Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

Trade Retaliation Measures Could Hurt U.S. Farm Sector

A FarmPolicyNews update last month discussed executive branch implementation of U.S. import tariffs on solar panels and washing machines, as well as the possibility of future implementation of import barriers on steel and aluminum. That update also included a look at the potential of retaliatory measures, particularly by China, that could have a negative impact on U.S. agricultural exports and farm income. On Thursday, President Trump signaled that he plans to levy the tariffs on steel and aluminum imports soon. Today’s update looks at recent news items that highlight the negative impact trade retaliation measures could have on U.S. agriculture if the President follows through on his import tariff promise.

Background

Jim Tankersley reported on Friday at The New York Times Online that, “[President] Trump said on Thursday that he would soon levy tariffs on imported steel and aluminum from every foreign country, a move that sent stocks tumbling through the end of the day. On Friday, he ramped up his rhetoric in the face of criticism, saying on Twitter that ‘trade wars are good, and easy to win.'”

When a country (USA) is losing many billions of dollars on trade with virtually every country it does business with, trade wars are good, and easy to win. Example, when we are down $100 billion with a certain country and they get cute, don’t trade anymore-we win big. It’s easy!

— Donald J. Trump (@realDonaldTrump) March 2, 2018

The Times article noted that, “The planned tariffs are stiff: 25 percent for steel and 10 percent for aluminum. They appear likely to buoy domestic investment and, to some degree, job creation in those industries, while raising prices on consumers and squeezing other industries that rely heavily on metals, such as automobile manufacturing and beverage production.”

Mr. Tankersley explained that, “What worries many economists, particularly on Wall Street, is the prospect that Mr. Trump is set to launch a broader trade war. The national security grounds he is invoking as rationale for the tariffs could provoke swift retaliation from trading partners such as Canada, which will be affected far more by the measures than China will.”

Meanwhile, The Wall Street Journal editorial board stated in Friday’s paper that,

Donald Trump made the biggest policy blunder of his Presidency Thursday by announcing that next week he’ll impose tariffs of 25% on imported steel and 10% on aluminum.

The Journal added that, “The economic damage will quickly compound because other countries can and will retaliate against U.S. exports. Not steel, but against farm goods, Harley-Davidson motorcycles, Cummins engines, John Deere tractors, and much more.”

Agricultural Worries, Implications

Wall Street Journal writer William Mauldin reported on Saturday that, “For Kansas farmer Dan Atkisson, tensions over trade surfaced weeks before President Donald Trump announced plans to slap tariffs on imported steel and aluminum.

“On Feb. 4, Mr. Atkisson woke up to news Beijing had launched an investigation into alleged American dumping of—and subsidies on—sorghum, a grain known as ‘milo’ in western Kansas. Mr. Atkisson, 32 years old, grows one variety of sorghum to feed his cattle but devotes most of his fields to ‘grain sorghum,’ which in large part is exported to China.

“Beijing’s probe, which some in Kansas fear could end in painful tariffs on American sorghum, came shortly after the Trump administration imposed tariffs on solar cells and washing machines in January.”

"@USDA Experts Studying Possible Effects of any #Chinese Ag. Trade," https://t.co/vk47MgEjcD (MP3- 1 minute). @USDA Radio. #soybeans pic.twitter.com/cPzm9Qv1XP

— Farm Policy (@FarmPolicy) March 3, 2018

The Journal article indicated that, “Some saw China’s move as retaliation against those tariffs. ‘Countries sometimes utilize these issues to send messages,’ said Sen. Jerry Moran, a Kansas Republican who hails from the same county as Mr. Atkisson. ‘In this case, the message China was sending hits agriculture in the middle of the country.'”

China’s sorghum move amounts to a foretaste of what U.S. farmers and manufacturers might face now that Mr. Trump has announced a plan to slap 25% tariffs on steel imports and 10% on aluminum. The White House is also looking at options for punishing China broadly over intellectual-property violations.

