The U.S. Courts report that 315 farm bankruptcies were filed in calendar year 2025, up 46% from 2024. While still down from recent highs, this is the second year in…

Abundant Supply, Lower Prices and Trade Issues- Focus on Soybeans

The U.S. Department of Agriculture painted a clearer picture of soybean and corn production prospects for this year’s harvest on Friday. In addition, recent USDA trade data, along with business news articles, have provided further perspective on U.S. soybean exports, particularly as it relates to China. Today’s update explores a few of these issues in more detail.

USDA Production and Trade Updates

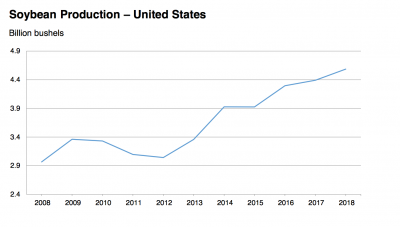

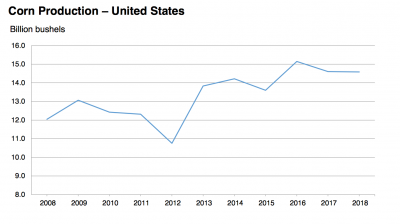

A news release Friday from USDA’s National Agricultural Statistics Service (NASS) stated that, “U.S. farmers are expected to produce a record-high soybean crop this year, according to the Crop Production report issued today by [NASS]. Up 4 percent from 2017, soybean production is forecast at record high 4.59 billion bushels, while corn growers are expected to decrease their production slightly from last year, forecast at 14.6 billion bushels.”

The news update explained that, “Soybean yields are expected to average 51.6 bushels per acre, up 2.5 bushels from last year…[and]… average corn yield is forecast at 178.4 bushels per acre, up 1.8 bushels from last year. If realized, this will be the highest yield on record for the United States.”

Financial Times writer Gregory Meyer reported on Friday that, “The US government has forecast the largest soyabean crop in history thanks to a favourable growing season, putting more pressure on prices for a commodity that has already been hit by Chinese tariffs.”

US #soybean prices reach a 9-year low. https://t.co/L7uKpqCJcQ pic.twitter.com/kj0Kw6awm2

— USDA_ERS (@USDA_ERS) August 8, 2018

Also Friday, Wall Street Journal writers Benjamin Parkin and Francesca Fontana pointed out that, “The larger bounty will contribute to a growing domestic [soybean] surplus, the [USDA] said, with stockpiles in 2018-’19 expected to climb to a record 785 million bushels, 80% above the same time a year earlier. Global soybean stocks also are due to increase, according to the USDA.”

Bearish #WASDE for U.S. #corn and #soybean

— Javier Blas (@JavierBlas) August 10, 2018

Ending stocks for soybean are going to be absolutely **sky-high**.

Record high corn yield. More bumper crops in America. #USDA #TradeWars #China pic.twitter.com/su0mG6hoTA

“Analysts pointed to a difficult path ahead for soybean prices after Friday’s report,” the Journal article said.

The World Agricultural Outlook Board noted in its World Agricultural Supply and Demand Estimates report Friday that, “With larger [soybean] supplies…exports are raised…20 million bushels.”

US soybean ending stocks could get really scary if no resolution to trade disputes and yield really is over 51bpa. Hard to imagine a B/S with over 800 million ending stocks but it could happen. This is why the market tanked. https://t.co/3J6N7LU2St

— Scott Irwin (@ScottIrwinUI) August 13, 2018

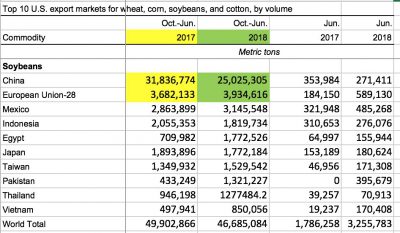

For the first nine months of this fiscal year (October – June, before Chinese tariffs went on), U.S. soybean exports to China were down 21 percent from last year, while exports to the European Union were up seven percent.

