A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Kansas City Fed Ag Outlook- Robust Corn, Soybean Production Make Exports Increasingly Important

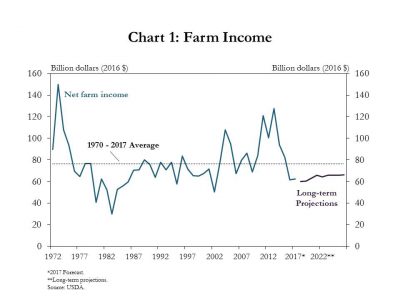

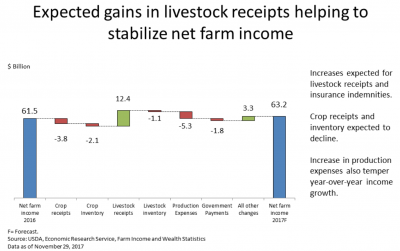

Cortney Cowley, an economist at the Federal Reserve Bank of Kansas City, indicated in an update last week (“As Winter Looms, Key Risks Keep Ag Outlook Cool“) that, “Following steep declines for three consecutive years, farm income was expected to stabilize in 2017 and beyond. In inflation-adjusted dollars, real net farm income was forecast to be relatively unchanged from 2016.”

“Forecasts for stable farm income were led by expectations that increasing revenues for livestock and livestock products would offset declining revenues in the crop sector. However, despite the forecast for stable farm income relative to 2016, levels for 2017 still were expected to be 18 percent lower than the long-run average.”

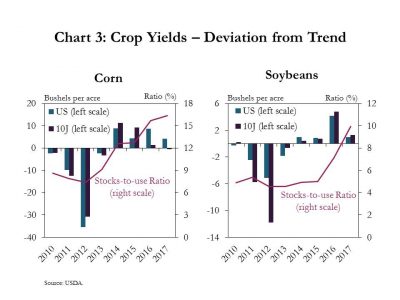

Dr. Cowley explained that, “Although farm income appears to have stabilized in the short to longer term, one risk to the outlook has been growing supplies. Yields for corn and soybeans have been above 20-year trend levels since 2014 and have contributed to increasing inventories.”

#Corn for Grain Yield, @usda_nass pic.twitter.com/qvshzpI97l

— Farm Policy (@FarmPolicy) January 12, 2018

United States #Soybean Yield, @usda_nass pic.twitter.com/zzHi8HmAap

— Farm Policy (@FarmPolicy) January 12, 2018

“In addition, soybean inventories have doubled since 2015. Growth in U.S. corn and soybean inventories is a risk to the outlook because larger inventories have been linked to lower prices.”

The Kansas City Fed update indicated that,

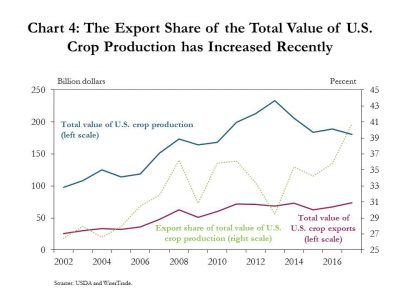

As growth in domestic production has continued to outpace domestic use, U.S. agriculture has become increasingly reliant on exports.

“The USDA recently reported that exports are responsible for 20 percent of farm income. Therefore, although international demand has provided some opportunities for the agricultural sector, uncertainty surrounding trade remains a risk to the outlook.

“One reason trade is a risk to the outlook is because exports in recent years have contributed a larger share of the total value of U.S. crop production. The total value of crop production has declined since 2013 (Chart 4). At the same time, the total value of crop exports has increased slightly. Over the last four years, the export share of the total value of U.S. crop production increased from 29 percent in 2013 to an estimated 40 percent in 2017.

This seems to indicate that demand from international markets has provided some support for the U.S. agricultural sector during the recent downturn.

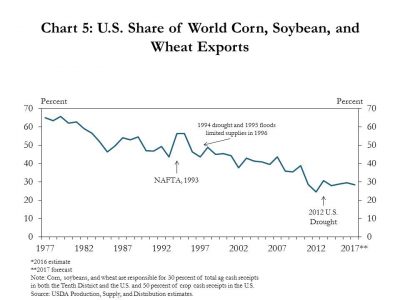

Dr. Cowley added that, “However, the U.S. share of world crop exports has fallen steadily over time. In the late 1970s, the U.S. held a 65-percent share of world crop exports (Chart 5). In 2017, the U.S. share of world crop exports was forecast to be 28 percent. The decline in the U.S. share of world crop exports suggests that the rest of the world has become more active in global export markets when the U.S. has become increasingly reliant on world trade.”

“One mitigating factor of increasing global competition has been trade deals, such as the North American Free Trade Agreement (NAFTA),” the Kansas City Fed update said.

Last week’s update stated that, “In fact, the value of agricultural exports to both NAFTA partners more than doubled following the implementation of NAFTA. It is unclear what would happen if the United States fails to renegotiate NAFTA. However, because the United States has become more reliant on international demand for agricultural products and international competition for agricultural exports has increased, uncertainty surrounding NAFTA and other trade deals is a key risk to the agricultural outlook.”