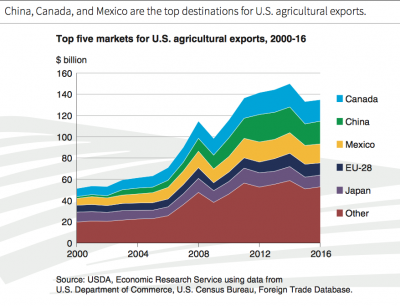

The Journal article added that, “Economists say bigger crops are at risk, including soybeans, whose exports to China last year reached $12.4 billion. Other countries could target U.S. dairy, almonds, blueberries, apples, beef, pork and wine.”

And DTN Ag Policy Editor Chris Clayton reported Thursday that, “Soybeans amount to $14 billion in export value to China, making it the largest U.S. commodity shipped there.”

U.S. #soybean exports averaged 50% of total U.S. ag and related product exports to #China over the last 5 year period, https://t.co/dO2lptMIIB (from #AgOutlook presentation by Michael Ward, Senior Agricultural Attaché, @USDAForeignAg American Embassy, Beijing, China). pic.twitter.com/w1qhsT8KeM

— Farm Policy (@FarmPolicy) March 2, 2018

The DTN article noted that, “‘Brazil has got a pretty big crop, and they (China) can buy more from them for a while,’ [John Heisdorffer, president of the American Soybean Association and a farmer from Keota, Iowa] said. ‘Brazil has so many acres they can put into production pretty fast. Let’s say if we lose 20% to 30% of our market, and they pick it up, then what happens?‘”

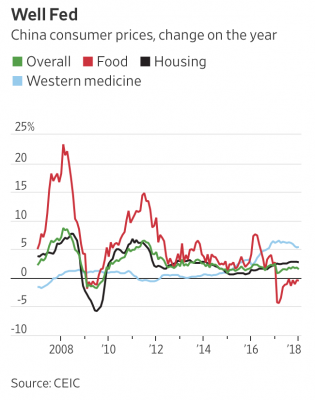

Nathaniel Taplin reported on Thursday at The Wall Street Journal Online that, “How might China respond [to restrictions imports on steel and aluminum]? One possibility is soybeans. The country imported $12.4 billion of American soybeans last year to feed its pigs. China relies on these imports to keep feed prices low, which in turn keeps low the politically-sensitive price of pork. The meat is China’s staple protein, and a sizable component in household budgets.

But China is arguably now in a better position to handle disruption from American soy. Food price inflation has been running negative for over a year thanks to agricultural reforms, rebounding pork supply and a worldwide grain glut. The strengthening Chinese yuan is also weighing on the price of imported foodstuffs.

The Journal article stated that, “U.S. farmers’ leverage with China, meanwhile, is exceptionally weak. Farm debt is high and incomes are falling. Global soybean prices remain mired at barely half their 2012 peak. And Brazil, America’s main competitor for the Chinese soy market, is growing another bumper crop.

“Brazil’s 2017-18 soybean harvest is expected to clock in at 112 million metric tons, the second highest ever, according to Reuters’ February survey—surpassed only by last year’s record of 114 million.”

#Brazil remains top #soybean exporter, but U.S. market share to recover in 2018/19 - https://t.co/PeIjf1z6Gb (From #AgOutlook presentation by Joanna Hitchner, Economist, @USDA, World Agricultural Outlook Board) pic.twitter.com/GZFOWlj8dp

— Farm Policy (@FarmPolicy) March 2, 2018

In a related article, Reuters news reported on Friday that, “Brazilian farm exports may benefit from rising trade tensions between the United States and China, an official from Mato Grosso state, Brazil’s largest grain growing region, said in an interview on Friday.”

Also, Bloomberg News reported on Saturday that, “The man who runs China’s biggest consumer of American soybeans said he hopes his country will avoid a clash with the U.S. over trade, though his firm can line up alternative suppliers if necessary.

“‘We hope that China and the U.S. will not have a trade war, which is also in line with the interests of business and people in both countries,’ Liu Yonghao, founder of New Hope Group, one of China’s largest pig feed companies, told reporters Saturday ahead of National People’s Congress meetings in Beijing. ‘Any trade war will have an impact on our business.'”

