with lower sales activity, a new report shows.”

“Average farmland values were 1.8 percent higher over the past year, based on sales data and appraisals of 21 Iowa farms used as benchmarks by Farm Credit Services of America in Omaha.

Despite the increase, Iowa’s benchmark farmland values are still nearly 13 percent lower than five years ago, due to declining corn, soybean and other commodity prices.

Ms. Eller noted, “The report echos findings from Iowa State University in December, showing average farmland values climbed 2 percent to $7,326 an acre.”