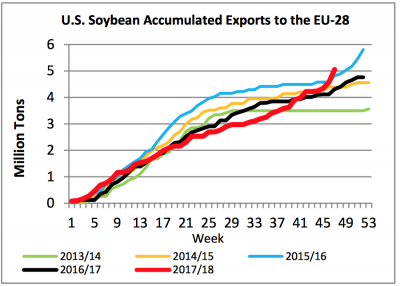

More specifically, in its Oilseeds: World Markets and Trade update Friday, USDA’s Foreign Agricultural Service (FAS) stated that, “Lower U.S. soybean prices vis-à-vis Brazil, a result of China’s duties imposed on U.S.-origin soybeans, have contributed to a surge in EU imports from the United States.

“While China substitutes U.S. soybeans by maximizing purchases from Brazil, the rest of the world is taking advantage of competitively priced U.S. supplies and the improved crush margins that have resulted. The recent shift to U.S. origin is likely to continue as long as crush margins remain attractive.

However, it is important to note that the European Union is a mature market with limited capacity to expand. According to industry contacts, oilseeds processors are crushing at or near capacity which limits soybean import growth.

The FAS update also pointed out that, “Between October 2017 and July 2018, China imported nearly 77.0 million tons of soybeans, almost replicating last marketing year. Based on available trade-to-date information, USDA is cutting 2017/18 China soybean imports by 1.0 million tons to 96.0 million. Even though, soybean arrivals in recent months have been below expectations, partly in response to port congestion, USDA still expects robust imports in August and September, mostly Brazilian origin.”

China, Soybeans- Recent News

Early last week, Bloomberg writers Shruti Singh and Kevin Varley reported that, “A ship with U.S. soybeans set sail for China last week, according to data released Monday, showing that the Asian nation is still importing some quantities of the commodity grown in America despite tariffs imposed by the government in July.

“The bulk carrier Betis departed Gavilon Group LLC’s export terminal in Kalama, Washington, for Shanghai on July 29, carrying the first cargo of American soybeans destined for China in three weeks, according to a report published by the U.S. Department of Agriculture.”

The article noted that, “The Betis is the fourth ship departing from U.S. shores with American soybeans since mid-June.”

Also last week, Reuters writer Micheal Hogan reported that, “China may have to start buying U.S. soybeans again in coming weeks despite the trade war between the two countries as other regions cannot supply enough soybeans to meet China’s needs, Hamburg-based oilseeds analysts Oil World said on Tuesday.”

And on Tuesday, Reuters writers Hallie Gu and Josephine Mason reported that, “China’s soybean imports in July fell from a month ago, customs data showed on Wednesday, as processors slowed purchases after building up a record inventory of the oilseed in preparation for hefty import tariffs on U.S. shipments introduced last month.”

Meanwhile, Bloomberg writers Shruti Singh and Tatiana Freitas reported Tuesday that, “Brazil’s [soybean] supplies will start to tighten by October, after months of record shipments. That’s also just about the time that U.S. crop gathering is under full swing. With no other growers really exporting enough to satisfy China’s demand, the nation will likely either buy from the U.S. or suffer through a shortage.

“‘We will start to see more business being done’ between the U.S. and China, said Mark Schultz, chief market analyst for Northstar Commodity in Minneapolis. ‘It may never get to levels we enjoyed, but it’s going to be better than none.'”

Also, Reuters News reported Friday that, “China’s imports of U.S. agricultural products will fall sharply once Beijing implements retaliatory trade measures and the country is able to cover its demand for cooking oil and animal feed, vice agriculture minister Han Jun said on Friday.

“The trade dispute will have a limited impact on China’s agriculture sector, but hit its U.S. counterparts harder, Han Jun was quoted by state radio as saying.”

The Reuters article added, “‘Relevant departments are fully prepared after meticulous studies and China is fully capable of ensuring domestic demand for cooking oil and protein-based animal feed be covered.’

“One solution is to boost imports from other exporters such as Brazil, and soymeal could easily be substituted by animal feeds made from other seeds, Han added.”

Reuters News reported Monday that, “A vessel carrying U.S. soybeans was unloading its cargo worth at least $23 million at the Chinese port of Dalian on Monday, becoming one of the first shipments to incur hefty new import duties as the trade row deepens between Beijing and Washington.”

Today’s article added, “Two other ships carrying U.S. soybeans, Star Jennifer and Cemtex Pioneer, have been anchored off China’s coast for the past few weeks.

“This is unlikely to be the start of a trend while China, the world’s top importer, can source alternative supplies from exporters such as Brazil, analysts said. Domestic stockpiles are 8.21 million tonnes, close to their highest on records.”