And Reuters news reported on over the weekend that, “China does not want a trade war with the United States but will defend its interests, a senior Chinese diplomat said on Sunday, after U.S. President Donald Trump announced a plan to put tariffs on steel and aluminum imports.”

Meanwhile, Tom Meersman reported late last month at the Minneapolis Star Tribune Online that, “Minnesota soybean growers can be forgiven if they are a little on edge lately.

“About half of the 380 million bushels they produced last year were exported.

“China is by far their largest customer, and Minnesota soybean sales to China reached nearly $1.2 billion in 2016.”

The article stated that, “So the risk of an escalating tariff war between the U.S. and China — and the chance that it may suck in agricultural products — is receiving their full attention.

It would be the worst possible time to lose export markets, some say, because bumper U.S. crops for the past three years have created a national oversupply of grain that has already depressed prices

Nonetheless, the Star Tribune article pointed out that, “Su Ye, chief economist and market research leader with the Minnesota Department of Agriculture, said China would need to think long and hard about trade retaliations against the U.S. that included soybeans.

“Making those changes would hurt both countries, she said, because China has grown to depend on huge soybean imports to supply its immense soybean crushing industry and its expanding dairy, cattle, hog and poultry farms.”

With respect to lawmaker perspective on the Trump Administration’s tariff actions, Lindsay Wise reported on Friday at The Kansas City Star Online that, “Kansas Sen. Pat Roberts, the Republican chairman of the Senate Agriculture Committee, struggled to find words to describe his state of mind after hearing Thursday that President Donald Trump would impose tariffs on imported steel and aluminum.

‘This is not going to go down well in farm country,’ Roberts said.

In her article, Ms. Wise explained that, “Roberts said he and other Republicans from farming states and from the Senate Finance Committee had lobbied Trump hard to try to convince him that raising tariffs would blow back badly on the very rural and middle-class voters who supported his election in 2016.

“‘These are the people who voted for the president,’ Roberts said. ‘These are his people. One county in Kansas even voted for him 90 percent, and they’re not going to be happy at all about this.’

“Roberts is beginning to wonder if the president is at all persuadable on trade.”

FrtPg business today's @latimes, "#Farmers and #ranchers in the Golden State are twice as dependent on foreign trade as the country as a whole." https://t.co/DrAt5Y44dh pic.twitter.com/1BuIrShEZ8

— Farm Policy (@FarmPolicy) March 3, 2018

Outside of the Midwest, Geoffrey Mohan reported in Saturday’s Los Angeles Times that, “Steel and aluminum may be the intended quarry of a trade war that President Trump has said would be ‘good’ for the U.S. economy, but the casualties of the conflict could be food, agricultural economists warn.

“China, the European Union, Mexico, Canada and other trading partners have sent strong signals that they may retaliate if Trump succeeds in imposing stiff tariffs on imports of steel and aluminum.

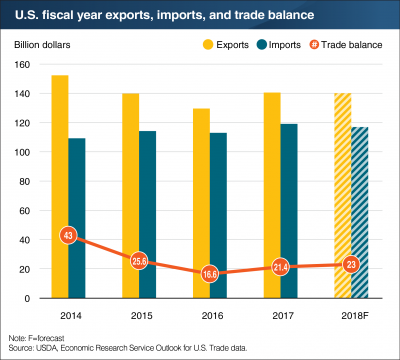

“Each of those trading partners is a major buyer of U.S. agricultural goods, which amass a surplus of about $21 billion from worldwide trade, according to the U.S. Department of Agriculture.”

Mr. Mohan pointed out that, “The wheat industry, which has pushed for more open international markets, blasted the proposal Friday. ‘It is dismaying that the voices of farmers and many other industries were ignored in favor of an industry that is already among the most protected in the country,’ a joint statement from the National Assn. of Wheat Growers and U.S. Wheat Associates said.”

The LA Times article stated, “No state has more at stake than California, which leads the country in agricultural revenue.

Farmers and ranchers in the Golden State are twice as dependent on foreign trade as the country as a whole.

“World leaders also likely know that Trump enjoyed deep support in rural, agricultural areas, including much of the Central Valley, said Dan Sumner, an economist who directs the Agricultural Issues Center at UC Davis.”