Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

Trade Update: Trans-Pacific Partnership (TPP), China, and NAFTA

Trans-Pacific Partnership (TPP), China, and Soybeans

Jacob M. Schlesinger reported on Tuesday at The Wall Street Journal Online that, “Eleven Pacific Rim nations agreed to forge a new trade bloc [TPP] that excludes the U.S. on Tuesday, as President Donald Trump signed an order to block certain cheap Asian imports [Chinese makers of solar panels and South Korean producers of washing machines], illustrating the battle lines of a new global trade climate.

“The announcements underscore Mr. Trump’s challenge as he prepares to defend his new ‘America First’ trade policy in a speech on Friday to the champions of globalism at the World Economic Forum in Davos, Switzerland.”

“Our action today helps to create jobs in America for Americans.” -@POTUS https://t.co/rO1yOcy87y

— USTR (@USTradeRep) January 23, 2018

Mr. Schlesinger explained,

It will be hard to convince allies that ‘America First’ goes beyond isolationism and protectionism. The risk is that other countries retaliate against American producers with their own sanctions and step up new trade accords without the U.S.

Financial Times writers Shawn Donnan, Robin Harding and Mark Odell pointed out on Tuesday that, “Mr Trump has said he would prefer to pursue bilateral deals with TPP members including Japan, and administration officials say pushing for those will be a priority this year. But the government of Shinzo Abe and others have so far refused to begin negotiations over any such deals, with many countries warily eyeing the Trump administration’s aggressive bid to renegotiate the North American Free Trade Agreement with Canada and Mexico, who are both TPP members.”

Meanwhile, Bloomberg writer Shruti Singh reported on Tuesday that, “After six consecutive days of weather-driven price gains, the rally in soybean futures in Chicago almost came to a halt Tuesday. One explanation may be the tariffs on imported solar panels and washing machines announced by President Donald Trump a day earlier.

“China is the biggest maker of solar panels and expressed displeasure at the move. The country is also the largest buyer of U.S. soybeans, at a time when growing production and inventories have weighed on prices and intensified the battle between the U.S. and South America for market share. Could the crop get sucked into a China-U.S. trade dispute?”

The Bloomberg article added, “Trade isn’t the only bearish factor in the soybean market right now. U.S. exports are slower compared with a year ago and improving weather may ease crop concerns in Brazil and Argentina.”

NAFTA

Reuters writers David Ljunggren and Anthony Esposito reported on Tuesday that, “Officials opened a key round of negotiations to modernize NAFTA on Tuesday amidst optimistic signs, as U.S. President Donald Trump said the talks were going ‘pretty well‘ and Canada’s chief negotiator said he had high hopes for progress.”

The article pointed out that, “Trump, vowing to undo what he portrays as disastrous trade deals, has in recent days expressed different views of the North American Free Trade Agreement, stoking investor worries.”

“‘NAFTA is moving along pretty well. I happen to be of the opinion that if it doesn’t work out, we’ll terminate it,’ Trump said in the Oval Office as he signed orders imposing tariffs on imported solar panels and washing machines [see video clip above].

“With time running out to address U.S. demands for major changes to NAFTA, officials met in a Montreal hotel for the sixth and penultimate round of scheduled talks, which are to conclude by the end of March to avoid a clash with Mexico’s elections.”

Tuesday’s article added, “Many Canadian officials, however, are downbeat about the talks amid uncertainty over whether Washington really wants to negotiate.”

Sen. @PatRoberts emphasizes at @SenateFinance hearing that the U.S. cannot "pull the trigger on the termination" of #Nafta. He says he's spoken to Trump and "I don’t think that’s going to happen."

— William Mauldin (@willmauldin) January 17, 2018

Meanwhile, James Q. Lynch reported last week at The Gazette (Cedar Rapids, Iowa) Online that, “Add U.S. Sen. Joni Ernst’s voice to those who believe that President Donald Trump is reassessing his position on the North American Free Trade Agreement.

“Although the president repeatedly has threatened to pull out of the 23-year-old trade agreement with Mexico and Canada, ‘I think he has doubts,‘ Ernst told members of the Iowa Corn Growers at their winter meeting Monday in Tama.”

The Gazette article explained, “Ernst, who was among a group of GOP senators who met with the president to discuss NAFTA before Christmas, said Trump was under the impression they wanted him to pull out of the agreement with the countries that are the United States’ and Iowa’s largest trading partners.

“However, when Trump polled everyone at the meeting, Ernst said only U.S. trade representative Robert Lighthizer supported withdrawing from NAFTA.

“None of the farm state senators in the room advised him to end the deal that has been under renegotiation for months.”

With respect to perspective from the U.S. Department of Agriculture, Bloomberg writer Alan Bjerga reported last week that,

President Donald Trump has come to see that Nafta has some benefits to the U.S., particularly for farming, even as he stays firm in his demand for a new deal, Agriculture Secretary Sonny Perdue said.

Mr. Bjerga noted that, “Trump ‘probably left the campaign trail literally believing that Nafta had not been good for any sector of the economy,’ Perdue said in an interview at his office on Wednesday [Jan. 17th] in Washington. But ‘I think that he has now come to realize that agriculture has been benefited by a Nafta agreement.'”

...We are whispering in @realDonaldTrump's ear every week about how important #NAFTA is to American #agricutlure, @SecretarySonny https://t.co/YZ1UEKenER

— Farm Policy (@FarmPolicy) January 20, 2018

Opinion columns and newspaper editorial boards continue to highlight the important benefits NAFTA has provided to agriculture:

– Wall Street Journal Editorial Board (Jan. 8th)- “The greatest danger to the Farm Belt is that Mr. Trump might withdraw from the North American Free Trade Agreement.”

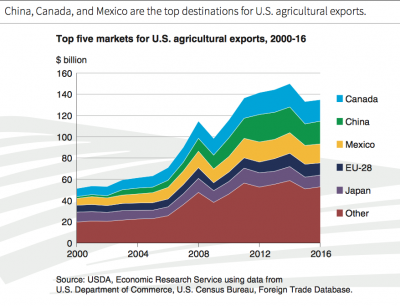

– St. Louis Post-Dispatch Editorial Board (Jan. 13th)- “Agriculture is one area where the balance has worked overwhelmingly in America’s favor. In 2016, for example, American farmers exported an estimated $41 billion in agricultural products to Mexico and Canada. Exports of soy and corn — crucially important to Missouri and Illinois agriculture — have quadrupled since NAFTA went into effect in 1994.”

– Karl Rove, Wall Street Journal Op-Ed (Jan. 17th)- “Once disrupted, those [NAFTA] agricultural markets wouldn’t come back quickly. People in farming would know who to blame.”

– Mark Recker, president of the Iowa Corn Growers Association (Jan. 19th, The Des Moines Register)- “We need a brighter 2018, and this starts with trade. We face increasing global competition for our agricultural exports.”

– Kevin Skunes, the president of the National Corn Growers Association and North Dakota farmer (Jan. 23rd, The Hill Online)- “With record yields being produced across the United States, we’ve needed access to export markets more than ever and NAFTA has met the challenge.”

And Reuters writers Jason Lange and David Alire Garcia reported on Tuesday that, “The [NAFTA] stakes are high for the U.S. poultry sector, which exports products worth more than $1 billion a year to Mexico.

Mexico could slap a 75 percent tariff on U.S. chicken and turkey under its commitments to World Trade Organization rules, compared to the 20 percent tax on imports the Latin American nation could apply to other major U.S. exports like pork.

“‘It would effectively prohibit us from selling product to Mexico,’ Sanderson Farms Chief Financial Officer Mike Cockrell said. He added that the loss of the market would be comparable to the impact of Russia’s 2002 ban on U.S. chicken imports.”

The Reuters writers pointed out that, “Texas, Georgia, Arkansas and Mississippi are the top four states sending poultry meat to Mexico. Each is a Republican stronghold that voted heavily for Trump in the 2016 presidential election.”